Oil Steadies After Four-Day Rally as US Considers Iran Response

(Bloomberg) -- Oil steadied after the biggest four-day gain in more than six months, as US officials planned to discuss Iran during a White House meeting.

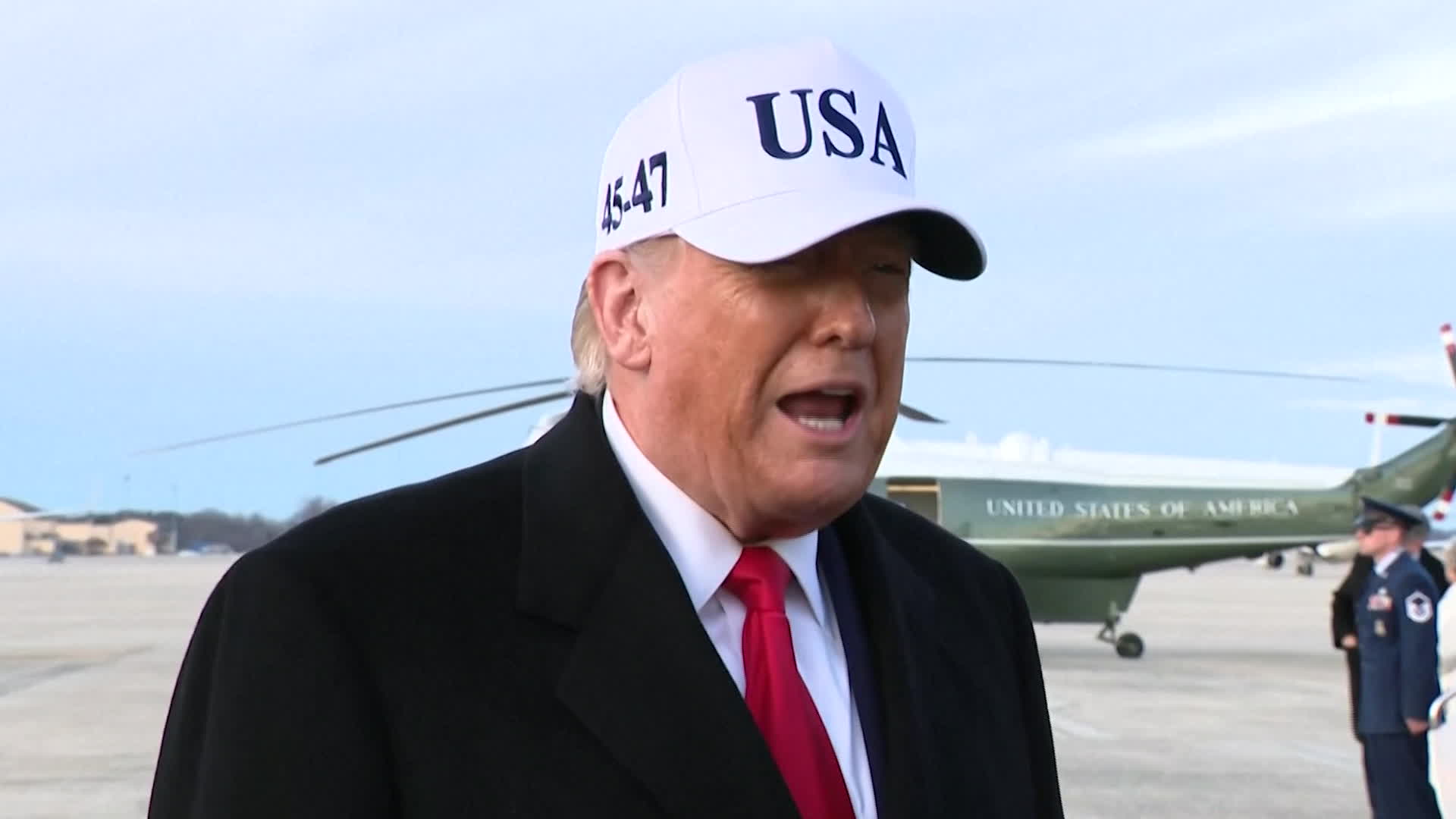

Brent traded near $65 a barrel, after adding more than 9% over the previous four sessions, while West Texas Intermediate was below $61. President Donald Trump urged Iranians to continue protests against the government of Supreme Leader Ayatollah Ali Khamenei, and said he would “act accordingly” once he gets a sense for how many of the demonstrators have been killed.

Trump suggested his next move would hinge on an upcoming meeting of the National Security Council. The body met Tuesday without Trump to prepare options for the president, the Washington Post reported, citing a person familiar with the meeting.

Traders are watching the unrest in Iran and possible American intervention, which could threaten the country’s roughly 3.3 million barrels-a-day oil output. Meanwhile, Energy Secretary Chris Wright told Fox News the US would “happily be a commercial partner” for Iranian crude if the regime fell.

Oil has pushed higher in the new year as the turmoil in OPEC’s fourth-largest producer, along with upheaval in Venezuela, reinserted a premium into prices following a run of five monthly losses spurred by expectations for a glut. The rally has caught off guard a market that had been steeped with bearish bets.

“The market remains caught between the reality of an ongoing oversupply and the escalation of geopolitical risks,” said Zhou Mi, an analyst at a research institute affiliated with Chaos Ternary Futures Co. “In the near term, developments in Iran could trigger another burst of price swings, and any US military action would likely drive oil prices higher.”

Brent’s second-month volatility rose to the highest since June on Wednesday. Its prompt spread — the difference between its two nearest contracts — strengthened in a bullish backwardation structure compared with a month ago.

On the physical front, an industry report indicated US crude stockpiles rose 5.3 million barrels last week. That would be the biggest increase in two months if confirmed by official data later Wednesday. In addition, the snapshot from the American Petroleum Industry showed builds in gasoline and distillates.

In the Black Sea, meanwhile, two tankers were attacked near the terminal for the Caspian Pipeline Consortium. That’s complicated Kazakhstan’s exports, with planned shipments already affected by bad weather and mooring damage.

©2026 Bloomberg L.P.