New Tankers Join Russian Oil Trade as Rates Jump

(Bloomberg) -- Soaring freight rates — along with lower oil prices that have reduced the risk of violating curbs on Moscow’s crude sales — are enticing more shipping companies to join the Russian trade, with some using nearly new tankers to ferry fuel around the world.

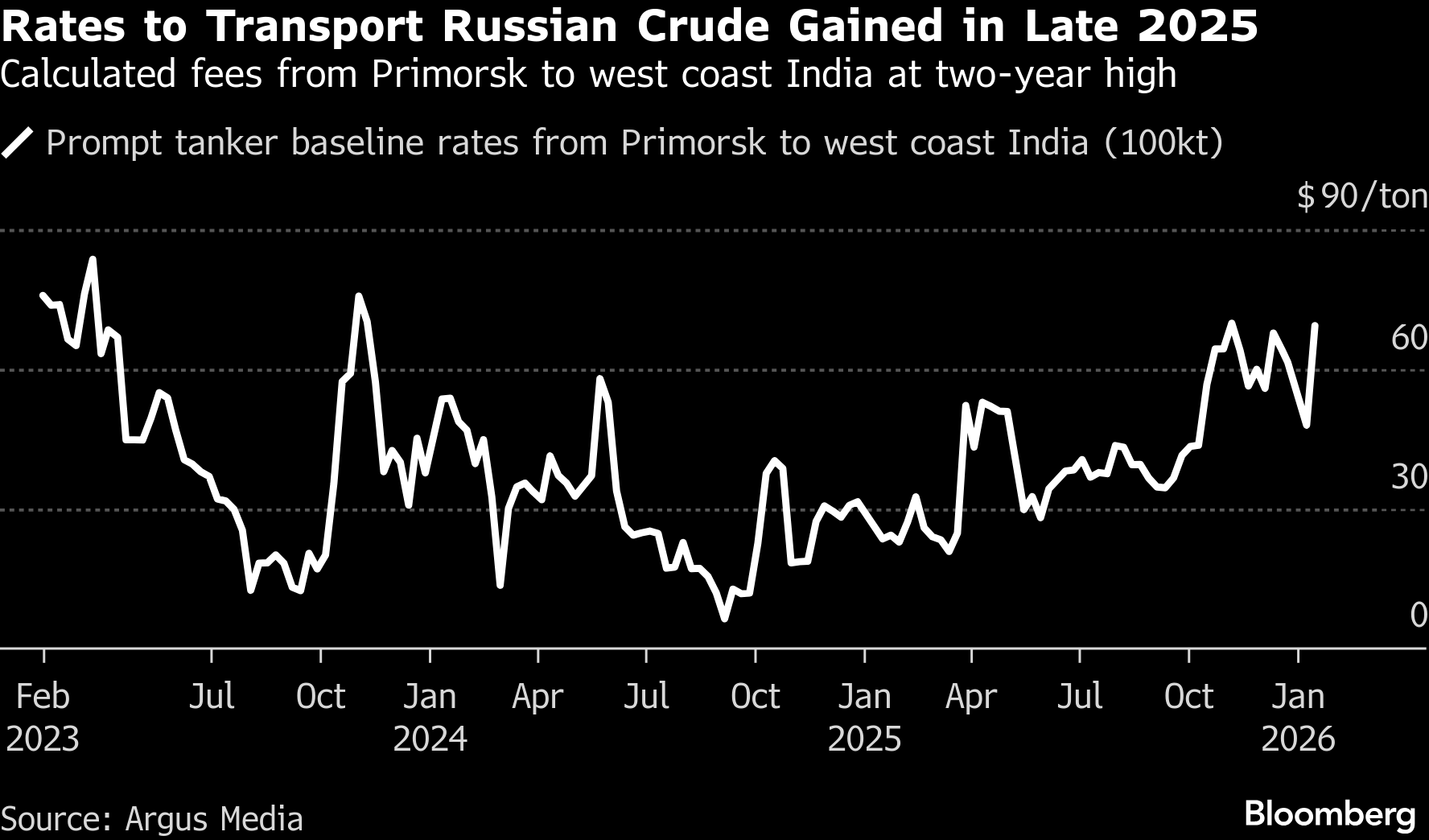

The price charged to transport crude has jumped over recent months, as the US and Europe cranked up pressure on the Kremlin and sanctioned hundreds of tankers involved in moving Russian cargoes, significantly reducing the number of legitimate vessels available.

The average rate charged to transport Russian Urals oil from Primorsk to India’s west coast rose to more than $60 per ton in late December, the highest level in two years, according to data compiled by Argus Media. That compares with around $25 at the beginning of last year.

At the same time, widening discounts have pushed Russian oil well below the price cap, a measure introduced by the Group of Seven to allow crude to continue flowing while limiting revenue for the Kremlin. Moscow’s oil is not itself sanctioned, but fears of breaching that level have frequently deterred legitimate companies eyeing Russian exports.

In a sign of how far the trade has changed and widened, at least two shipping companies, both with offices in Greece, Dynacom Tankers Management Ltd. and Capital Ship Management Corp., are deploying tankers that are less than a year old.

Russian oil has largely been trading near or above the price cap since the restriction was introduced after the invasion of Ukraine. That made paperwork onerous and risk elevated for legitimate players, all but excluding them even before the US sanctioned major Russian oil suppliers. It left much of the trade to small, private investors using older, cheaper ships.

The deployment of these virtually new vessels marks a significant departure.

Argeus I — a tanker managed by Capital Ship Management and owned by a company that shares its registered address — recently arrived at Paradip on India’s east coast with more than 700,000 barrels of Urals, its first cargo of Russian crude, according to ship-tracking data compiled by Bloomberg, Vortexa and Kpler. It’s unclear when the vessel will discharge the oil.

This month, the Rodos delivered a shipment to China, while the Samothraki transported oil to Vadinar port on India’s west coast in December, the data shows. Both ships are managed by Dynacom Tankers, and the company has transported Russian oil to India previously, though on much older vessels.

A representative for Capital Ship Management told Bloomberg that “a key reason for the G7’s strategy is to avoid further proliferation of the parallel fleet, the intention being to uphold high standards of safety, including for the environment and crew protection. This goal is furthered by having modern, properly insured vessels, operating in strict conformity with price cap, such as Argeus I is doing.”

Dynacom Tankers did not respond to emailed requests for comment.

“The risk‑reward balance still looks compelling enough to draw in newer ships, and that underlines the durability of the Russian crude trade,” said Angelica Kemene, head of Optima Shipping Services’ market strategy team in Athens.

(Corrects to write through from first paragraph in order to clarify the major factors changing the trade of Russian oil and better explain the use of new tankers. Removes analyst comment that’s no longer relevant to the corrected story and adds statement from shipping company in third-to-last paragraph.)

©2026 Bloomberg L.P.