Oil Steadies as Russia Port Restart Vies With Political Risk

(Bloomberg) -- Oil traded little changed as signs that activity had resumed at a key Russian port countered wider geopolitical risks to prices.

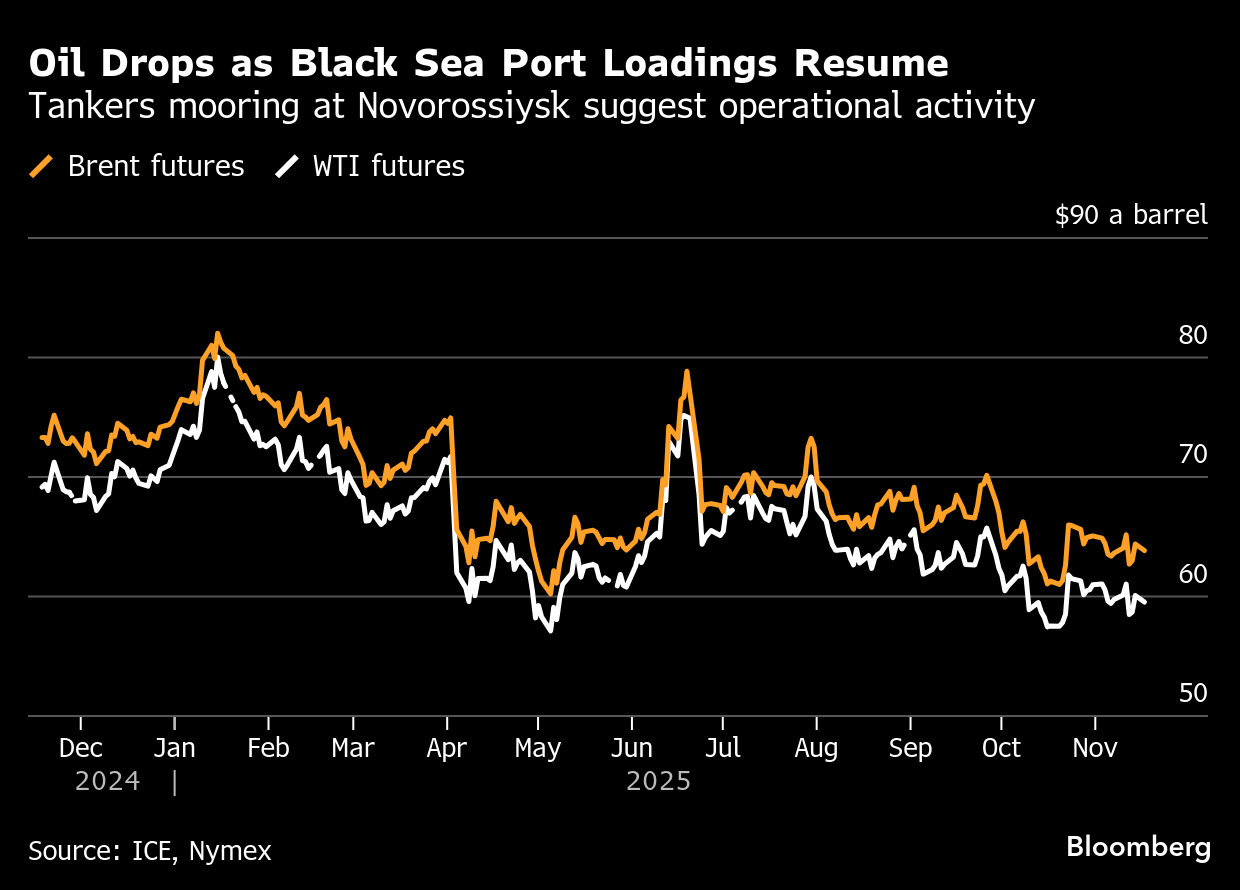

Brent was near $64 a barrel after closing more than 2% higher on Friday following an attack on Novorossiysk, while West Texas Intermediate traded around $60. Two tankers moored on Sunday at the facility, indicating operational activity at the terminals.

“Brent crude oil prices continue to fluctuate in a $60-$70 a-barrel range, with the market focus shifting to how Russian oil exports will evolve over the coming months,” UBS analyst Giovanni Staunovo wrote in a note. “The market appears skeptical that Russia will struggle to export its oil barrels.”

The attack on Novorossiysk, along with Iran’s seizure of an oil tanker near the Strait of Hormuz, injected fresh geopolitical premium into prices as the market faces pressure from an emerging global surplus. OPEC+ and producers from outside of the group are ramping up output, though China and India are providing some buying support due to US sanctions on Russian energy.

The US has stepped up its actions against Moscow in an effort to end the war in Ukraine, including blacklisting Rosneft PJSC and Lukoil PJSC. President Donald Trump told reporters on Sunday that he’d back proposed Senate legislation to sanction countries that conduct business with Russia.

Meanwhile, refinery margins have surged as relentless attacks on Russia’s energy infrastructure, outages at key plants in Asia and Africa, and permanent closures across Europe and the US cut diesel and gasoline supplies. Speculators last week had their biggest outright bullish wagers on Europe’s diesel benchmark since 2022.

©2025 Bloomberg L.P.