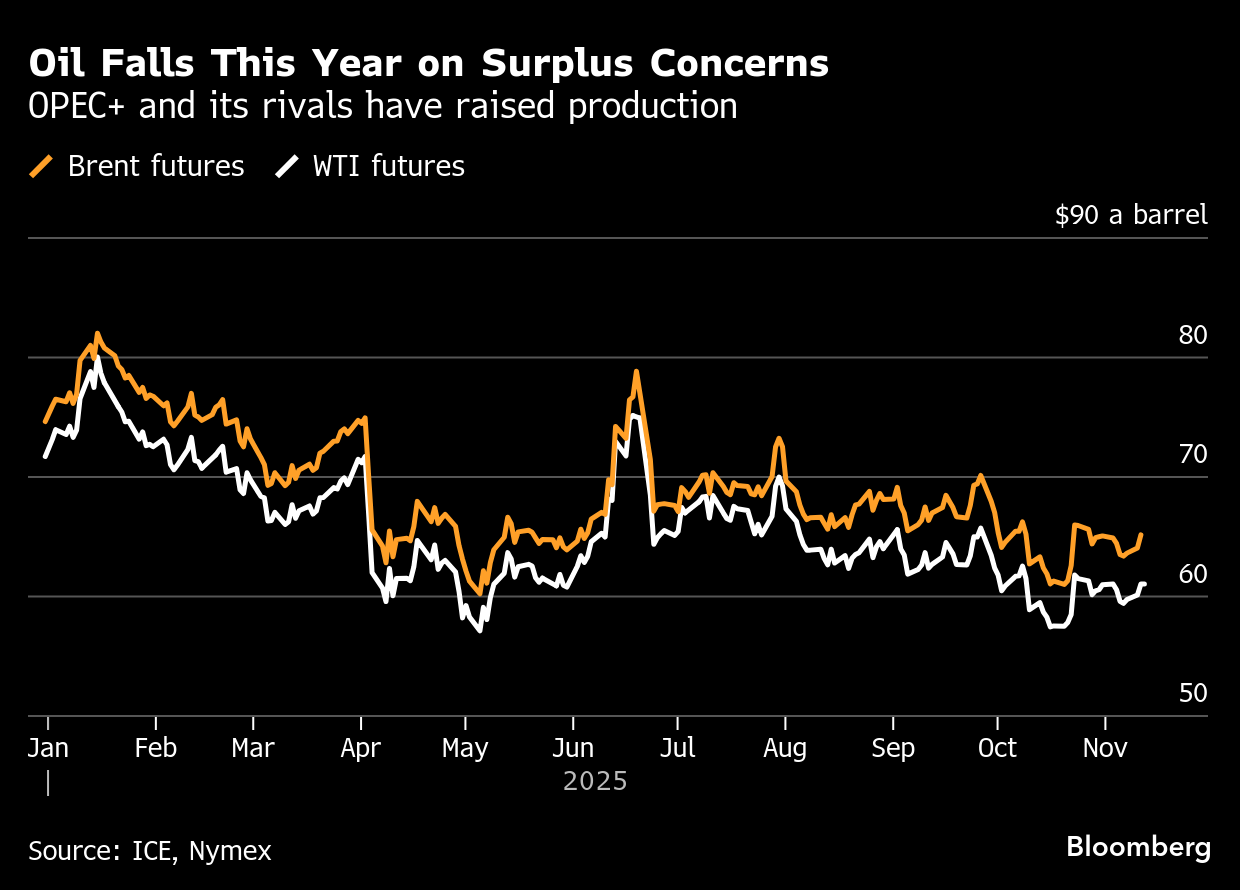

Oil Steadies After Gains as Traders Count Down to OPEC Outlook

(Bloomberg) -- Oil steadied following a three-day gain as traders eye reports that’ll shed light on the outlook for global market balances into 2026.

Brent was near $65 a barrel, after climbing 1.7% on Tuesday, while West Texas Intermediate traded below $61. The International Energy Agency reiterated that markets look well supplied in the near term, but tempered its stance on an imminent peak in oil demand, according to its annual energy outlook. OPEC is scheduled to issue its monthly analysis later on Wednesday.

Oil has lost ground this year on concerns that there will be a hefty surplus, with OPEC+ restoring capacity and drillers outside the group raising production. The Paris-based IEA previously forecast a record glut next year, and banks including Goldman Sachs Group Inc. have warned of rising inventories.

Some metrics are already flashing looser conditions. The premium paid for WTI’s front-month contract over the next in sequence — known as the prompt spread — has narrowed to just 5 cents a barrel in backwardation.

“These reports should emphasize that global crude markets are well-supplied, and structural surpluses are building,” said Robert Rennie, head of commodity research at Westpac Bank Corp. However, short-term prospects for higher fuel prices remain as Europe looks to unpick Lukoil PJSC from its national energy systems, he added, referring to the fallout from US sanctions.

As part of efforts to push Russia to end the war in Ukraine, the US blacklisted energy giants Lukoil and Rosneft PJSC. The move — which has supported diesel prices — has set off a rush by governments in Europe and the Middle East to ensure Lukoil’s sprawling operations can keep running.

©2025 Bloomberg L.P.