Big Oil Refuses to Budge on Production Ahead of OPEC+ Decision

(Bloomberg) -- The largest western oil producers are mostly sticking with their growth plans for now, despite a 16% decline in crude prices during April and the potential for further increases in output from OPEC+.

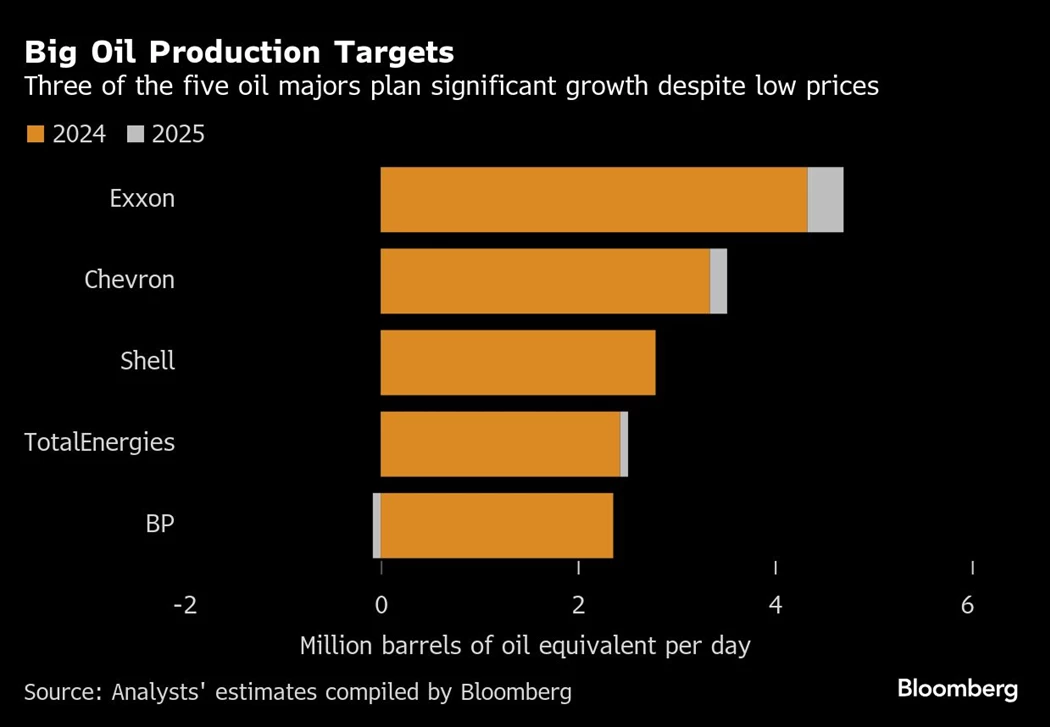

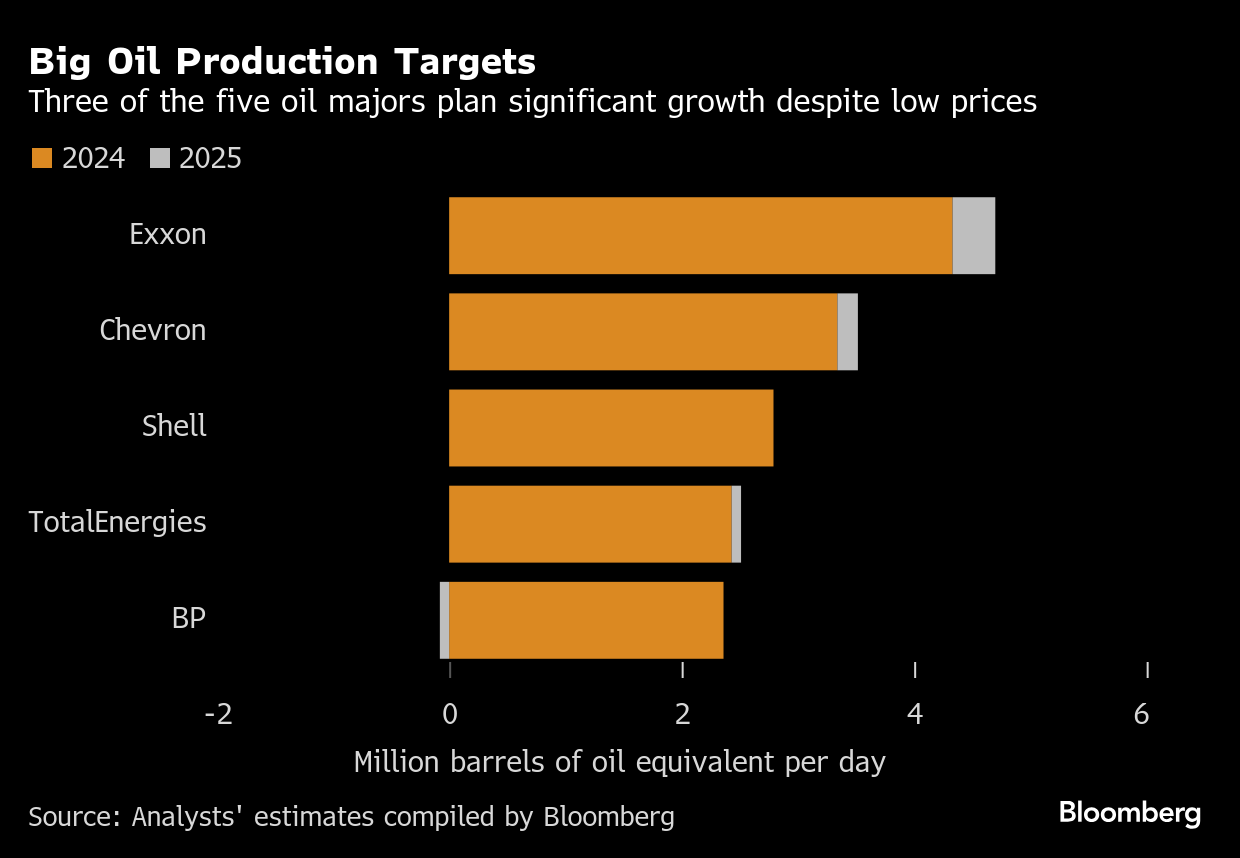

Exxon Mobil Corp., Chevron Corp. Shell Plc, and TotalEnergies SE all maintained their capital spending plans as they reported first-quarter results this week. BP Plc was the exception, cutting spending under pressure from activist investor Elliott Investment Management LP.

The steadfastness of the so-called oil majors comes as the market appears to be over-supplied. Prices are at a four-year low as tariffs threaten to hurt the global economy and curb energy demand, and following the surprise decision last month by the Organization of Petroleum Exporting Countries to increase production.

Even more supply could be on its way. Key OPEC+ nations are discussing making another production increase of roughly 400,000 barrels a day in June, ahead of a virtual meeting on Saturday to set policy, according to delegates.

Big Oil’s message that it will grow production in spite of lower prices contrasts with the position of US shale operators, who generally need more than $60 a barrel to break even. West Texas Intermediate, the US benchmark price, closed 1.6% lower Friday at $58.29 a barrel in New York. One shale-focused company, EOG Resources Inc., said Thursday it had already reduced its growth plans for 2025.

President Donald Trump has repeatedly urged domestic producers to ramp up output as part of his policy of US energy dominance, as well as to keep prices in check. On Friday he touted low gasoline prices as a key economic achievement of his first 100 days in office.

Exxon and Chevron on Friday reiterated their plans to grow production this year by about 7% and 9% respectively. Both companies expect more barrels from Kazakhstan, where they are partners on the recently-completed Tengiz expansion project. The country has repeatedly flouted its OPEC production quota, frustrating Saudi Arabia and spurring the kingdom’s pivot toward pushing for more supply to punish laggards among the group of producing nations.

“The presence of US companies like ExxonMobil and Chevron in Kazakhstan could play a key role in driving the supply growth,” Mukesh Sahdev of Rystad Energy said in a note Friday. “This raises questions about the potential for US backing to pressure OPEC+ into adding more barrels to the market.”

Much of Kazakhstan’s production is operated by foreign companies, and there’s little sign of efforts to rein in the flow of oil there. Chevron Chief Executive Officer Mike Wirth said he didn’t discuss possible curtailments at Tengiz, the Kazakh project ramping up to 1 million barrels per day later this year, at a recent meeting with Kazakh leaders.

“The barrels we produce at [Tengiz] are of high value to the government, they’re important to their fiscal balance, and historically those barrels have not been curtailed,” he said Friday.

EOG, which fracks in the Permian Basin, cut $200 million from its budget for this year and dialed back its forecast crude output growth to 2% from a previous view of 3%. Analysts at JPMorgan Chase & Co. have called the move the “canary in the coal mine.” More shale producers due to report earnings next week, including DiamondBack Energy Inc., Occidental Petroleum Corp. and ConocoPhillips.

Nabors Industries Ltd., a Houston-based drilling contractor, said this week that shale producers plan to cut 4% of their drilling rigs by the end of the year, citing a survey of nearly half the industry.

Still, such cutbacks are unlikely to have an immediate effect on global supply. US shale “is foreshadowing modest (at best) adjustments to lower oil price as the market digests a gathering storm of macroeconomic indicators,” said Stephen Richardson, an analyst at Evercore ISI.

And in any case, efforts by independent operators to cut back on US shale are likely to be offset by Exxon and Chevron, who have grown so much in recent years that they now make up a much larger portion of overall production. Chevron increased output 12% over the past year to almost 1 million barrels of oil equivalent a day while Exxon is targeting 1.5 million barrels, a 25% increase, after buying Pioneer Natural Resources Co.

It all adds up to a lot of oil, at a time when the global economy is expected to slow down, hurting demand.

“With that degree of economic uncertainty, it’s hard to see a catalyst that could accelerate oil and gas demand over the next two quarters,” said Nick Hummel, a St. Louis-based analyst at Edward Jones & Co. “We’re probably in a modest commodity price environment over the near to medium term.”

©2025 Bloomberg L.P.