Oil Rally Breaks Crude Out of Tight Range With Technical Support

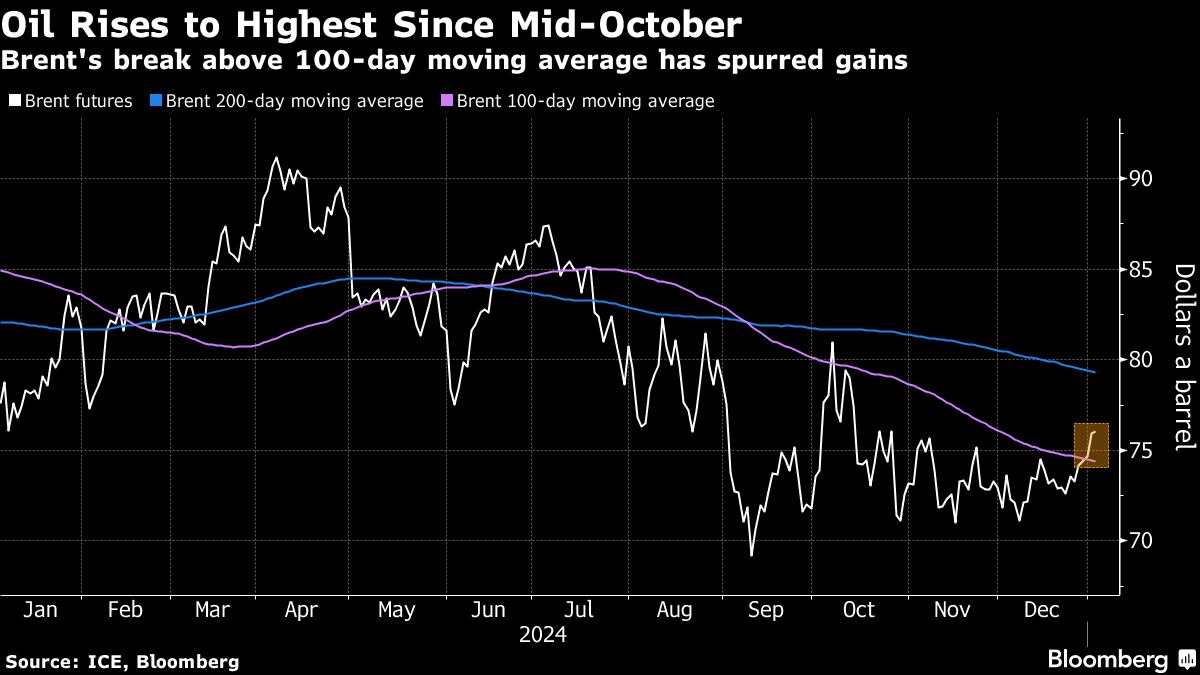

(Bloomberg) -- Oil has broken out of a tight trading range that it’s been stuck in for months, with a breach of a key technical threshold and shrinking US crude stockpiles helping to drive prices higher.

Brent was steady near $76 a barrel after a four-day rally that’s pushed futures to the highest level in more than two months. West Texas Intermediate was above $73. Nationwide crude inventories remain well below the seasonal average after stockpiles dropped for a sixth straight week.

A jump by both benchmarks above their 100-day moving average also spurred algorithmic buying, helping to break crude out of the roughly $6 range it’s been in since mid-October. Oil is also on track for a second weekly gain.

“The question now is whether this can kick toward the 200-day moving average,” said Chris Weston, head of research for Pepperstone Group Ltd. “That may need economics to improve.”

The outlook for 2025 remains uncertain, however, with expectations for a glut, the possible revival of idled OPEC+ production and lackluster demand from top importer China. The return of Donald Trump to the White House at the end of this month also adds a level of unpredictability for global markets.

©2025 Bloomberg L.P.