Oil Extends Second Weekly Drop on New China Recovery Concerns

(Bloomberg) -- Oil extended two weeks of losses after data from China reignited concerns about a patchy recovery in the world’s biggest crude importer.

West Texas Intermediate futures declined 0.9%, after rallying 2.7% on Friday on the back of strong US company earnings to pare a weekly decline. China’s manufacturing activity unexpectedly contracted in April, data released Sunday showed, in a sign the nation’s economy may be struggling to regain momentum even as consumers splurged at the start of the Labor Day break.

Hedge funds and money managers have turned deeply bearish on crude after prices swung sharply in April — surging to a 15-month high after the Organization of Petroleum Exporting Countries and its allies announced an output cut, before giving up those gains amid a deteriorating outlook. With China on holiday through Wednesday, the focus will likely be on whether major central banks including the Federal Reserve will continue tightening rates.

“Investors remain cautious amid mixed economic signals,” ANZ Banking Group Ltd. analysts Brian Martin and Daniel Hynes said in a note. “A hawkish tone from the Fed could put pressure on energy and metals.”

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Erases Gain as Traders Weigh Israeli Response to Iran Attack

Apr 16, 2024

Kent confirms enhanced project alliances with ExxonMobil and Repsol Norge

Apr 16, 2024

Mexico’s Sheinbaum Plans to Spend Billions on Gas, Solar Plants

Apr 15, 2024

What’s Next for Crude Oil? Analysts Weigh In After Iran’s Attack

Apr 15, 2024

Oil Traders Weigh Risks of Iran-Israel Conflict in Tight Market

Apr 14, 2024

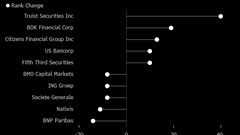

US Regional Banks Dramatically Step Up Loans to Oil and Gas

Apr 14, 2024

Oil Rises to October High as Israel Prepares for Iranian Attack

Apr 12, 2024

Gold Hits New Record, Oil Rises on Mideast Tension: Markets Wrap

Apr 12, 2024

Oil Swings Near $90 With Risk of Iran Strike on Israel in Focus

Apr 11, 2024

Oil Holds Two-Day Loss as Report Points to Rising US Inventories

Apr 10, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

Neway sees strong growth in Africa

Feb 27, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum