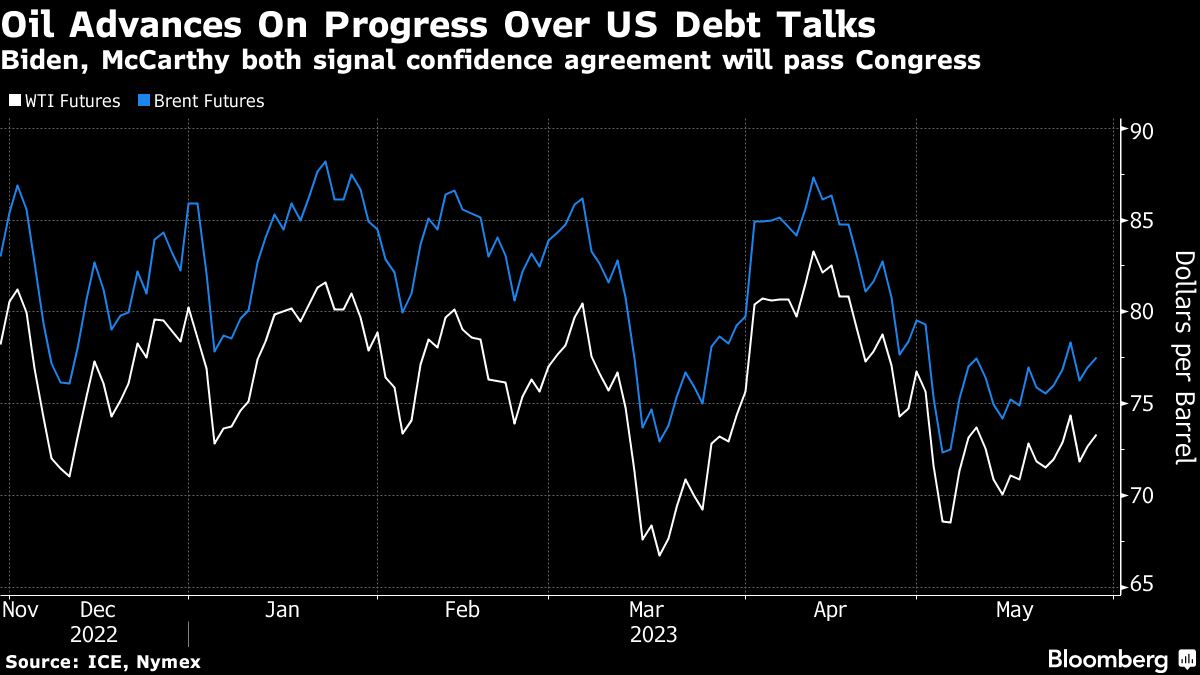

Oil Ekes Out Gain as US Lawmakers Address Tentative Debt Deal

(Bloomberg) -- Oil eked out a second session of gains as traders waited to see if US lawmakers would approve a tentative deal to avert a catastrophic default.

West Texas Intermediate futures edged above $73 a barrel after gaining 1.2% on Friday. President Joe Biden and House Speaker Kevin McCarthy voiced confidence that their agreement will pass Congress and be signed into law, avoiding a default that would threaten a financial collapse. Treasury Secretary Janet Yellen has said the debt limit must be extended by June 5 to avoid default, giving lawmakers until next week to act on the deal. Liquidity was thin in trading on Monday, with the US and UK observing national holidays.

The agreement “reduces the risk of a significant crash,” but “the outcome was pretty much priced in,” Bart Melek, global head of commodity strategy at TD Securities, said by phone. The agreement calls for reduced spending, making it “flat to modestly negative for demand.”

Oil is about 9% lower this year as China’s lackluster economic recovery and the Federal Reserve’s aggressive monetary tightening weighed on the demand outlook. Russian supply has also been resilient, even after the nation said it would cut output, while domestic crude processing has dropped.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight