Oil Holds Advance as Broad China Stimulus Plan Aids Sentiment

(Bloomberg) -- Oil held onto a sharp overnight gain that was driven by signs China is shifting into stimulus mode and a US plan to replenish reserves.

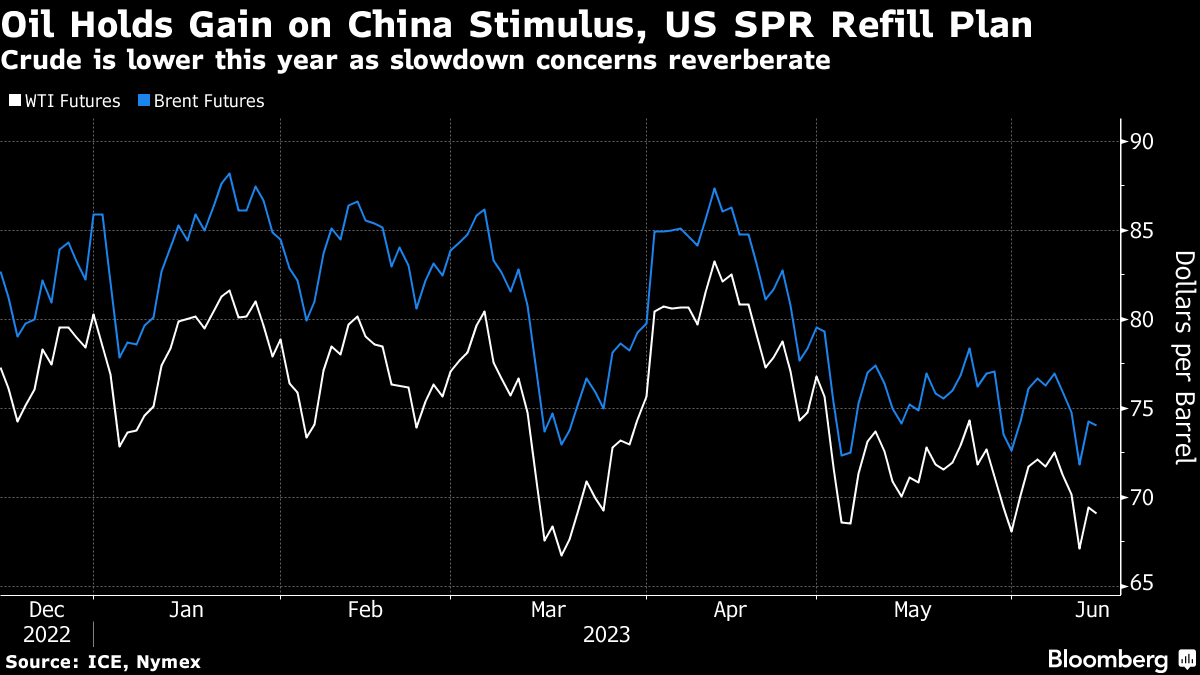

West Texas Intermediate traded above $69 a barrel after rising 3.4% on Tuesday, the most in more than five weeks. Beijing is considering a broad range of stimulus measures to revive China’s flagging recovery after already having taken steps to loosen monetary policy. The country also issued a fresh crude import quota for non state-owned refiners and traders for 2023.

The US is planning to buy about 12 million barrels of oil this year to refill its depleted emergency reserves, according to people familiar. Slowing inflation is also adding to expectations the Federal Reserve will pause interest-rate hikes for the first time in 15 months.

Crude is still down about 17% since mid-April as a worsening demand outlook and resilient exports from Russia — despite pledged output cuts — weighed on prices. However, the more bullish signals emanating from China and the US, and an OPEC report that suggested Saudi Arabia’s output cuts will succeed in tightening supply in the second half, are aiding sentiment.

The recent gains have been mainly “a reaction to China’s monetary policy support,” said Yeap Jun Rong, a market strategist for IG Asia Pte in Singapore. “The broader risk-on environment and a weaker US dollar over the past days haven’t been able to ignite much of a positive reaction for oil prices,” suggesting demand remains the key driver, he said.

Investors will also be watching for the International Energy Agency’s monthly report, due later Wednesday, for insight on the state of the market.

The industry-funded American Petroleum Institute reported US nationwide crude inventories expanded by 1 million barrels last week. Gasoline and distillate stockpiles, and supplies at the Cushing, Oklahoma storage hub also rose. Official data is due later Wednesday.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output