Canadian Oil Flows to Asia Surge After US Refinery Disruptions

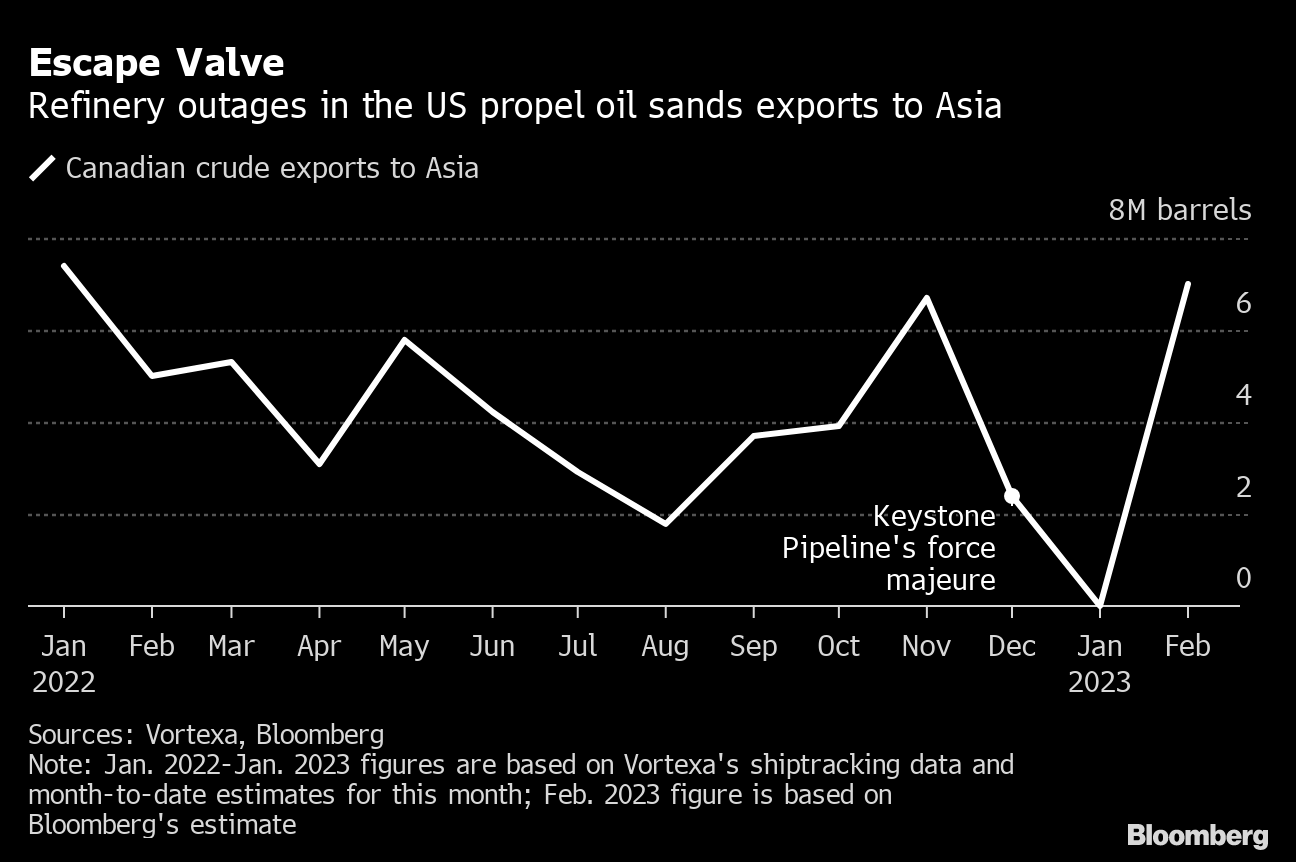

(Bloomberg) -- Canadian crude shipments to Asia are set to surge to the highest in more than a year as US refinery outages force producers to find new outlets for their oil.

At least 7 million barrels of heavy-sour crude produced in Canada’s oil sands have been sold to Asian buyers for February loading, according to people familiar with the matter. That’s the most since January 2022, Vortexa data shows.

Unipec, the trading arm of China’s biggest state-owned oil refiner Sinopec, will take 3 million barrels, while PetroChina Co. and Indian refiner Reliance Industries Ltd. will each receive 2 million, said the people, who asked not to be named discussing confidential matters. Another 1 million barrels was sold to Repsol SA for Europe, the people said.

The purchases come after fires at two US refineries forced them to halt production, eliminating outlets for Canadian oil. BP Plc’s BP-Husky Toledo refinery in Ohio isn’t expected to return to service before late in the second quarter, while Suncor Energy’s Commerce City facility in Colorado is shut until later this quarter. Together they consume an average of 3 million barrels of Canadian oil per month.

Cold Lake crude from Alberta was being offered in the export market at about $22 a barrel below the ICE Brent benchmark for loading on the US Gulf Coast, traders said. The same grade for domestic consumption traded at a $14.85 discount to WTI on the Gulf Coast, 40 cents stronger than Tuesday, data show.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company