Oil’s New Map: How India Turns Russia Crude Into the West’s Fuel

(Bloomberg) -- India is playing an increasingly important role in global oil markets, buying more and more cheap Russian oil and refining it into fuel for Europe and the US.

Yet New Delhi has faced little public blowback because it’s meeting the West’s twin goals of crimping Moscow’s energy revenue while preventing an oil supply shock. And as Europe ramps us sanctions, India is only going to become more central to a global oil map that’s been redrawn by Vladimir Putin’s year-long war in Ukraine.

“US treasury officials have two main goals: keep the market well supplied, and deprive Russia of oil revenue,” said Ben Cahill, a senior fellow with the Center for Strategic and International Studies, a Washington think tank. “They are aware that Indian and Chinese refiners can earn bigger margins by buying discounted Russian crude and exporting products at market prices. They’re fine with that.”

India shipped about 89,000 barrels a day of gasoline and diesel to New York last month, the most in nearly four years, according to data intelligence firm Kpler. Daily low-sulfur diesel flows to Europe were at 172,000 barrels in January, the most since October 2021.

The Asian nation’s importance is expected to expand after fresh European Union sanctions on Russian petroleum exports take effect Sunday. The ban will remove a huge volume of diesel from the market and see more consumers, especially in Europe, tap Asia to fill the supply gap.

That will make cheap Russian oil even more attractive to India, which relies on imports to meet around 85% of its crude needs. The nation’s refiners, including state-run processors that are responsible for meeting domestic demand, ramped up exports last year in order to profit from higher international prices.

Fueling the West

“India is a net exporter of refined product and much of this will be going to the West to help ease current tightness,” said Warren Patterson, Singapore-based head of commodities strategy at ING Groep NV. “It’s pretty clear that a growing share of the feedstock used for this product originates from Russia.”

Under EU guidelines, India is likely operating within the rules. When Russian crude is processed into fuels in a country outside of the bloc such as India, the refined products can be delivered into the EU because they’re not deemed to be of Russian origin.

The Group of Seven nations are keen to cut Moscow’s revenue as much as possible, but they also have an interest in ensuring that Russia’s oil and refined products continue to flow to avoid a global supply crunch, said Serena Huang, lead Asia analyst at Vortexa Ltd.

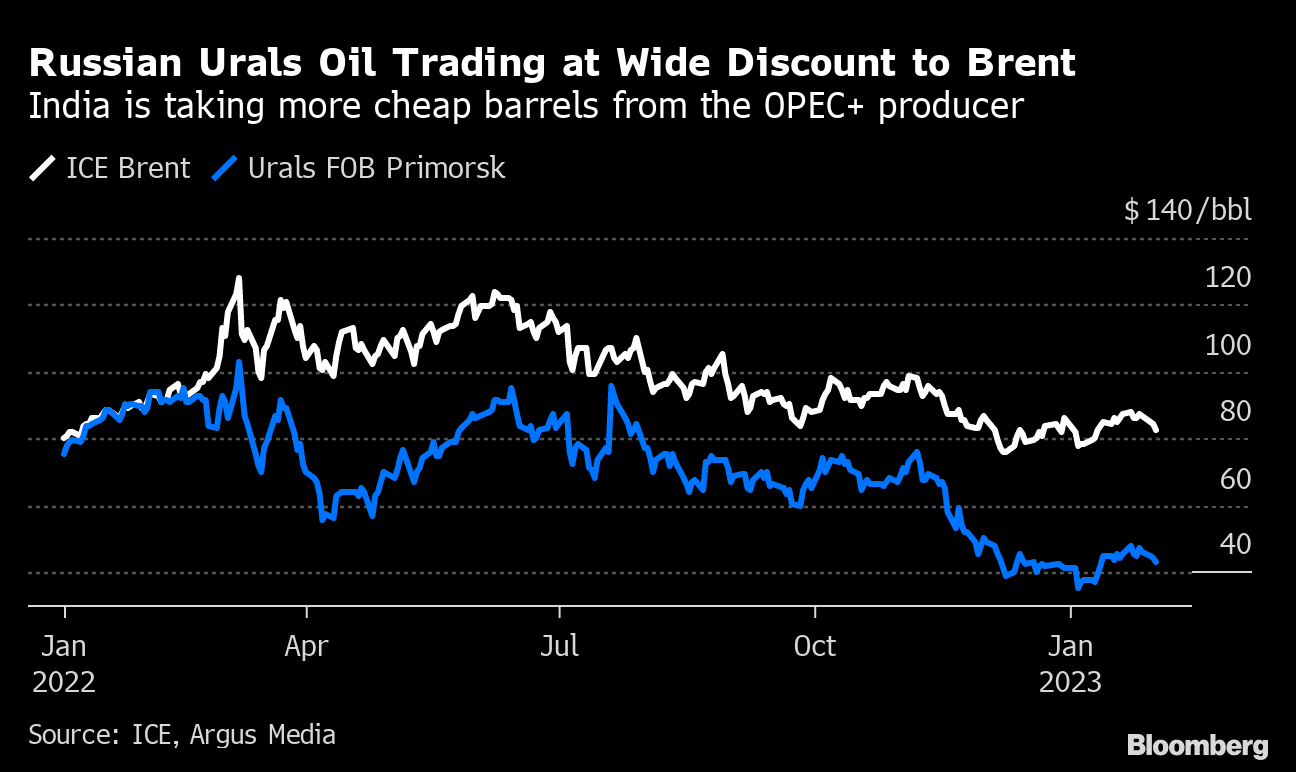

A key facet of the mechanism to crimp revenues to the Kremlin and keep some oil on the market has been a price cap on Russian crude, a measure that was spearheaded by the US. India hasn’t publicly said if the nation does or doesn’t adhere to the limit, but sanctions have driven oil from the OPEC+ producer below the $60 a barrel cap.

A US National Security Council spokesperson said a price cap had been put in place that countries including India could leverage to keep energy markets stable, while limiting the Kremlin’s revenue.

“India’s willingness to buy more Russian crude at a steeper discount is a feature, not a bug, in the plan of Western nations to impose economic pain on Putin without imposing it on themselves,” said Jason Bordoff, founding director of the Center on Global Energy Policy at Columbia University and a former adviser in the Obama administration.

Executives and officials from nations and companies including Saudi Arabia, United Arab Emirates, the US, and Abu Dhabi National Oil Co. are gathering in Bangalore Monday for a three-day energy forum organized with India’s petroleum and natural gas ministry.

--With assistance from , , and .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output