Oil Holds Loss on Signs of Supply Rebound as Demand Woes Linger

(Bloomberg) -- Oil held a decline on signs that supply is rebounding while concerns linger about demand in China, the biggest importer.

West Texas Intermediate futures for October traded near $80 a barrel, after falling 0.7% on Monday. Exports from Iran surged to 2.2 million barrels a day this month, while Reuters reported that Iraq’s oil minister arrived in Ankara to discuss issues including resuming shipments through the Ceyhan terminal.

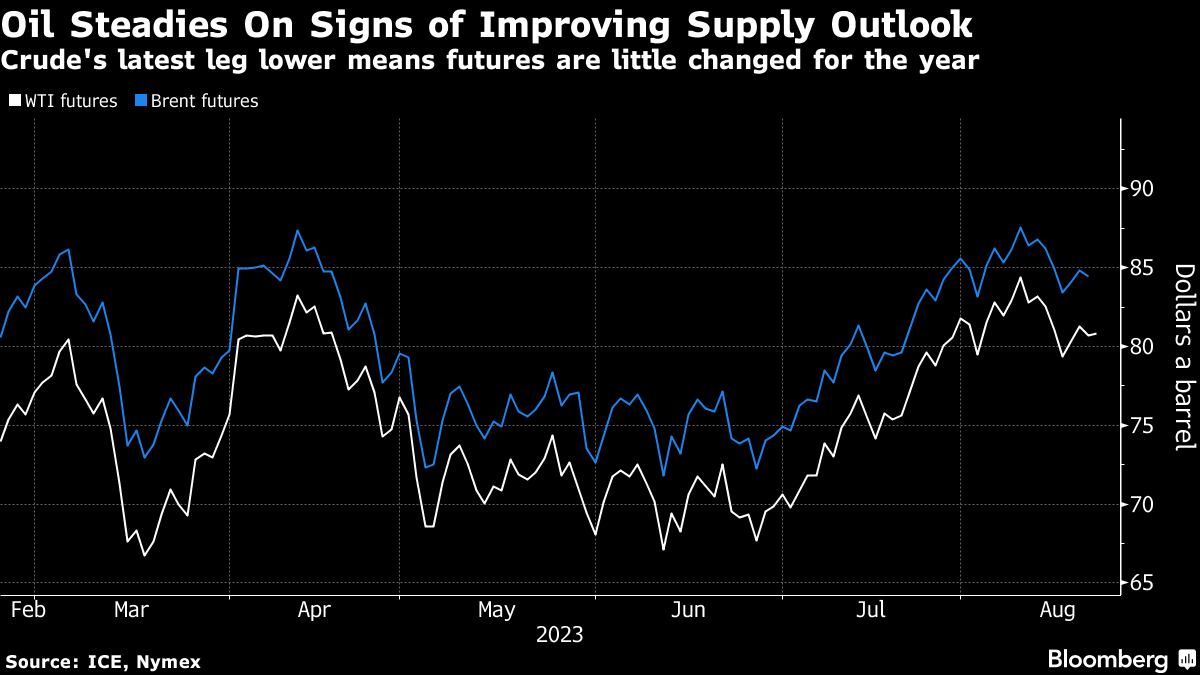

A rally in crude that started in late June has faltered over the last couple of weeks, with futures back to where they were at the start of the year. Efforts by OPEC+ linchpins Saudi Arabia and Russia to curb production have tightened the market but the demand outlook in China is worsening and there are signs US interest rates will need to stay higher for longer to rein in inflation.

“Supply tightness could ease” as Iraq plans the resumption of oil exports from Ceyhan, said Charu Chanana, market strategist for Saxo Capital Markets Pte, noting that flows were around 500,000 barrels a day before they were halted. “With the demand outlook also deteriorating, the downside in oil prices could become more pronounced.”

Elsewhere, the price of Russia’s flagship oil may have jumped above a Group of Seven imposed cap, but that has done little to impede the provision of services for the trade. Ships owned or insured by companies based in countries signed up to the cap still represent a vital part of Moscow’s petroleum supply chain.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output