Stocks Climb to Session Highs as Tech Regains Mojo: Markets Wrap

(Bloomberg) -- US stocks gained surer footing after a choppy morning session, extending a rally sparked by a slowdown in inflation. The dollar fell, heading for a fourth week of losses.

The S&P 500 rose to session highs, with the tech-heavy Nasdaq 100 outperformed, rising more than 1.5%. Cash Treasury trading is closed for Veterans Day.

Meanwhile, cryptocurrencies resumed a selloff amid FTX’s deepening woes with Sam Bankman-Fried’s crypto empire filing for bankruptcy.

Elsewhere, US-listed Chinese stocks higher rose and commodities from oil to soybeans to precious metals jumped after China eased some Covid restrictions.

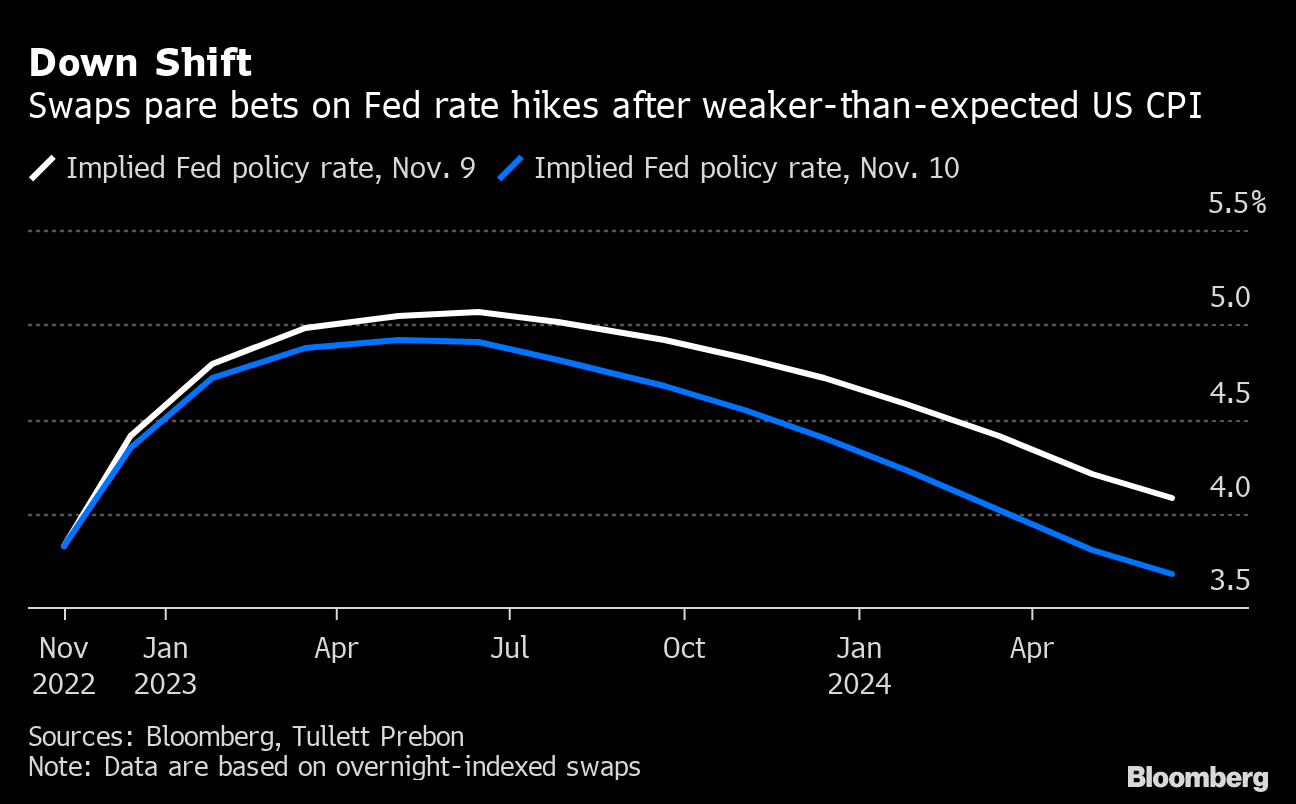

US stocks soared the most since 2020 on Thursday after a better-than-forecast cooling in US inflation improved the prospects of a dovish tilt by the Federal Reserve. On Friday, the University of Michigan’s preliminary November survey showed US consumer inflation expectations increased in the short and long run while sentiment retreated.

“The moderation in the pace of inflation is a welcome development, while it is still far too early to declare the inflation threat over,” Mark Haefele, chief investment officer at UBS Global Wealth Management, wrote. “We still think the Fed is likely to raise at least another 100 basis points in total before it pauses the rate hiking cycle. Meanwhile, the cumulative impact of prior rate rises will continue to weigh on economic growth and corporate profits.”

The dollar slumped more than 1% on Friday, heading for a fourth successive week of losses. It is also the biggest weekly drop since the pandemic-fueled volatility in March 2020.

Bitcoin dropped as much as 8% to $16,376 and Ether fell as much as 9.2%. FTX.com’s bankruptcy filing capped a swift reversal of fortune for the crypto exchange led by Bankman-Fried.

“From my vantage point, the real-world impact seems somewhat limited,” said Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors LLC. “It’s hard to imagine how it has a big impact on the overall economy. Crypto makes up a relatively small portion of financial markets, financial transaction, jobs, consumer spending, business spending, etc.”

Summers Says FTX Meltdown Has ‘Whiffs’ of Enron-Like Scandal

Pinduoduo Inc. and JD.com Inc. jumped in US trading amid growing optimism Beijing is on its way to ending the crippling Covid Zero policy. China reduced the amount of time travelers and close contacts must spend in quarantine.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.8% as of 1:55 p.m. New York time

- The Nasdaq 100 rose 1.7%

- The Dow Jones Industrial Average fell 0.2%

- The MSCI World index rose 1.9%

Currencies

- The Bloomberg Dollar Spot Index fell 1.3%

- The euro rose 1.4% to $1.0355

- The British pound rose 1% to $1.1838

- The Japanese yen rose 1.7% to 138.54 per dollar

Cryptocurrencies

- Bitcoin fell 5.7% to $16,794

- Ether fell 4.6% to $1,260.04

Bonds

- The yield on 10-year Treasuries was little changed at 3.81%

- Germany’s 10-year yield advanced 15 basis points to 2.16%

- Britain’s 10-year yield advanced seven basis points to 3.36%

Commodities

- West Texas Intermediate crude rose 2% to $88.18 a barrel

- Gold futures rose 0.8% to $1,767.20 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from , , , , and .

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output