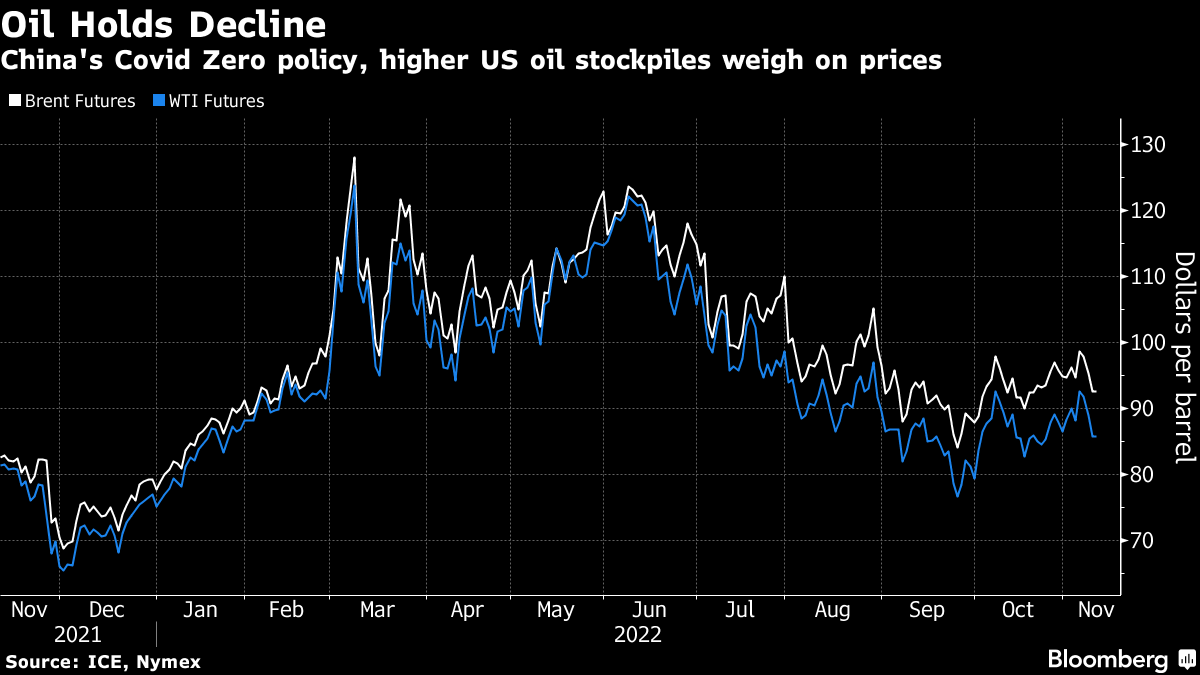

Oil Holds Drop as China’s Covid Struggles Crimp Demand Outlook

(Bloomberg) -- Oil held a drop as China’s Covid Zero policy fanned concerns about energy demand in the largest crude importer, with lockdowns spreading.

West Texas Intermediate traded below $86 a barrel, after losing 3.5% on Wednesday as data showed US crude stockpiles hit the highest since July 2021. China’s anti-virus policies are hurting consumption, with the country now adding curbs in the southern manufacturing hub of Guangzhou.

Crude has slumped by almost a third from its June highs as a global slowdown and tighter monetary policy threaten to sap energy demand. Still, futures have regained some ground this quarter after the Organization of Petroleum Exporting Countries and its allies agreed to reduce supply, and traders looked ahead to tighter European Union curbs on Russian flows.

“Oil traders were wrong-footed after backing a China reopening,” said Stephen Innes, managing partner at SPI Asset Management. The worsening China outlook is “bringing the recessionary narrative back to the forefront.”

Oil market differentials have narrowed, signaling an easing of tightness. Brent’s prompt spread -- the difference between its two nearest contracts -- was $1.44 a barrel in backwardation, down from $1.83 a month ago.

Investors are also watching for critical US inflation data due later Thursday as the figures will provide clues on how much more the Federal Reserve will raise interest rates. Charles Evans, the outgoing president of the Federal Reserve Bank of Chicago, said it’s time for the central bank to begin slowing the blistering pace of increases given how high rates have already gone.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output