World takes cover from stock chaos in oil, utilities and China

(Bloomberg) -- Optimism may be in short supply for equity investors caught in the downdraft of volatile global markets, but pockets of shelter are emerging.

From banks benefiting from interest-rate hikes to stocks offering high dividend yields and cheap valuations, portfolio managers and strategists are finding areas of resilience. Those willing to stomach high volatility are betting on China’s eventual reopening.

The search for relative havens comes as riskier assets have been roiled by worries over surging interest rates, inflation and slowing economic growth. The speculative fervor that drove meme stocks, blank-check companies and cryptocurrencies has waned. Down 17% from a record high hit six months ago, the MSCI All Country World Index is nearing a bear market.

“Investors are caught between fears that earnings and valuations will be under pressure in the short term from these headwinds, but also realize that the equity valuations have declined to levels that have become attractive for long term investors,” said David Sekera, chief US market strategist at Morningstar.

Dividend Champions

As companies navigate a world of rising borrowing costs and input prices, stocks offering investors income via higher dividend yields are being rewarded by the market. The MSCI World High Dividend Yield gauge, which is estimated to offer a yield of 3.8% over the next 12 months, has outperformed its broader peer by more than 10 percentage points this year.

“The short duration nature of the high-yielding stocks should also provide protection against higher interest rates,” Goldman Sachs Group Inc. strategists led by Timothy Moe wrote in an Asia-focused note on Wednesday.

Value Names

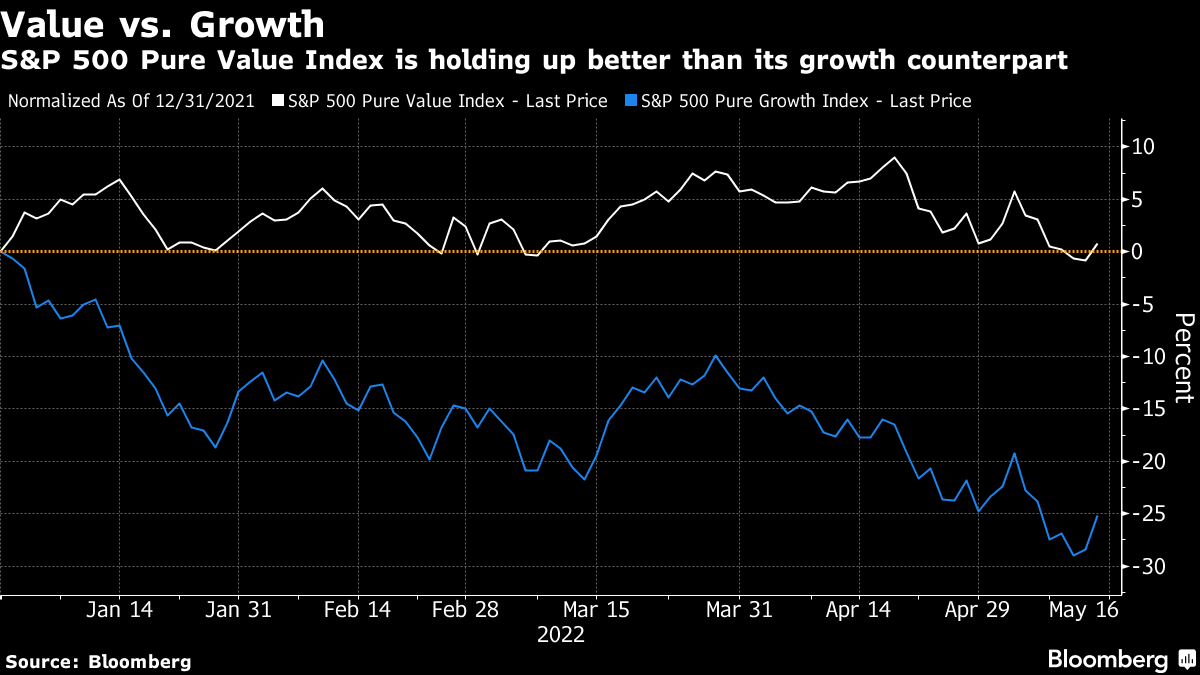

While value shares have outshone growth peers amid the tech rout, sectors such as commodities and financials still offer room for upside as earnings are set to improve in the high-inflation, rising-rates environment, strategists say. Earnings forecasts for the S&P Pure Value Index have risen at a time when outlooks for growth peers are worsening rapidly, according to Bloomberg Intelligence.

Oil and gas stocks offer a natural hedge against inflation -- particularly energy inflation -- and have outperformed broader indexes by a wide margin through 2021 and so far in 2022. The S&P 500 Energy Index is up 45% so far this year, outperforming the broader S&P 500, which is down 16%.

Energy has also dominated the list of top-performing global stocks on the MSCI World Index this year. Texas-focused Occidental Petroleum Corp. sits at the top after rising 121% so far this year.

Even after that run, Wells Fargo analysts Nitin Kumar and Joseph McKay wrote “the outlook for the sector remains strong” and the “global market remains structurally under-supplied” for oil and gas due in part to Russia’s invasion of Ukraine creating a tightness in commodities supplies.

“Energy, while a consensus long, still makes sense” as an overweight investment class, JP Morgan analysts wrote in a research note after U.S. inflation data showed a greater than expected increase in consumer prices on Wednesday at 8.3%.

For energy stocks, “the fact that oil prices have stopped going up makes the sector not as attractive as before, but it remains a sector that can extract quite a big chunk of margins over the others,” said Andrea Cicione, head of research at TS Lombard.

Allocating to companies with stable earnings growth and ample pricing power “makes sense given support for commodity prices,” said Marcella Chow, global market strategist at JPMorgan Asset Management.

China, Southeast Asia

China might currently seem like a contrarian bet, but Credit Suisse Group AG and Invesco Ltd. are among those that point to an impending rebound once lockdowns ease in major cities such as Shanghai and Beijing.

While mired in a bear market, China’s benchmark CSI 300 Index gained 2% last week, led by industrial stocks, posting its biggest weekly outperformance versus global peers since 2020.

READ: China Stocks Set For Recovery Post Lockdowns, Credit Suisse Says

Elsewhere in Asia, reopening Southeast Asian economies are also seen offering some opportunities including in energy and financial shares, with the latter holding a nearly 40% weight in the region’s benchmark MSCI index.

“High quality Asean banks with strong deposit franchises look relatively well placed,” such as Indonesia’s Bank Central Asia Tbk, said Ross Cameron, a Tokyo-based fund manager of Northcape Capital Ltd.

READ: Chinese Stocks Stand Out as Rare Winners in Global Equity Rout

Utilities, Japan

Defensive stocks -- whose earnings are less dependent on economic cycles -- are also seen offering some solace. In Europe the Stoxx 600 Optimised Defensives Index is nearly flat for the year, compared to a 15.3% drop in the equivalent cyclicals index.

Investors should stay “relatively constructive” on sectors such as US health care and European utilities and telecom, Morgan Stanley strategists led by Mike Wilson wrote in a mid-year outlook report.

Overall, Morgan Stanley prefers Japanese equities over US shares due to the differing monetary-policy backdrops, cheaper valuations and light investor positioning.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output