Oil Rebounds From Tumble as Traders Focus on Demand Outlook

(Bloomberg) -- Oil rose after the biggest one-day drop this year as traders focused on the still-positive demand outlook and appetite for risk rebounded.

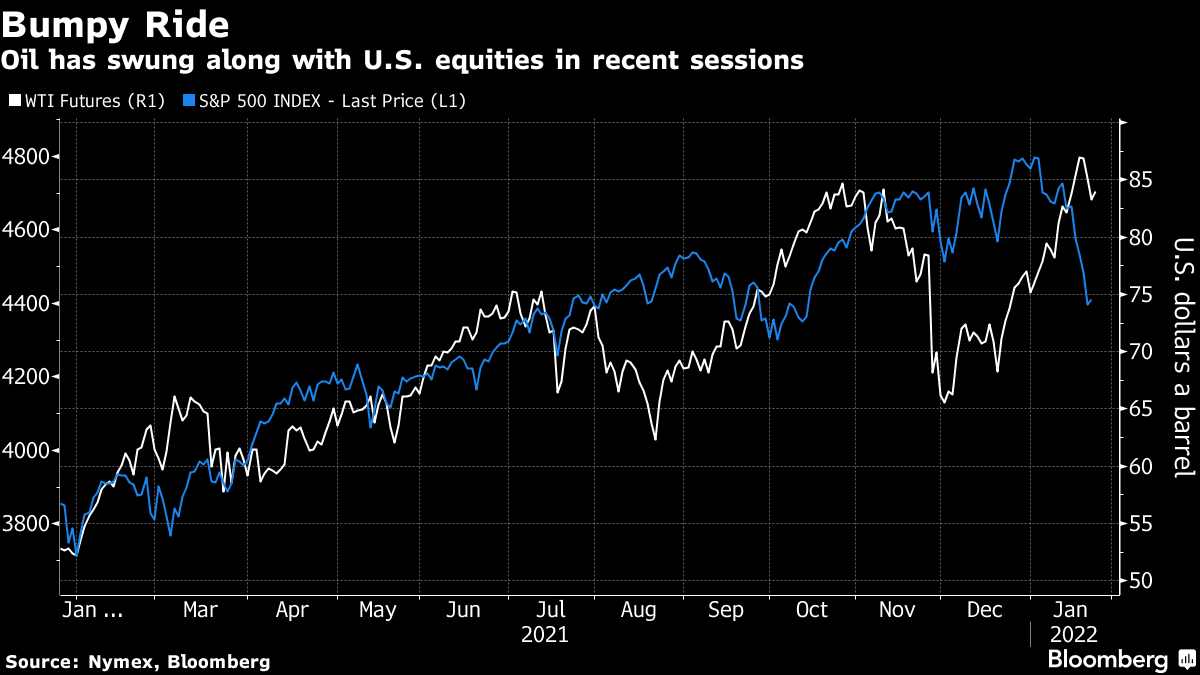

West Texas Intermediate climbed toward $84 a barrel after shedding more than 2% on Monday, when U.S. equities swooned then recovered. The volatile trading comes as the Federal Reserve prepares the ground for interest-rate increases, and Russian troops mass on the border with Ukraine. In recent months, oil bears have retreated as speculators turn more bullish amid lower stockpiles.

Crude rallied to a seven-year high last week as worldwide consumption recovered from the impact of the pandemic, eroding inventories. U.S. oilfield services giant Halliburton Co. said it expected the environment to remain supportive as it reported a jump in profit and higher dividend on Monday.

“Oil markets slid overnight on growth concerns,” said Stephen Innes, managing partner at SPI Asset Management Pte. Still, with the prospect of military escalation in Eastern Europe, “speculators could still cover dips betting on a plus-$90-per-barrel kneejerk reaction,” he said.

A Russian invasion of Ukraine would potentially have widespread implications for energy and commodities markets, including oil and gas. The risk of that happening in the next few weeks stands at more than 50%, according to RBC Capital Markets analyst Helima Croft.

U.S. crude stockpiles are headed for another monthly drop in January after contracting by 15% in 2021. The industry-funded American Petroleum Institute will release its latest weekly estimate of nationwide oil inventories on Tuesday, as well as key products including gasoline.

Oil markets remain in backwardation, a bullish pattern in which traders pay a premium to secure near-term supplies. Brent’s prompt spread -- the difference between its nearest two contracts -- rose to 86 cents a barrel on Tuesday, up from 73 cents a week ago.

Costlier oil is helping to fan inflationary pressures worldwide, prompting central banks to tighten monetary policy and leading governments to implement measures to cushion the impact on consumers. On Tuesday, Japan said it will give subsidies to refiners in an bid to curb gasoline prices.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company