Oil Drops With a Stronger Dollar Offsetting China Trade Data

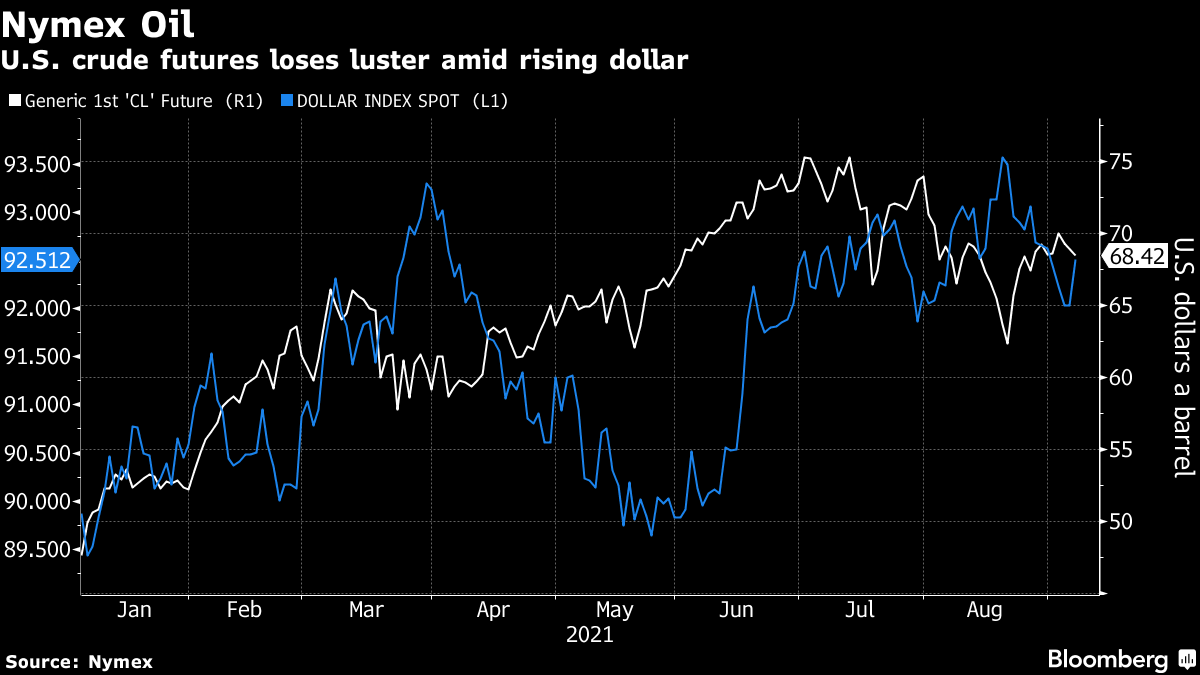

(Bloomberg) -- Oil in New York weakened as the dollar rose, offsetting bullish Chinese trade data that added to positive economic signs emerging from key energy users.

U.S. crude futures earlier lost as much as 2.4%, with a stronger dollar making commodities priced in the currency less attractive. Prices earlier got a lift from a surge Chinese trade data, suggesting sturdy demand for goods in the U.S. and Europe. The Asian country’s overall imports also rose, with crude purchases climbing to a five-month high, pointing to a revival in the region’s biggest economy following a recent wave of Covid-19 infections.

“WTI is basically getting thumbed down by the rising U.S. dollar,” said Bart Melek, head of commodity strategy at TD Securities. Looking forward, there seems to be a pull back in risk appetite with slower-than-expected economic growth due to the delta-variant of the coronavirus, and the impending Federal Reserve’s asset tapering later in 2021, he added.

The fast-spreading delta variant has raised demand concerns in recent weeks, though China was able to swiftly contain its latest outbreak. There are expectations that the market will tighten over the rest of 2021, with the Organization of Petroleum Exporting Countries and its allies deciding last week to keep boosting supply on a bet that the recovery will accelerate.

“The good news is that Chinese exports expanded at an unexpected pace in August,” said Tamas Varga, an analyst at oil brokerage PVM Oil Associates Ltd. “The question is how long the delta variant will weigh on demand forecasts.”

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad