Europe Poised to Import More LNG Than Ever This year, IEA Says

(Bloomberg) -- Europe will import record volumes of liquefied natural gas this year, deepening its reliance on the volatile global market, according to the International Energy Agency.

The region is expected to buy more than 185 billion cubic meters of LNG, the agency said in a report Friday. Even as overall demand for the fuel is set to drop amid the continued expansion of renewables, Europe will need more to replenish rapidly depleting inventories and sustain exports to war-torn Ukraine.

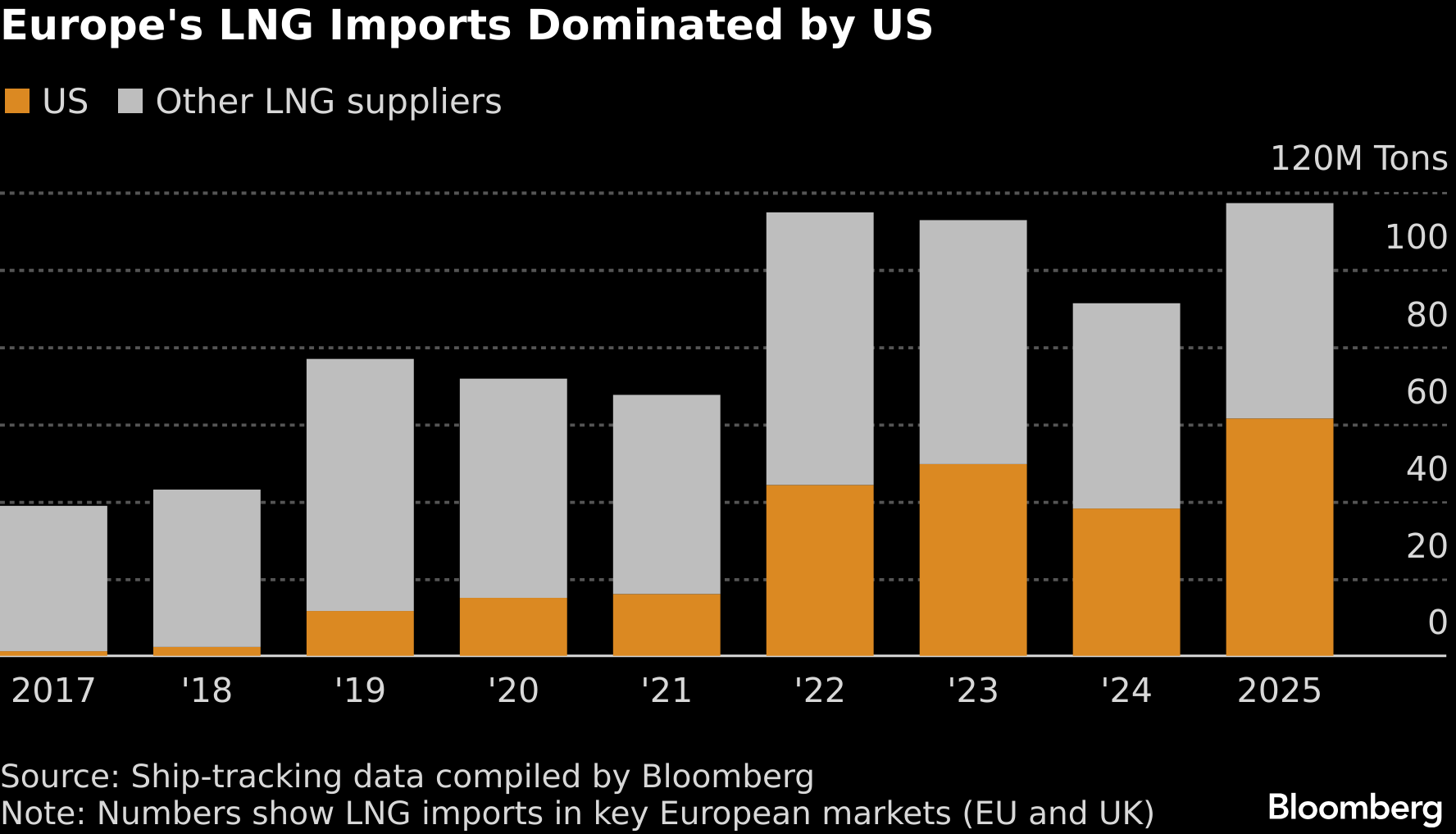

Imports have been rising since Europe lost most of its Russian pipeline supplies after the invasion of Ukraine. The super-chilled fuel now covers roughly half of the continent’s gas needs. While that’s helped to avoid any supply shortages — including during the energy crisis four years ago — it’s increased its exposure to global price volatility and geopolitical risks.

Global LNG supply growth, already accelerating, is expected to expand at its fastest pace since 2019 this year, the IEA said. The additional volumes should ease fears of market tightness, but geopolitical tensions and weather risks could still stoke huge price swings.

The growing interdependence of regional markets is reflected in prices, the IEA said. The correlation between European and Asian benchmarks rose to a record 0.955 in 2025. The link is driven by the rising share of destination-flexible LNG supplies.

Gas prices and volatility eased to pre-crisis levels last year, but jumped again this month. The rebound was triggered by low European inventories, colder-than-expected weather in key markets and short covering, as traders unwound bearish positions built during a period of relative price stability.

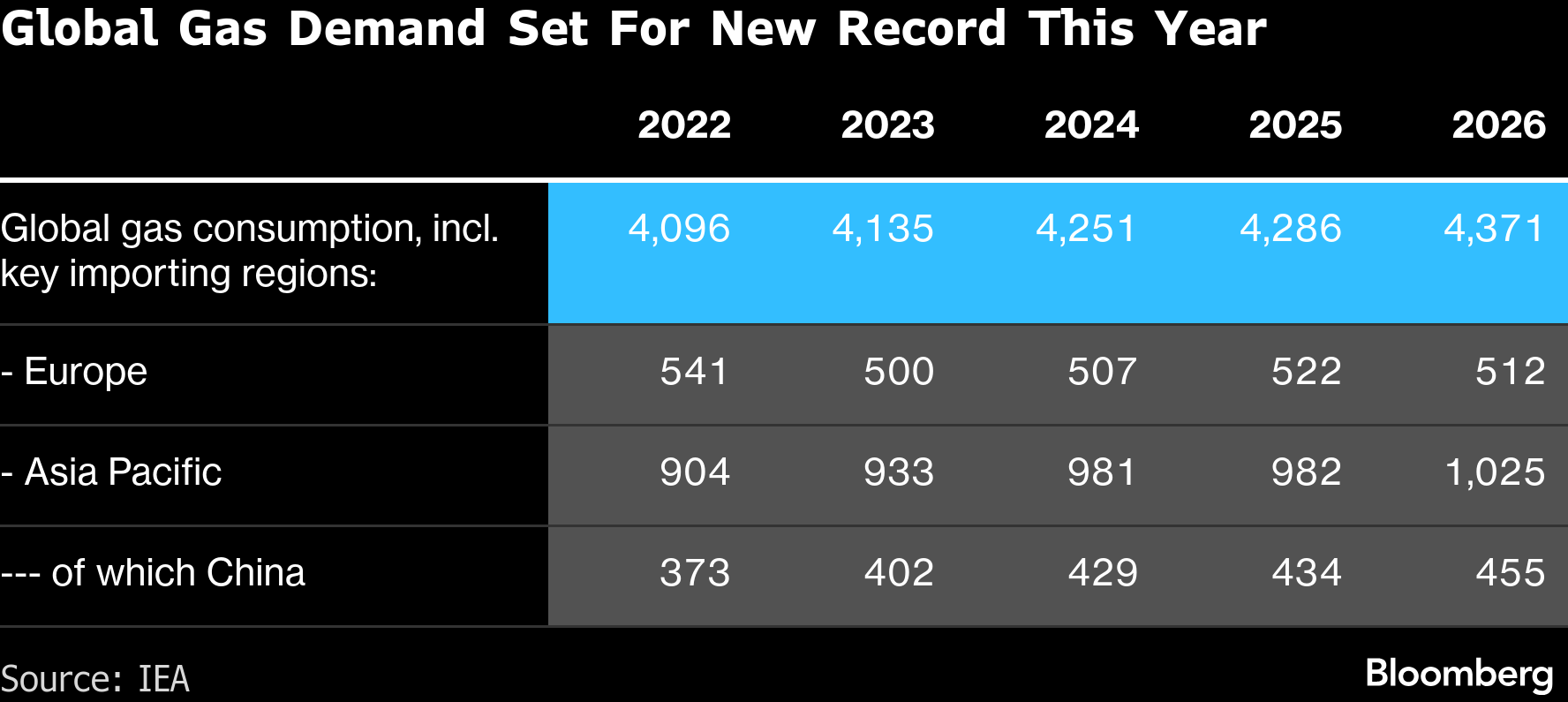

Looking ahead, the IEA expects global gas consumption to rise nearly 2% this year to a record, following growth of less than 1% in 2025. Asia is forecast to be the main driver.

In Europe, total gas demand is projected to fall 2%. Continued growth in renewables is set to curb gas use in the power sector, while industrial demand may pick up as supply availability improves.

©2026 Bloomberg L.P.