BP Flags Up to $5 Billion of Energy Transition Writedowns

(Bloomberg) -- BP Plc said it expects to take as much as $5 billion in writedowns from its energy transition business, just weeks after a leadership change as it pivots back to fossil fuels.

In an update ahead of earnings next month, the energy giant also flagged weak oil trading and flat production for the fourth-quarter, while net debt was reduced.

The update follows the shock ouster of chief executive officer Murray Auchincloss, who sought to reset the company after years of failed low-carbon bets and pressure from activist shareholder Elliott Investment Management. New Chairman Albert Manifold said changes weren’t happening fast enough and named Woodside Energy Group Ltd. CEO Meg O’Neill to replace him.

The London-based oil major is divesting non-strategic assets, with the sales helping bring down debt. Meanwhile, the weak oil trading results and flat production in a lower oil price environment will add more pressure to BP’s ability to maintain its pace of share repurchases.

The company’s “next logical step” is to halt the buybacks and “allow for further de-leveraging in a weaker macro environment,” RBC analyst Biraj Borkhataria said in a note on Wednesday.

BP shares fell as much as 1.7% in early London trading after the report.

O’Neill will take over in April with some of the groundwork to turn the company around laid out for her, and the writedowns should help provide a cleaner slate.

BP didn’t specify which assets were being written off, but its low-carbon portfolio includes a global offshore wind joint venture with Jera Co., as well as solar power, biofuels and electric-vehicle charging. Borkhataria anticipates more assets “to be on the chopping block.”

The company in December agreed to sell a majority stake in its Castrol lubricants division to US investment firm Stonepeak Partners, a crucial step in its efforts to reduce debt and refocus the business on fossil fuels. Last year it also announced a spate of oil and gas field startups.

Divestment proceeds of $5.3 billion in 2025 don’t include Castrol, BP said. The stake sale should raise about $6 billion, BP said last month. The company, which has the highest leverage among top oil majors, is targeting $20 billion from asset sales by the end of 2027.

Its net debt to equity ratio could be negatively impacted by the writedowns, Jefferies analyst Mark Wilson said in a note on Wednesday.

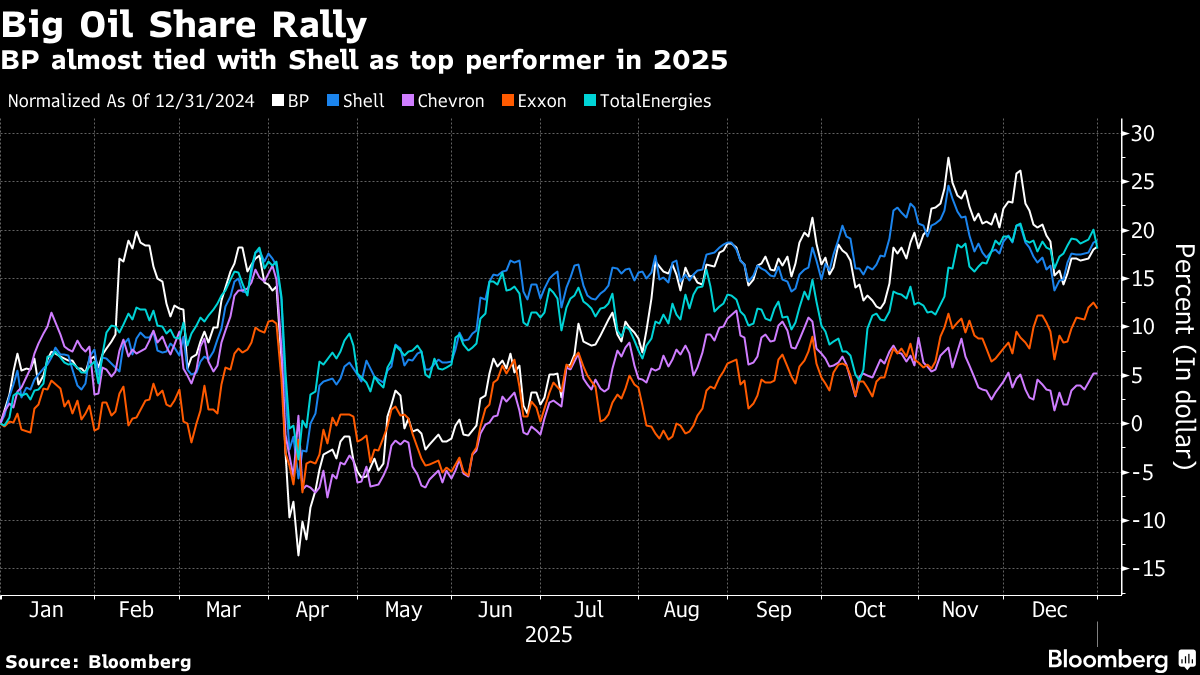

BP’s turnaround efforts helped shares to almost tie with Shell Plc as best performer among the top five oil majors last year in dollar terms, but the recovery started faltering in mid-November to end the year with a 10% gain. Third-quarter earnings beat expectations largely thanks to rising oil and gas output in the period.

The reversal is now under the threat of lower oil prices as the market seems headed to oversupply, though geopolitical risks have offered some price support. Even with the recent turmoil in Venezuela and Iran, international benchmark Brent crude has traded below the $70-a-barrel level that BP needs in order to achieve its turnaround targets.

Both Shell and Exxon Mobil Corp. have signaled a tougher fourth quarter. Already, European competitor TotalEnergies SE cut its share repurchases in the fourth quarter and said the pace could fall further in 2026 as the Paris-based major faces mounting debts and a challenging oil-market outlook.

If BP maintains its share buyback level by the time O’Neill starts, she may need to contend with how to organically fund investor payouts with lower crude prices.

(Updates with analyst comment in fifth paragraph. A previous version corrected the spelling of the new CEO’s name.)

©2026 Bloomberg L.P.