Siemens Energy Boosts Outlook on Turbine, Data Center Demand

(Bloomberg) -- Siemens Energy AG substantially raised its mid-term financial targets on strong demand for gas turbines and data center equipment as well as restructuring progress at its Gamesa wind turbine unit.

The manufacturer sees returns before special items as high as 16% by fiscal 2028, up from a previous target of as much as 12%. The company, which long struggled to overcome issues with malfunctioning onshore wind turbines, also hiked its projections for revenue growth.

Siemens Energy has profited from the artificial intelligence boom by securing more orders for its transformers and circuit breakers that are used in data centers. Rising global energy needs have lifted demand for its gas turbines that offer robust margins.

“We see that momentum continuing,” Chief Financial Officer Maria Ferraro said Friday in an interview with Bloomberg Television. “We’re booking now in certain businesses past 2028 and beyond.”

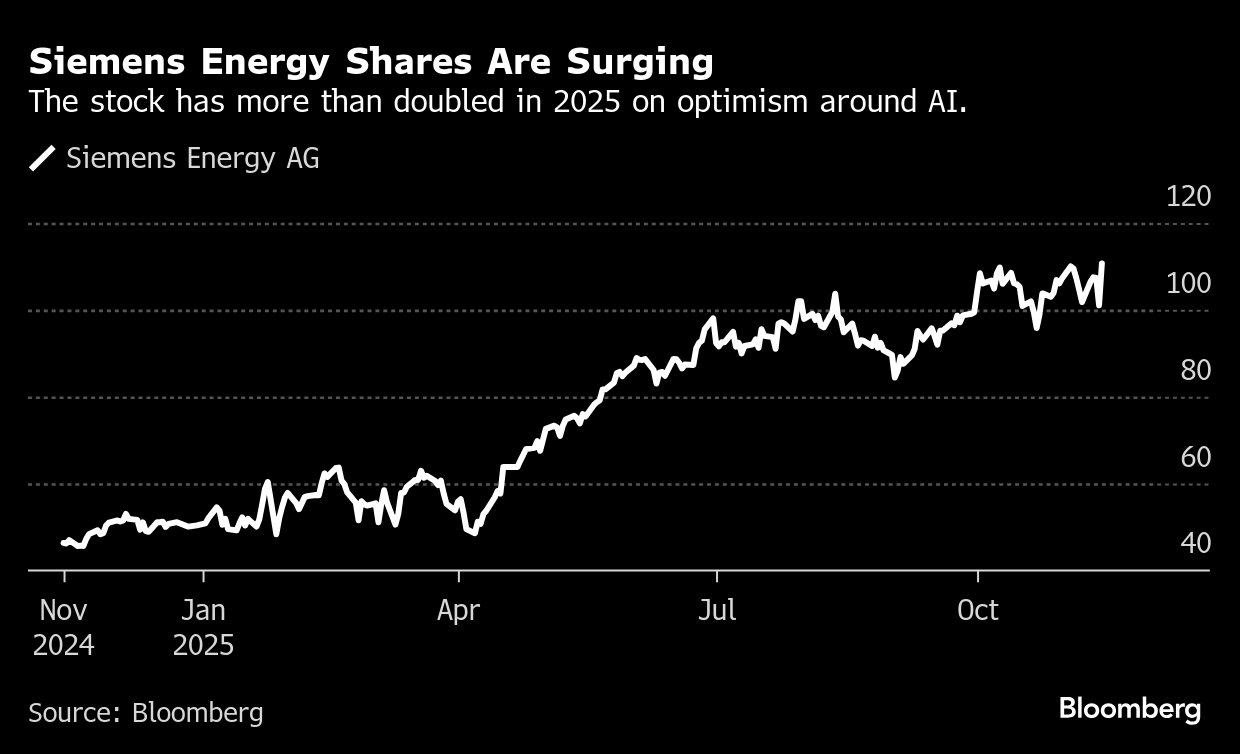

The company’s shares jumped as much as 12% in Frankfurt, the steepest intraday gain since April. While the stock has more than doubled this year on optimism around AI, Siemens Energy is still struggling to turn around its unprofitable Gamesa wind-turbine unit.

The manufacturer continues to expect Gamesa to break even in 2026, though the division reported another operating loss in the fourth quarter as low-margin contracts weighed on the onshore business. Costs associated with the ramp-up of offshore wind and US tariffs also held back the result.

Gamesa is pushing to increase production, optimizing supply chains and raising efficiencies to ensure that “every dollar is going into the right direction,” Ferraro said.

Siemens Energy also detailed results for the fiscal fourth quarter ending in September. Revenue rose 9.7% to €10.4 billion ($12.1 billion). Profit at the grid technologies unit, which supplies data centers, jumped 71%, giving a return before special items of nearly 15%.

For fiscal 2026, Siemens Energy expects current favorable trends in the energy sector to continue, led by growing demand for electricity and modernization of infrastructure, benefiting all of the company’s business areas.

It forecast comparable revenue growth, excluding currency translation and portfolio effects, of as much as 13% and a profit margin before special items between 9% and 11%. The impact from tariffs will be lower than the around €200 million incurred in fiscal 2025, Ferraro said during an earnings press conference in Berlin.

While the company’s guidance for the current fiscal year is broadly in line with consensus, its updated mid-term outlook came in “above already high investor expectations,” Citi analysts led by Vivek Midha said in a note.

(Updates with analyst comment in final paragraph.)

©2025 Bloomberg L.P.