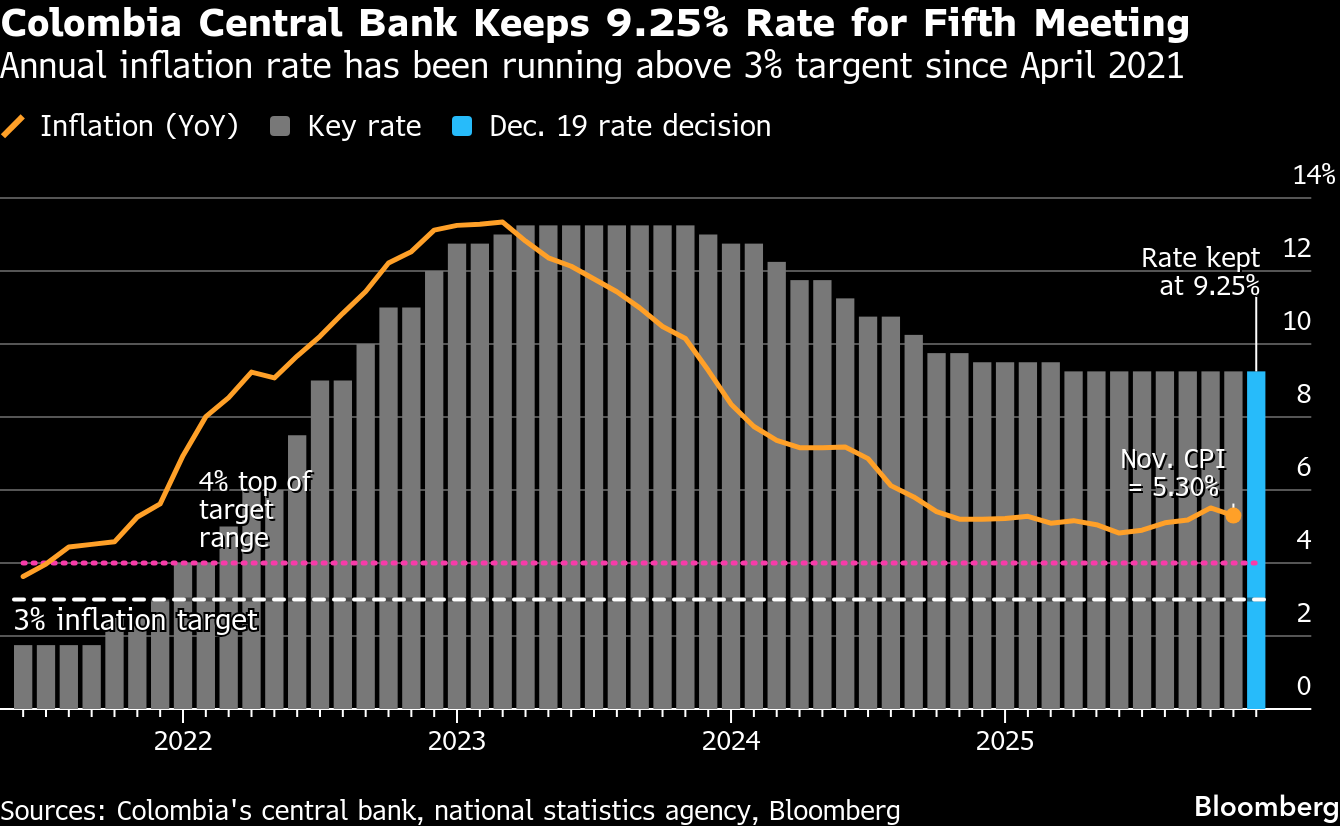

Colombia Holds Key Interest Rate at 9.25% in Split Decision

(Bloomberg) -- Colombia left interest rates unchanged as the strong peso helps keep a lid on inflationary pressure.

Policymakers voted to keep the policy rate at 9.25%, Governor Leonardo Villar said after Friday’s meeting.

Four of the seven-member board backed the decision. Two, including Finance Minister Germán Ávila, argued for a cut of half a percentage point, while one called for a quarter-point reduction.

“The majority decision maintains a cautious stance on monetary policy that recognizes the identified risks to the convergence of inflation to the target,” the bank said in its statement.

The decision was in line with forecasts from 25 of 29 economists surveyed by Bloomberg, while the others predicted an increase of a quarter percentage point.

Policymakers are monitoring a series of potential inflation risks, including a large increase in the minimum wage for 2026, a reversal of the peso’s recent strength, a jump in natural gas prices, and a further widening of the fiscal deficit. Villar and co-director Mauricio Villamizar warned last month that higher interest rates may at some point be warranted to ensure that inflation slows toward its target.

The peso strengthened as much as 2.1% on Friday, the most in emerging markets, as an offshore investor made the largest-ever purchase of local peso bonds, or TES.

Annual inflation slowed more than expected, to 5.3%, in November. Even so, economists surveyed by the central bank expect inflation to overshoot its target for a sixth consecutive year in 2026. The bank seeks annual consumer price rises of 3%, plus or minus one percentage point.

After failing to reach an agreement between business groups and union leaders, the government will set the minimum wage increase by decree. Several cabinet members have hinted the hike could exceed 10%, a move that could fuel inflation through indexation effects.

Fitch Ratings downgraded Colombia’s sovereign credit rating one notch deeper into junk this week, citing persistently large fiscal deficits. Congress last week rejected a tax bill that sought to raise 16 trillion pesos ($4.2 billion) in revenue for next year.

(Adds split decision in second paragraph; comment from central bank in fourth paragraph.)

©2025 Bloomberg L.P.