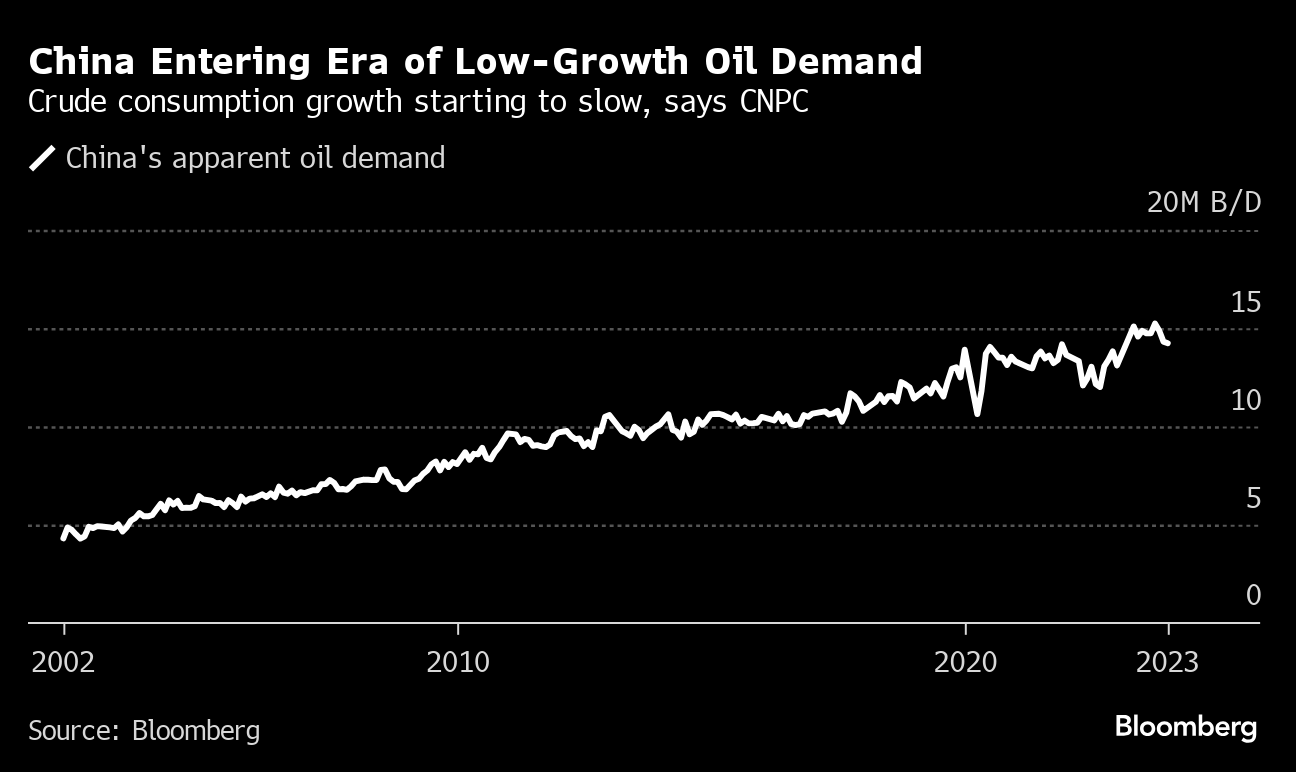

Chinese Oil Demand Is Entering Era of Low Growth, CNPC Says

(Bloomberg) -- China’s oil demand has entered a low-growth phase as decarbonization starts to eat into consumption of fossil fuels, the country’s biggest energy producer said.

Greater take-up of electric vehicles, as well as trucks powered by liquefied natural gas, will replace about 20 million tons, or 10% to 12% of the country’s gasoline and diesel consumption this year, said Lu Ruquan, president of China National Petroleum Corp.’s Economics & Technology Research Institute.

Still, overall demand for crude will continue to grow, aided by the expanding petrochemical sector, Lu said in an interview with Bloomberg Television.

China is the world’s largest oil importer, and a slowdown in demand growth this year may act as a brake on international crude prices. Past expectations on timelines and peak demand levels have missed the mark, however, as fossil fuels from oil to coal remain the most accessible across Asia’s largest economy, despite renewable energy expanding rapidly.

Beijing set an annual growth target of about 5% this week, a goal that may add pressure on top leaders to unleash more stimulus as the government tries to boost confidence in an economy that’s been hampered by a prolonged property slump and entrenched deflation.

Even with just 1% growth in crude demand, other new energy sources will be able to support overall economic growth of 5%, said Lu, whose comments echo the findings in the institute’s annual outlook.

China’s dependency on imports — more than 70% of its crude oil feedstock and 40% of natural gas is sourced from overseas — is a concern for policymakers, he said. That means China is “sensitive but not vulnerable,” Lu said, citing domestic oil and gas production, as well as diversified import channels as risk-mitigating factors.

The country wants a US-style shale revolution to help it achieve energy security, he said. By 2035, China’s shale oil production will rise to 10 million tons a year, he added. The nation produced 4 million tons of shale oil in 2023, and achieving the target looks ambitious, given the amount of water it would require.

In the global crude market, current geopolitical risks including conflicts in Ukraine and the Middle East haven’t had a major impact on prices, Lu said. The energy sector has shifted from being a seller’s to a buyer’s market, given the energy transition and US shale output, he said. Against that backdrop, producers from Russia to Saudi Arabia will rush to sell more oil, Lu said.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales

ADNOC signs 15-year agreement with PETRONAS for Ruwais LNG project

Woodside signs revised EPC deal with Bechtel for Louisiana LNG