European Gas Jumps 13% as Unplanned Norwegian Outages Cut Supply

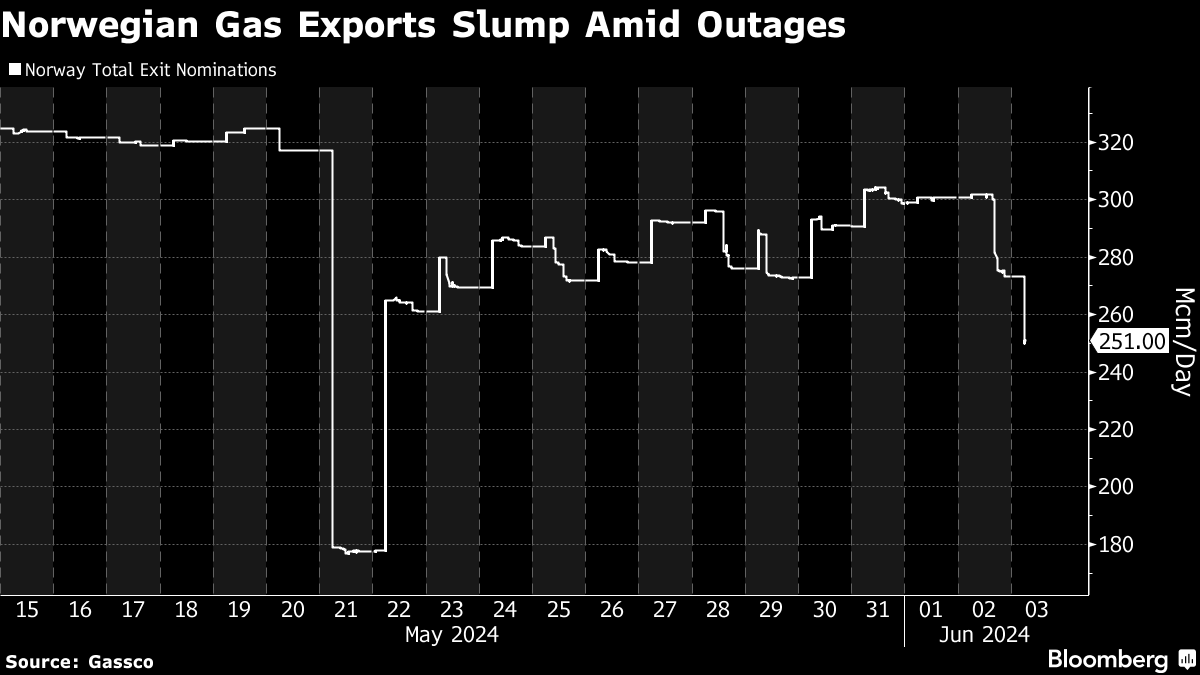

(Bloomberg) -- European natural gas prices surged to the highest this year after flows from Norway slumped, highlighting the risk of relying too much on one major supplier.

Benchmark Dutch gas futures jumped more than 13% on Monday, the most this year. It’s not clear how long an unplanned outage will last at Norway’s massive Nyhamna gas processing plant. At the same time, Norwegian flows into the UK’s Easington terminal, an entry point for a third of Britain’s total supply, plunged to zero.

The outages show the pivotal role Norway plays in supplying Europe after most Russian pipeline deliveries were halted following the invasion of Ukraine. Even after the energy crisis, the market remains very sensitive to supply issues and prices react quickly when there’s any deviation from the scheduled seasonal maintenance plans.

Equinor ASA is now investigating the source of the issue, Alfred Skar Hansen, senior vice president system operation at Gassco AS said by e-mail. The problem may be with a section of pipeline at the Sleipner natural gas field in the North Sea that connects to Easington and Nyhamna, he said.

“It is not yet entirely clear how long the repair will take,” Skar Hansen said.

Dutch front-month futures, Europe’s gas benchmark, rose to € a megawatt-hour at 12.14 p.m. in Amsterdam. The UK contract was up as much as 15%, the most since October.

The rally also highlights how the market remains susceptible to extreme volatility, even with storage sites already more than 70% full and industrial demand in Europe slow to recover. Gas futures have gained for three consecutive months, and jumped by 18% in May.

“The unplanned Norwegian outage is once again highlighting Europe’s dependency on imports,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S.

Gassco said on its website that Nyhamna and Easington are unavailable until at least Wednesday after upstream and downstream restrictions.

LNG imports to Europe have declined in recent weeks with higher demand in Asia, where a heat wave is increasing consumption for cooling. That’s driving competition for cargoes between Europe and Asia, said Saxo Bank’s Hansen.

In power markets, German day-ahead electricity surged to €114.25 a megawatt-hour, the highest since January, according to broker prices on Bloomberg. Prices at the day-ahead auction on Sunday settled at the highest since December. Month-ahead prices also climbed on Monday.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Tesla-Supplier Closure Shows Rising Fallout of Mozambique Unrest

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales

ADNOC signs 15-year agreement with PETRONAS for Ruwais LNG project