LNG Builder Plans New UK Terminal to Help Cut Reliance on Europe

(Bloomberg) -- The UK is a good candidate for a new terminal to import liquefied natural gas because of growing demand and the desire to kick its dependency on pipeline supplies from Europe, the project developer said.

Crown LNG Holdings Ltd., a Norwegian company that builds infrastructure in harsh weather conditions, is targeting Grangemouth, Scotland, for Britain’s fourth terminal. The site is meant to have a capacity of at least 2 million tons a year when it goes online by early 2027.

“It is a bold move, but the UK is too dependent on interconnectors,” Chief Executive Officer Swapan Kataria said in an interview. “If they stop working, what happens next?”

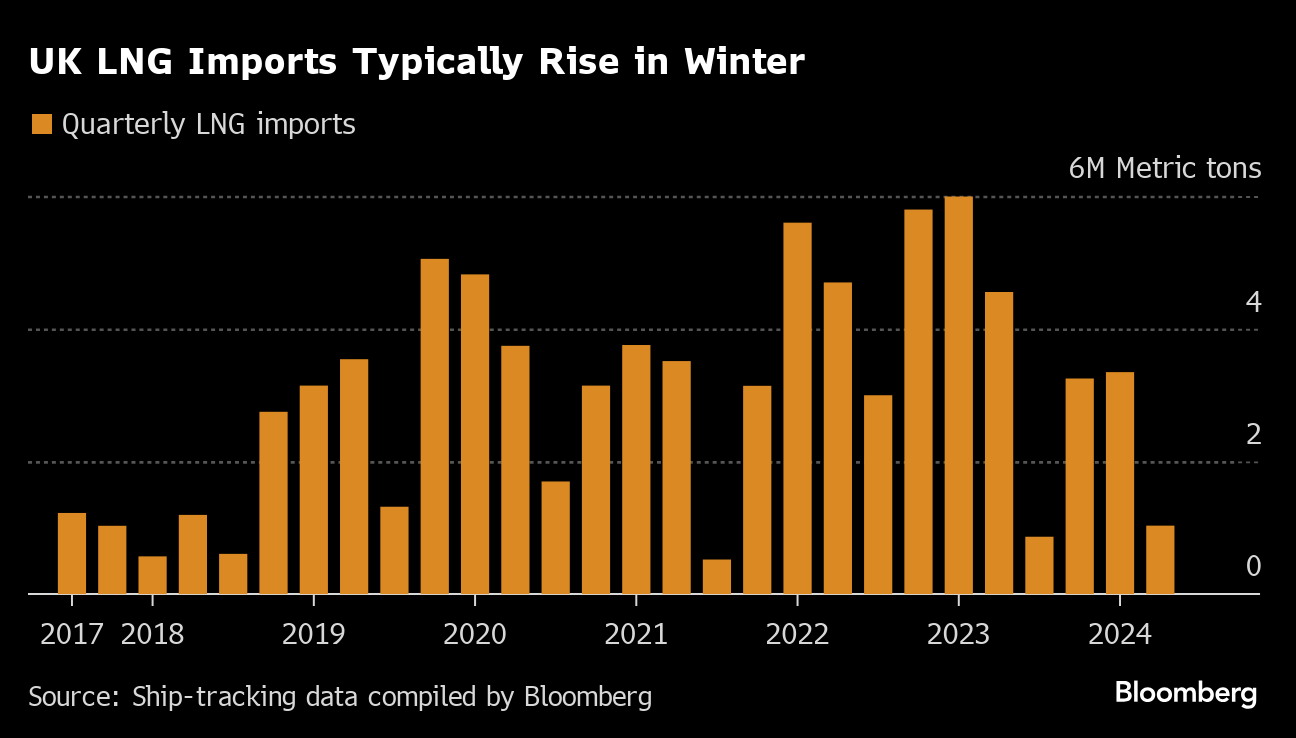

The UK increasingly depends on gas imports, including from the continent, as North Sea production declines, yet competition for the fuel may intensify as other nations try to fill the gaps left by reduced Russian supplies. The squeeze typically occurs during winter’s coldest days.

After Russia’s invasion of Ukraine in 2022, new LNG terminals were quickly built across the continent, and some projects are still being pursued. The Scotland facility was initially expected to link with a proposed power plant, but Crown LNG sees enough demand without it, Kataria said.

“What happened in the last two years, it has woken up a lot of people,” he said. “They have to be ready.”

The nation has two LNG terminals in Wales and one east of London — all onshore. Floating terminals, like the one proposed by Crown, are typically cheaper and faster to build, with an estimated price tag of about $600 million (£473 million).

Crown has spoken with potential customers in the local industrial and power sectors about the project, Kataria said. Developers of US export facilities, which are keen to have a big European market for their shipments, are also interested, he said, declining to identify them.

The intermittent generation of renewable power in Scotland also supports the case for building, he said.

“In light of declining gas production, the UK’s gas import dependency is expected to rise,” Kataria said.

The company is starting the preliminary application process, to be followed by an environmental assessment and the search for a floating storage and regasification unit, or FSRU — which may take at least 18 months.

The demand for specialized vessels that import LNG is high, with shipyards busy filling orders as countries prepare for a wave of fresh supply from the US and Qatar starting in about 2026.

“We are certainly concerned about availability of FSRU,” Kataria said. “Everyone is looking for a bargain, but the FSRU market is out of the bargain.”

Crown LNG targets a final investment decision on the project in late 2024.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Slovakia Plans Talks on Gas Transit Via Ukraine Starting Next Week

Gazprom’s NIS Set to Face US Sanctions, Serbian Leader Says

Tesla-Supplier Closure Shows Rising Fallout of Mozambique Unrest

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan