Europe’s Gas Hits One-Month High as Russian Risks Rattle Markets

(Bloomberg) -- European natural gas jumped to the highest level in a month as Moscow’s surprise ban on some fuel exports revived concerns over Russia’s broader energy supplies.

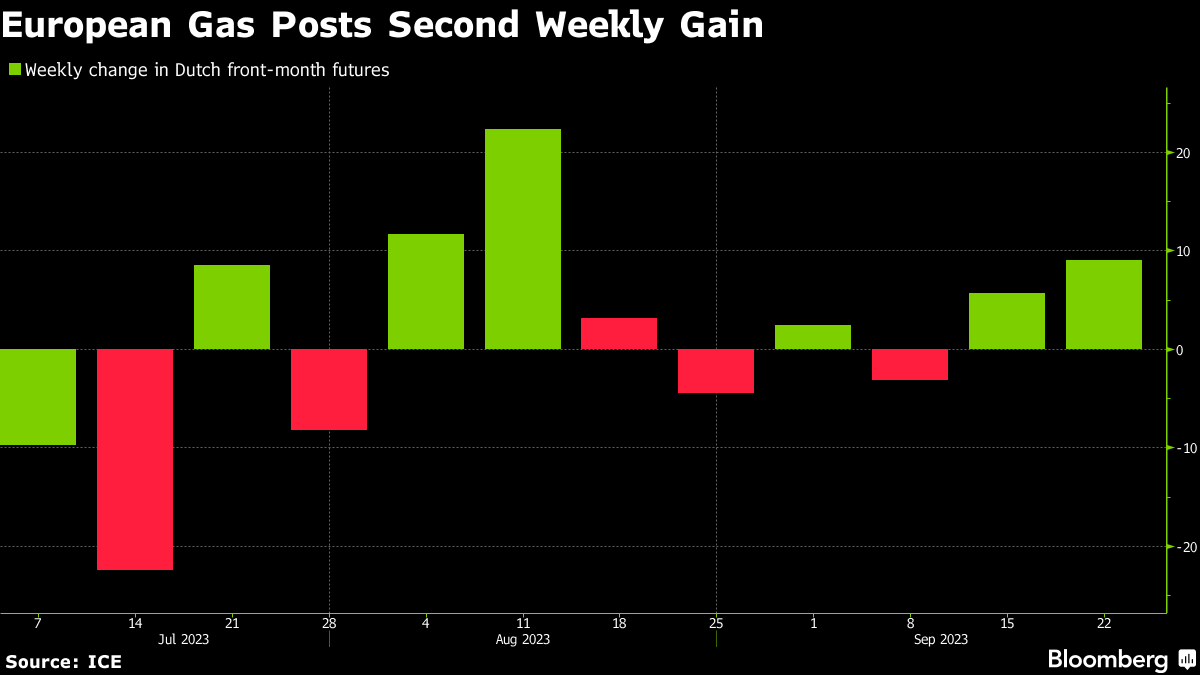

Benchmark futures settled 1.8% higher in a second weekly gain. The contract surged as much as 7.3% on Friday to top €40 a megawatt-hour for the first time since late August.

Moscow announced a temporary ban on diesel and gasoline exports on Thursday, lifting prices for oil and oil products, which later spread to some other commodities.

Russia’s Diesel Exports Ban Is Risky for Moscow and World Alike

While Europe relies on Russia for less than 10% of its gas — down from more than 30% before the Kremlin’s invasion of Ukraine last year — the region’s market remains tight and extremely sensitive to potential supply issues. There have been no reports that gas exports could be impacted, but some traders consider the new ban as a sign that Russian risks are back in focus.

“European gas rallied in tandem with crude on Thursday afternoon following the announcement from Russia regarding diesel exports,” said Tom Marzec-Manser, head of gas analytics at ICIS in London. “It is likely the ongoing upside in Brent is again supporting TTF on Friday,” he added, referring to Europe’s gas benchmark traded in the Netherlands.

Traders also are monitoring flows from Norway, currently Europe’s top supplier. Maintenance there is set to continue well into October, even as volumes from the country slowly recover from protracted outages.

Dutch front-month futures settled at €39.79 a megawatt-hour, adding 9% for the week. The UK equivalent also jumped.

Prices erased an earlier drop of more than 6% after Australian unions called off strikes at Chevron Corp. liquefied natural gas facilities — a bearish development on a normal day.

Europe’s winter gas inventories are almost full, but it’s not clear whether stockpiles will be enough to last the duration of winter. Russia’s pipeline cuts last year left the market without a substantial buffer to navigate sudden disruptions, and even brief supply interruptions globally are affecting prices.

In the US, gas supplies to the Sabine Pass liquefaction plant, the nation’s largest, began to recover after a dip on Thursday, data compiled by Bloomberg show. Traders are closely monitoring fuel shipments from the country as US LNG has helped to fill the gap left by Russia.

Recent near-term risks created a pattern this month where day-ahead prices at times traded higher than futures for October. Some European traders even used gas from storage to fill in the gaps — not an unheard-of practice, but an anomaly when there’s no heating demand yet.

“This reflects traders with capacity at short-churn storage sites selling gas into a tighter spot market and betting on a prompt price disconnect in October,” analysts at Energy Aspects Ltd. said in a note. The “capacity will be refilled and the net impact on storage fill will be minimal.”

Read also: Why Russia’s Ban on Diesel Exports Will Last Weeks Not Months

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Slovakia Plans Talks on Gas Transit Via Ukraine Starting Next Week

Tesla-Supplier Closure Shows Rising Fallout of Mozambique Unrest

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales