Australia LNG Workers to Resume Strikes, Fueling Price Gain

(Bloomberg) -- Workers at Chevron Corp. liquefied natural gas facilities in Australia plan to resume strikes, threatening global supplies just as Europe and Asia approach their winter heating season and pushing prices higher.

Union members at Chevron’s Gorgon and Wheatstone plants voted to return to walkouts, after suspending stoppages last month, according to Offshore Alliance, which represents the labor groups. The decision comes after the unions criticized the company’s efforts to finalize an agreement on pay and conditions.

The unions will give Chevron a notice of seven working days on Monday, a union representative said, asking not to be identified.

Chevron didn’t immediately respond to a request for comment. Benchmark gas futures in Europe rose as much as 5.1%.

Renewed strikes again raise the risk disruptions to gas supplies from Australia, one of the world’s biggest exporters of the fuel, as seasonal demand increases in the Northern Hemisphere. Prices in Europe and Asia jumped several times during the third quarter amid concern over the effects of potential strikes.

Although Europe receives almost no gas from Australia directly, it has been particularly sensitive to global supply risks. The region depends on LNG to replace Russian pipeline gas, and it would have to compete with Asian buyers for global tanker-borne fuel.

Unions say they’re concerned about Chevron’s commitment to implementing a proposed settlement to the dispute put forward by Australia’s labor regulator. Chevron said Thursday it had meaningfully engaged with staff to formalize an agreement.

“Since that agreement was reached the Offshore Alliance has been working with Chevron to finalize the drafting of the agreements,” the alliance said in a statement. “However as part of that process lawyers acting for Chevron have been attempting to walk back some clauses previously settled.”

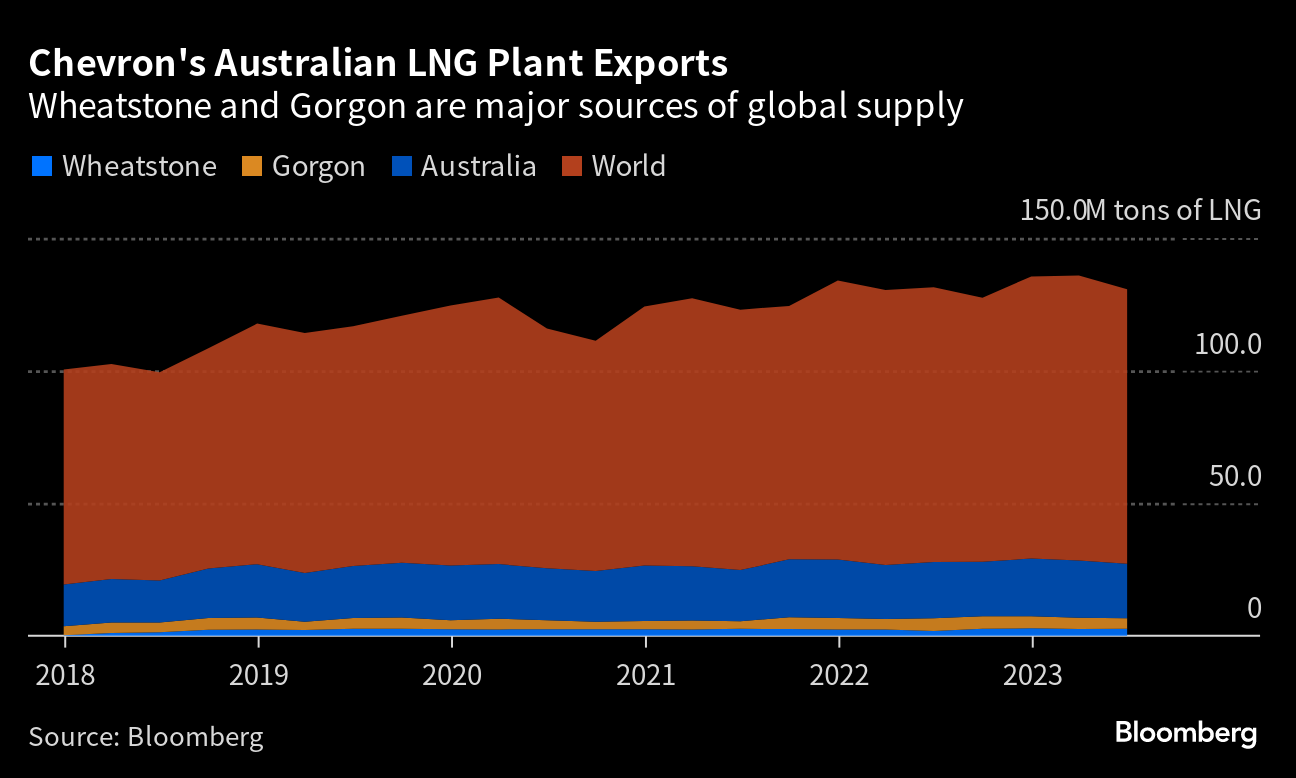

The Gorgon and Wheatstone facilities in Western Australia accounted for about 7% of global LNG supply last year.

European benchmark prices rose 1.6% to €36.78 a megawatt-hour by 12:30 p.m. in Amsterdam.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales

ADNOC signs 15-year agreement with PETRONAS for Ruwais LNG project

Woodside signs revised EPC deal with Bechtel for Louisiana LNG

Vitol, Glencore Eye New Fortress’ Jamaica LNG Assets