Europe’s Gas Buying Slows on Expectations of Further Price Crash

(Bloomberg) -- Natural gas purchases needed to refill Europe’s storage sites are slower than usual for this time of year despite a recent price drop with some buyers betting on a further slump.

The continent’s benchmark futures have crashed to just a fraction of the record levels seen last summer, but that’s not been enough to stimulate purchases with consumption slow to recover from crisis lows. Confidence that prices will continue to slide is leaving many buyers waiting to fill inventories ahead of next winter.

Reduced fuel usage means that global supplies are enough to cover European demand for now, even with reduced Russian flows. But gas producers and traders warn that the crisis is not over, and a delayed and uncertain rebound in consumption could disrupt what is a fragile market balance.

Consumers seem confident, buoyed by the message from political leaders that worst has passed, according to Klaus Reinisch, group chief sales officer at Swiss-based energy trader MET Holding AG.

“They are hearing from the news everywhere that Europe has done phenomenally well and the crisis is over,” Reinisch said in an interview in Amsterdam.

There are some expectations that prices could drop as low as €10 per megawatt-hour, down more than 70% from levels now, but even if that happens, lower prices won’t linger for long, he said.

Heavy reliance on a global commodity like liquefied natural gas — which replaced Russian pipeline fuel — leaves Europe extremely exposed to broader market moves and sharp price volatility, according to Reinisch.

The market is still vulnerable. A rapid pick-up in gas consumption from industry coupled with a resurgence in demand from Asia leaves risks. Analysts from Goldman Sachs Group Inc. to Boston Group Consulting see a possibility of a price rebound above €100.

Read also: World Gas Supply Shifts From Shortage to Glut With Demand Muted

Expectations of a further price dip mean gas-storage refills in some European countries will probably ease, according to Norwegian energy giant Equinor ASA, Europe’s top supplier.

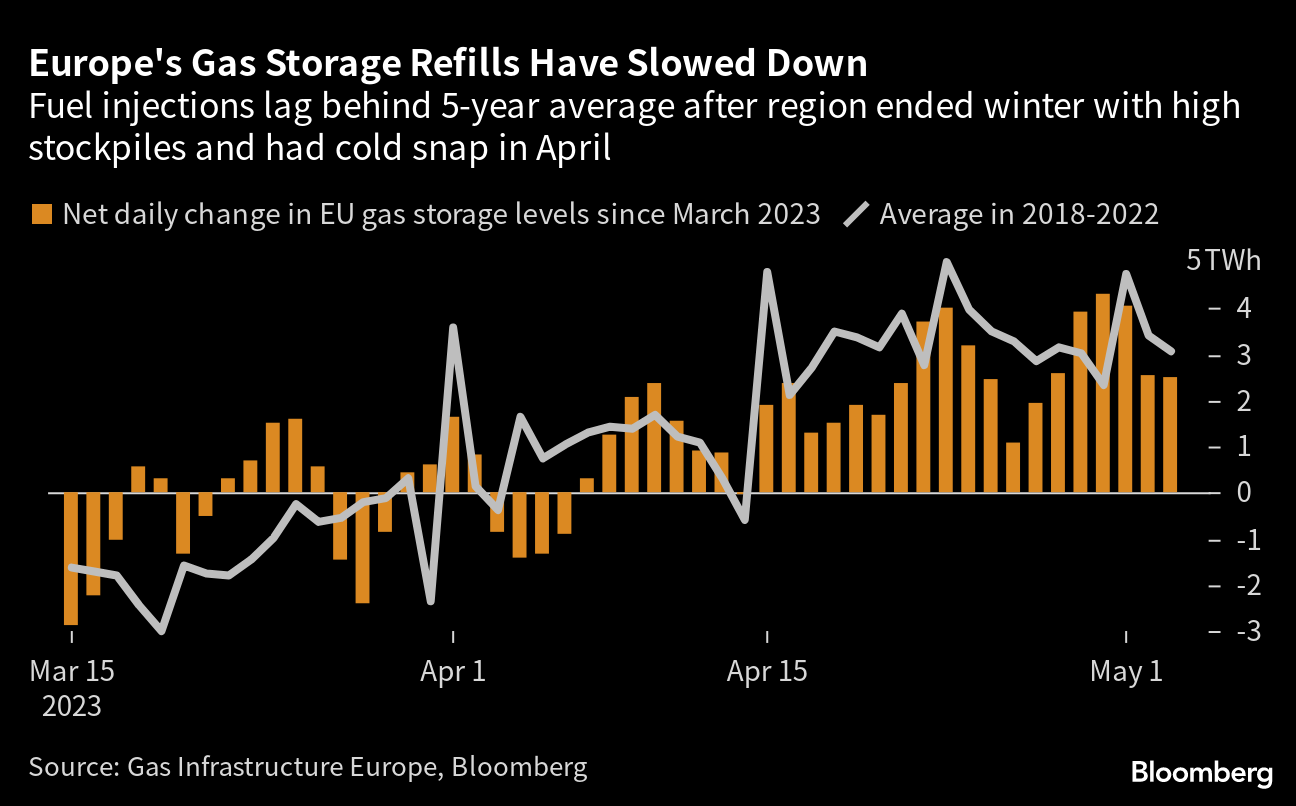

The refill - albeit from very high levels - has already been slower than usual amid a chilly April.

With gas prices relatively flat over the next three months before steep gains in the run up to the winter, “those who have flexibility that allows them to wait, they will wait,” Helge Haugane, Equinor’s senior vice president for gas and power marketing, said in a separate interview in Amsterdam.

“Most people would therefore not inject tomorrow,” he said. “That means you probably will not see storage levels increasing very much in the short term.”

To be sure, there is little doubt that Europe will still rebuild its gas stockpiles to meet European Union’s targets. Inventories are already fuller-than-normal, and there should not be issues for the upcoming winter, Haugane said.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales

ADNOC signs 15-year agreement with PETRONAS for Ruwais LNG project

Woodside signs revised EPC deal with Bechtel for Louisiana LNG