Star Investor Fuels Best Week for Adani Stocks Since Hindenburg

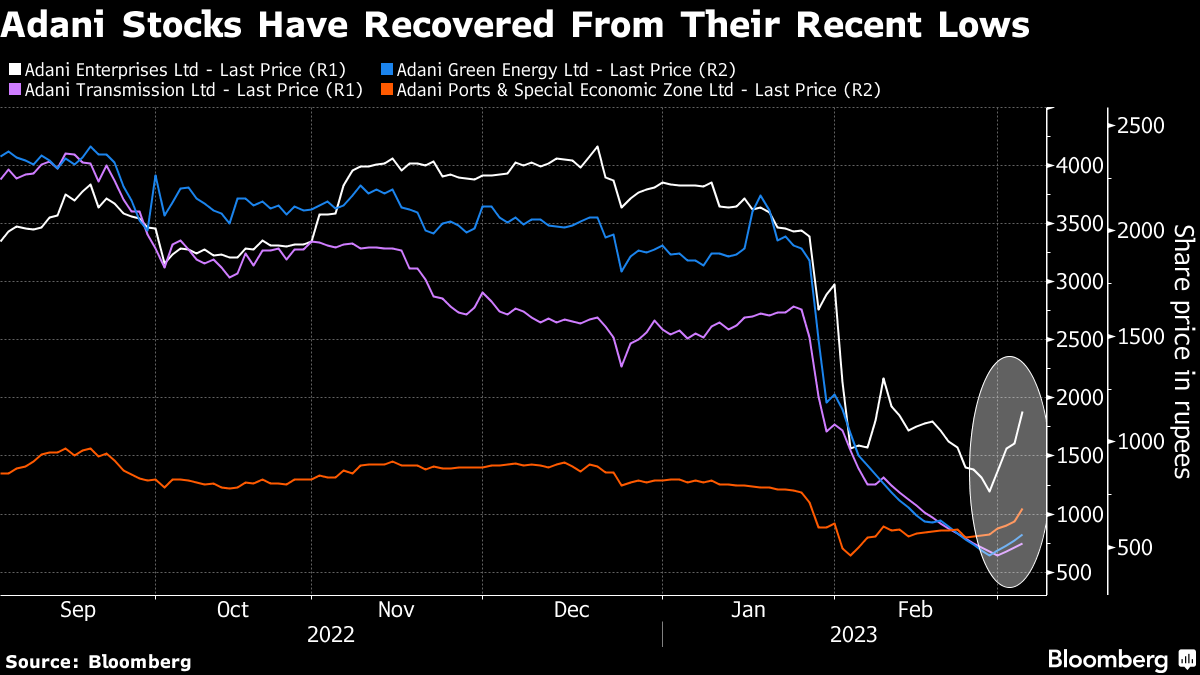

(Bloomberg) -- Adani Group’s stocks surged on Friday after winning a vote of confidence from one of the biggest names in emerging-market investing, helping cap the Indian conglomerate’s best week since late January when a US short-seller’s explosive report triggered an unprecedented rout.

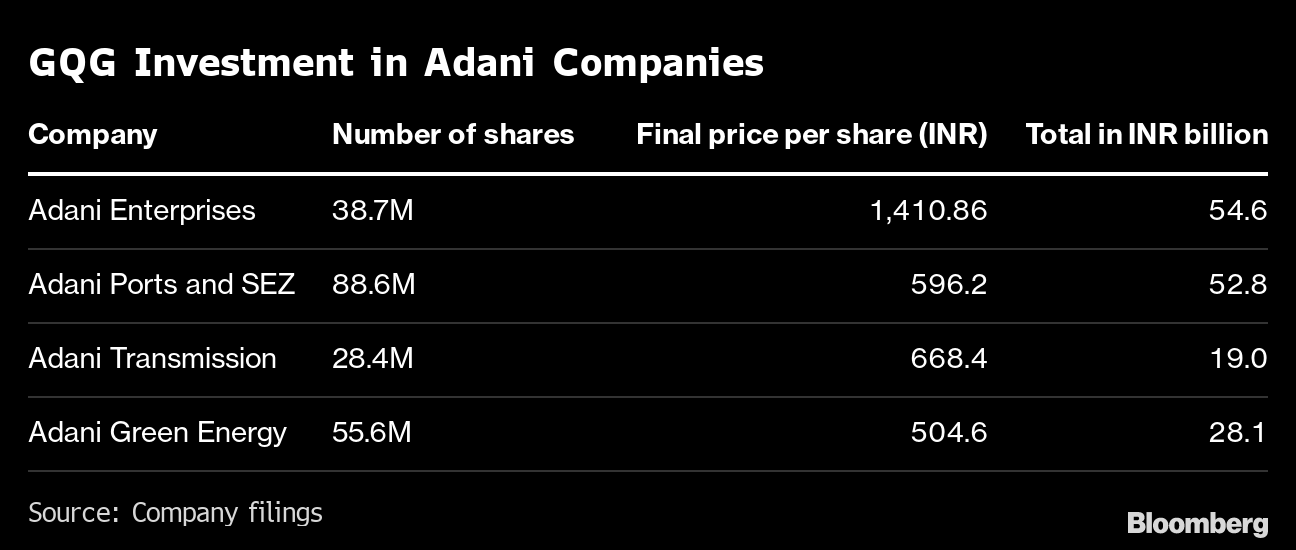

All 10 Adani stocks rose after Rajiv Jain’s GQG Partners bought shares in four firms from an Adani family trust on Thursday. The $1.9 billion investment is the most significant show of support for Adani from a major money manager since Hindenburg Research’s Jan. 24 report alleged accounting fraud and share-price manipulation, spurring a selloff that at one point erased nearly two-thirds of the group’s market value. About $18 billion was recouped this week.

Jain’s backing comes at a crucial time for Gautam Adani’s beleaguered empire, which has spent the past few weeks trying to repair an image damaged by Hindenburg’s accusations. Adani has tried to assure bondholders and has even pared aggressive growth targets to help assuage investor concerns. It is said to plan fixed-income investor meetings starting next week in cities including London, Dubai and across US, after a roadshow in Singapore and Hong Kong this week.

Adani is a bold wager for GQG Chairman Jain, who’s known to broadly prefer safe, defensive stocks of companies that have what he calls bullet-proof balance sheets.

READ: South Florida’s Anti-Cathie Wood Quietly Builds a Stock Behemoth

“It is surprising, but they have come to a conclusion that this is a good investment opportunity, which many others may not have tried to analyze or decipher,” said Deepak Jasani, head of retail research at HDFC Securities Ltd. “They may be seeing a lot of value at these depressed valuations. They may be looking to deploy large sums in India and have snapped up this opportunity.”

Born and raised in India, Jain made his name as a star emerging markets fund manager at Swiss firm Vontobel Asset Management. Later he co-founded GQG and built it into a $88 billion powerhouse with investments in industries like oil, tobacco and banking. In 2022, when most asset managers watched clients yank cash from their funds as markets cratered, Florida-based GQG thrived. The firm lured $8 billion in fresh investment and three of its four flagship funds beat benchmark indexes by wide margins.

In an interview Thursday after the investment announcement, Jain said that he first looked at billionaire Adani’s ports-to-energy empire more than five years ago, but that until recently the shares weren’t enough of a “bargain” to take a position.

The 10 Adani Group stocks saw as much as $153 billion of their combined market value evaporate in the rout after Hindenburg’s report called the conglomerate’s meteoric rise as the “largest con in corporate history.” They have all risen for three straight days now, with Friday’s rally adding back $8.5 billion in value and making it the best day since the selloff began. The group has denied all allegations.

Flagship Adani Enterprises Ltd. soared almost 17% on Friday to its highest close since Feb. 9. The stock had surged more than 30% in the previous three sessions. Adani Ports and Special Economic Zone Ltd. — considered the group’s crown jewel — climbed nearly 10%, the most since April 2021.

Still, the flagship’s shares are down about 46% since Jan. 24. Adani Total Gas Ltd. has been hurt the most among the 10 group stocks in the rout, having plunged about 80%.

Valuations for the group have similarly slumped. Adani Enterprises is trading at less than half of its 12-month forward earnings, while multiples for Adani Transmission Ltd. and Adani Green Energy Ltd. are down by more than two-thirds.

“What is missing here, what nobody talked about, was these are phenomenal, irreplaceable assets,” Jain said. “You have to be greedy when people are fearful. Whenever there are parties going on, we stand on the sidelines watching people dance most of the time.”

GQG bought shares of Adani Ports at a 4.2% discount to Thursday’s close, resulting in a 4% stake. It bought Adani Green Energy and Adani Transmission at a 5.7% discount for stakes of 3.5% and 2.5%, respectively, and Adani Enterprises at a 12.2% discount for a 3.3% stake. Jefferies brokered the deal.

Adani Transmission and Adani Green were up by the 5% limit on Friday.

The least surprising of GQG’s bets is probably Adani Ports, which has been touted by investors for its strong operations. The stock is the most well covered of the group outside of its cement-related acquisitions, with a buy rating from all 21 analysts tracked by Bloomberg.

Analysts at JM Financial Ltd. expect Adani Ports to generate 140 billion rupees ($1.7 billion) of free cash flow, which they say is substantially higher than its projected debt-repayment obligations of about 110 billion rupees over the 2024 and 2025 fiscal years.

Jain said his team met with Adani management last summer, and that he sees the investment helping advance India’s economy and energy infrastructure, including energy transition goals.

Regulated Assets

In a Feb. 23 interview with Bloomberg TV, Jain said that while Adani’s implosion didn’t change his view on India as a whole — where GQG is overweight — “Adani, specifically, is a different call to make.”

“These are regulated assets” unlike Enron, he said, adding India’s “banking system is fine.”

While GQG’s investment should help provide “tactical support” to the battered Adani stocks, investors will wait for the conclusion of a court-ordered probe into Hindenburg’s allegations against Adani, said Nitin Chanduka, a strategist at Bloomberg Intelligence in Singapore.

India’s Supreme Court on Thursday set up a six-member panel to investigate the bombshell report. It also asked the Securities and Exchange Board of India to look into any manipulation of Adani stocks and report its findings within two months.

The Adani Group said it welcomed the order, and that it will “bring finality in a time-bound manner.”

Desperate to Sell

The support from GQG could stem further declines in the near term, but the discounts also show the seller was desperate, said Abhay Agarwal, fund manager at Piper Serica Advisors.

When asked if the Adani trust was desperate to sell, Jain disputed the characterization, noting that some of the stocks have rallied more than 30% from recent lows.

Jain is confident in the conglomerate and said GQG’s “edge” is understanding better than others how utilities operate.

He pointed out that Adani Enterprises has generated returns of about 30% a year in dollar terms since it was listed in 1994, outperforming some of the best-known companies in the world.

“What would you say that company is?” Jain said. “I’m just stating you don’t have frauds lasting 30 years, generally.”

To be sure, Jain has had his share of missteps. His big bet on Russia — 16% of all his emerging-market fund’s money was invested in the country at the start of 2022 — backfired badly when President Vladimir Putin invaded Ukraine. He started to pull back as the war clouds began to gather but didn’t liquidate all the fund’s holdings and, as a result, it tumbled 21% last year, making it the only major GQG fund to underperform its benchmark.

Jain’s decision to underweight China has also been costly as the government lifted strict Covid lockdowns that were hamstringing the economy.

“In my view, the fall in the Adani family of company share prices was not so much about the quality of the business operations but more substantially about valuation,” said Gary Dugan, chief executive officer at the Global CIO Office. “Mr. Jain has made the bet that current share prices offer value. We will have to see if the market agrees.”

GQG Partners’ Australian depository receipts fell 3% on Friday, the most since Feb. 17.

--With assistance from , and .

(Recasts throughout.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales

ADNOC signs 15-year agreement with PETRONAS for Ruwais LNG project

Woodside signs revised EPC deal with Bechtel for Louisiana LNG

Vitol, Glencore Eye New Fortress’ Jamaica LNG Assets