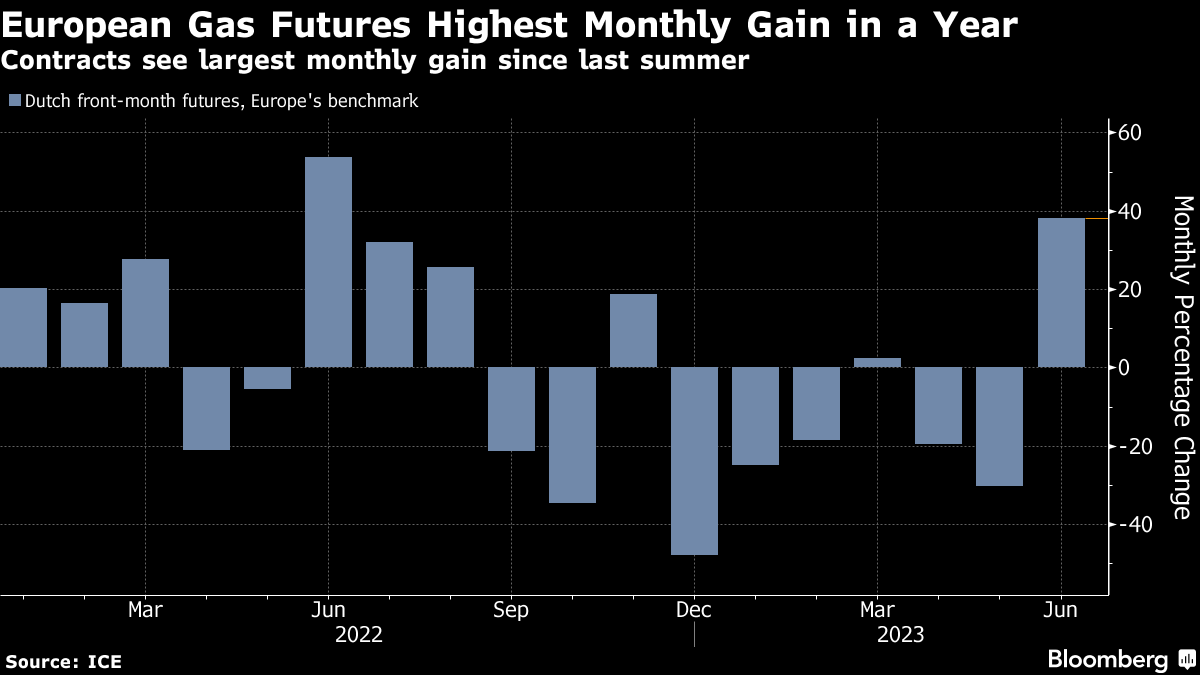

Europe Gas Ends June With 30% Rise, Nearing Last Summer’s Spikes

(Bloomberg) -- European natural gas logged its biggest monthly gain since last summer, near the height of the region’s energy crisis, following the most volatile stretch for trading this year.

Benchmark futures ended June more than 30% higher, after prices spiked almost 8% on Friday. It’s the first monthly increase since March and the largest jump since last July.

The past few weeks have seen market gyrations linked to unplanned outages, heat waves in parts of the region and a brief insurrection in Russia. Europe is still finding its energy footing after Russia curtailed pipeline gas shipments last year, and the volatility is a reminder of the market’s sensitivity to potential disruptions — even amid tepid demand and healthy inventory levels.

The region’s gas storage sites are now 77% full, well above their usual levels for the time of year, data from Gas Infrastructure Europe show. Still, “the markets are very sensitive to news of the maintenance of Norwegian gas supply,” said Mauro Chavez, a research director at Wood Mackenzie.

Centrica Plc, the UK’s top energy supplier, on Friday announced increased capacity at the country’s biggest gas storage site, providing a bigger safety cushion for next winter. The Rough facility will be able to store as much as 54 billion cubic feet of the fuel compared with 30 billion previously.

Meanwhile, northwest Europe’s imports of liquefied natural gas have dropped to near the lowest levels since last September. Competition with Asia for LNG could intensify in the coming months if rising temperatures stoke demand.

Since the start of June, a record number of futures have traded at the Title Transfer Facility, Europe’s key virtual trading point for gas in Amsterdam, exchange data show.

“A lot of hedge funds jumped into the European market amid the volatility last year, and the market will need to take more account of these financial flows going forward,” said James Waddell, head of European gas and global LNG at consultant Energy Aspects Ltd. “Volatility looks likely to continue given the new make-up of the market and the fact that Europe is very reliant on winning LNG cargoes to meet its balance.”

Dutch front-month futures for August delivery closed 5% higher at €37.10 per megawatt-hour, erasing an earlier loss. The UK equivalent advanced 4.5%.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales

ADNOC signs 15-year agreement with PETRONAS for Ruwais LNG project

Woodside signs revised EPC deal with Bechtel for Louisiana LNG

Vitol, Glencore Eye New Fortress’ Jamaica LNG Assets