Exxon Profit Surpasses Expectations on Natural Gas Export Surge

(Bloomberg) -- Exxon Mobil Corp. and Chevron Corp. amassed more than $30 billion in combined net income as pinched consumers spurred politicians to issue increasingly dire warnings about profiteering and climate change.

Exxon posted the highest profit in its 152-year history, while Chevron announced its second-best quarterly result as natural gas demand and prices surged. Those disclosures followed on the heels of similarly strong results from European peers Shell Plc and TotalEnergies SE.

Even as the supermajors bask in profits unimagined just two years ago during the darkest days of the pandemic, oil executives are under pressure to cut emissions and improve shareholder returns, and have been hesitant to expand costly exploration programs, adding to commodity-price pressures.

READ: Oct. 19, Biden Scolds Oil Producers on Buybacks as Ukraine War Rages

For Exxon, third-quarter per-share profit of $4.68 exceeded $3.89 median estimate from analysts in a Bloomberg survey. Net income of $19.7 billion surpassed the all-time high of $17.6 billion amassed during the second quarter.

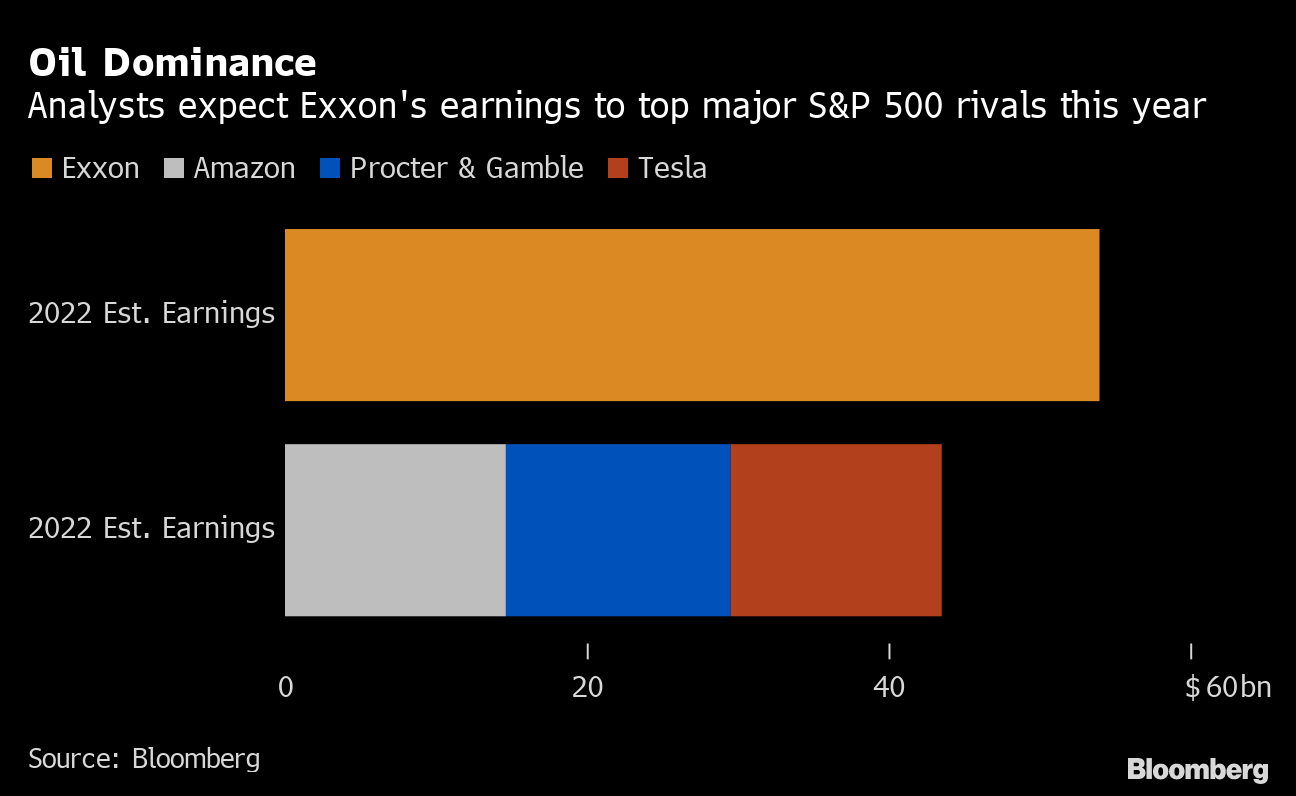

Expectations among analysts rose after Exxon’s Oct. 4 trading statement said that robust natural gas prices more than offset a dip in crude markets. The strong earnings streak is expected to continue through the current quarter; Exxon is forecast to post full-year profit in excess of $50 billion -- more than Amazon.com Inc., Procter & Gamble Co., and Tesla Inc. combined.

Meanwhile, Chevron’s third-quarter earnings of $5.56 per share surpassed the median $4.94 forecast among analysts in the Bloomberg Consensus. Net income was $11.2 billion, down slightly from the all-time high of more than $12 billion in the prior three months, according to a company statement on Friday.

“We delivered another quarter of strong financial performance with return on capital employed of 25 percent,” Chief Executive Officer Mike Wirth said in the statement. “At the same time, we’re increasing investments and growing energy supplies, with our Permian production reaching another quarterly record.”

The sheer size of the combined profits -- equivalent to roughly $14 million an hour -- is sure to amplify criticism from US President Joe Biden and other leading Democrats about profiteering, particularly as war wages in Ukraine. Biden already has singled out Exxon and Shell and the latest profit reports come little more than a week before Americans head to the polls.

Still, US oil supermajors are suffering less political whiplash than their European peers, which are subject to windfall profit taxes and greater calls to invest in low-carbon energy, despite some of the world’s biggest profits still being rooted in fossil fuels.

Exxon’s stock rose 2.1% at 6:45 a.m. New York time in pre-market trading. Chevron rose 1.7%.

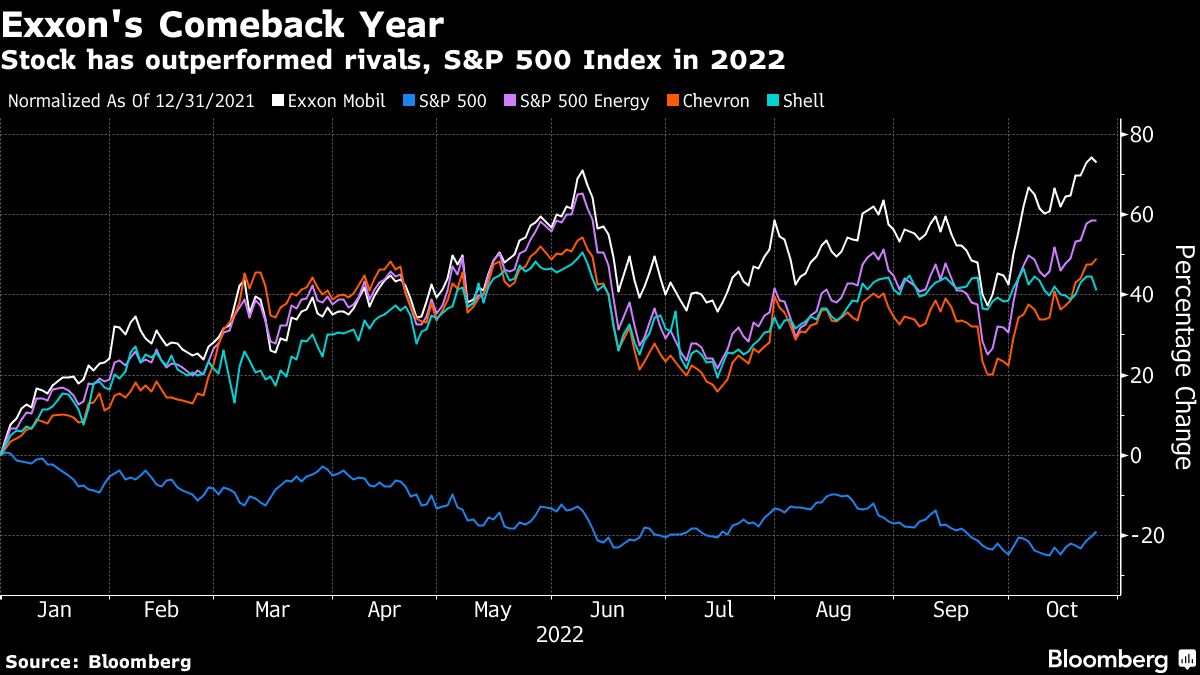

In recent weeks Exxon has overtaken Facebook parent Meta Platforms Inc. in market value and is now back in the S&P 500 Index’s top 10 stocks for the first time since 2019. The shares touched a record high this week and have soared more than 70% this year as high oil and gas prices combined with more modest capital spending.

Shareholders have been the main beneficiaries of Exxon’s post-pandemic comeback. At the beginning of the year, Chief Executive Officer Darren Woods reactivated share repurchases that had been on hold for more than half a decade. The $15 billion-a-year buyback program is about the same cash outlay as Exxon’s dividend, already the second-largest in the S&P 500 Index.

Despite the windfall from high energy prices, Woods has locked long-term spending at about $22.5 billion a year -- 30% below pre-Covid levels -- with production growth from Guyana and the Permian Basin largely offsetting asset sales and natural field declines elsewhere. Woods set a goal of lowering breakeven costs to the equivalent of about $30-a-barrel by 2027, down from $41 in 2021.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales

ADNOC signs 15-year agreement with PETRONAS for Ruwais LNG project

Woodside signs revised EPC deal with Bechtel for Louisiana LNG

Vitol, Glencore Eye New Fortress’ Jamaica LNG Assets