Germany Faces Reckoning for Relying on Russia’s Cheap Energy

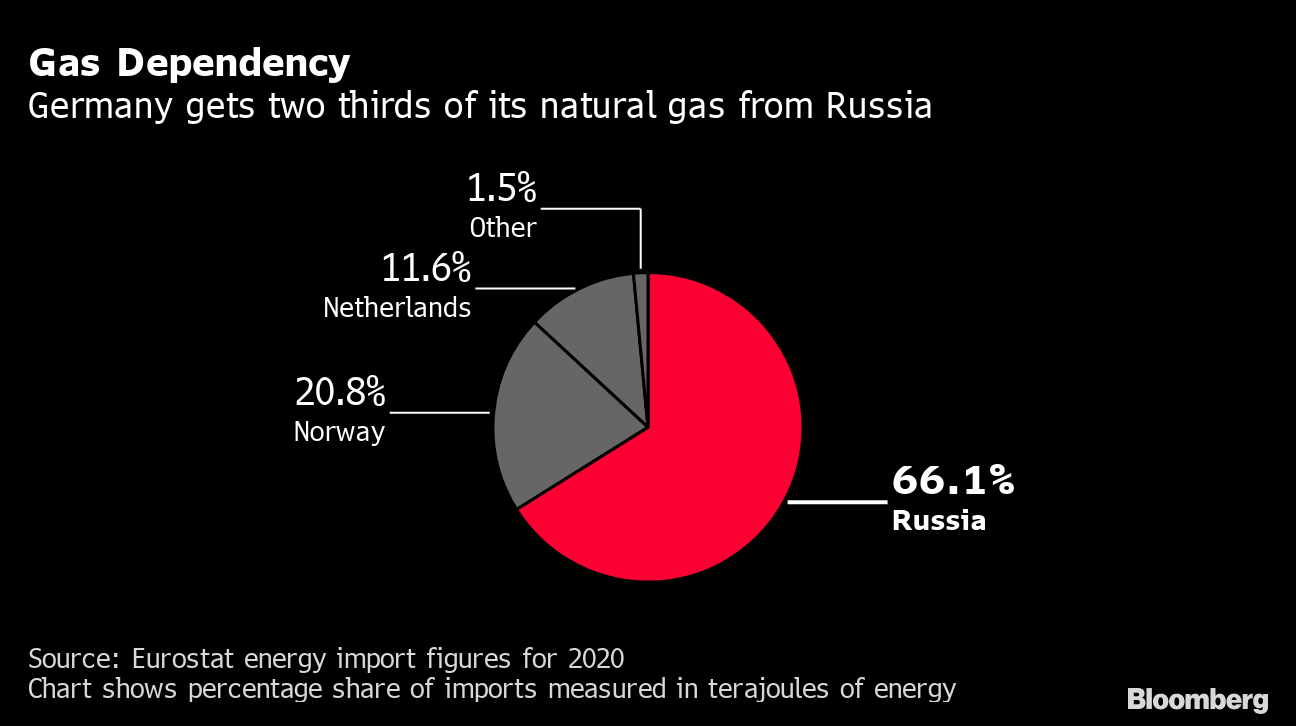

(Bloomberg) -- For years, the U.S. warned Germany of building up a dangerous energy dependence on Russia, the source of more than half of its fossil fuel imports. Now that the war in Ukraine has shocked Berlin into the same conclusion, the government is finding that changing course might be too late.

Europe's largest economy is facing up to the prospect that the bulk of its natural gas and coal supplies could get choked off, ripping through its industrial base and sparking economic upheaval. Companies including utility Uniper SE and chemical giant BASF SE are particularly exposed, and with gas reserves low, the pain would quickly spread to manufacturers and households already buckling under ever-rising bills.

If either the Europeans no longer want to buy the gas or Russia cuts them off, that would be a very significant shock, David Folkerts-Landau, the chief economist at Deutsche Bank AG, said in a Bloomberg TV interview this week. You will have a very serious recession.â€

Chancellor Olaf Scholz's government has said the country's gas needs are covered until next winter. But Europe's gas storage facilities are now less than a third full, well below the average for this time of the year. To compensate for lost Russian gas, Germany would need deliveries from the world's entire 600-vessel fleet of liquefied natural gas tankers, business lobby DIHK estimates.

WATCH: Germany;s Economy Minister Robert Habeck says he opposes an embargo on Russian energy imports.Source: Bloomberg

WATCH: Germany;s Economy Minister Robert Habeck says he opposes an embargo on Russian energy imports.Source: Bloomberg

For now, Moscow has given no indication that it may cut off supplies, while Germany opposes sanctions or political pressure that would prompt a full energy embargo. But already, Berlin is in crisis mode.Â

Highlighting the sense of urgency, the government has authorized a 1.5 billion-euro ($1.7 billion) ad-hoc payment to secure LNG. At current prices, that's only about a weeks worth of gas, according to BloombergNEF estimates, and LNG is typically at least 10% more expensive than supplies piped from Russia. The government announced Saturday that the state-owned lender KfW would partner with Nederlandse Gasunie NV and RWE AG to build an LNG terminal in the northern port city of Brunsbuettel.

Read More: Germany to Build LNG Terminal to Reduce Russian Gas Dependence

“I say this with great regret and without a smile on my face: Germany is dependent on Russian energy imports,†Robert Habeck, Germany's vice chancellor and minister for the economy and climate policy, said this week.

In the event of a supply shutdown, Uniper would likely be one of the first companies to feel the fallout. The Dusseldorf-based utility has more than half of its long-term gas contracts with Russia and faces a bleak future if those supplies get cut off. That would have a knock-on effect on consumers and factories dependent on its electricity.

The company is facing the crisis on shaky ground. Extreme price movements have forced it to borrow billions of euros to back up trading bets. Meanwhile, its investment in the Nord Stream 2 pipeline to Russia is likely lost after Germany put the gas link on hold.

The situation at the Russian-Ukrainian border leaves us at Uniper profoundly unsettled, Chief Executive Officer Klaus-Dieter Maubach said a day before President Vladimir Putin started the invasion.

A closed Nord Stream 2 information point.Photographer: Krisztian Bocsi/Bloomberg

A closed Nord Stream 2 information point.Photographer: Krisztian Bocsi/Bloomberg

German oil and gas producer Wintershall Dea AG also wrote down 1 billion euros invested in the controversial $11 billion project, which had long irked the U.S. because of the Russian connection but was nevertheless nearing completion until the government halted certification.

The first Nord Stream pipeline, which bypasses Ukraine to connect Germany directly with Russian gas fields, was opened by former Chancellor Angela Merkel in 2011, calling it a remarkable achievement.

Scholz also announced plans to fast-track construction of the country's first LNG terminals, but that would still take years. In the short term, the government released a crisis plan, including building up coal reserves for power plants and forcing gas firms to keep minimum storage levels -- nearly a third of that capacity is controlled by Russias Gazprom PJSC in a further sign of Germany's dependence.

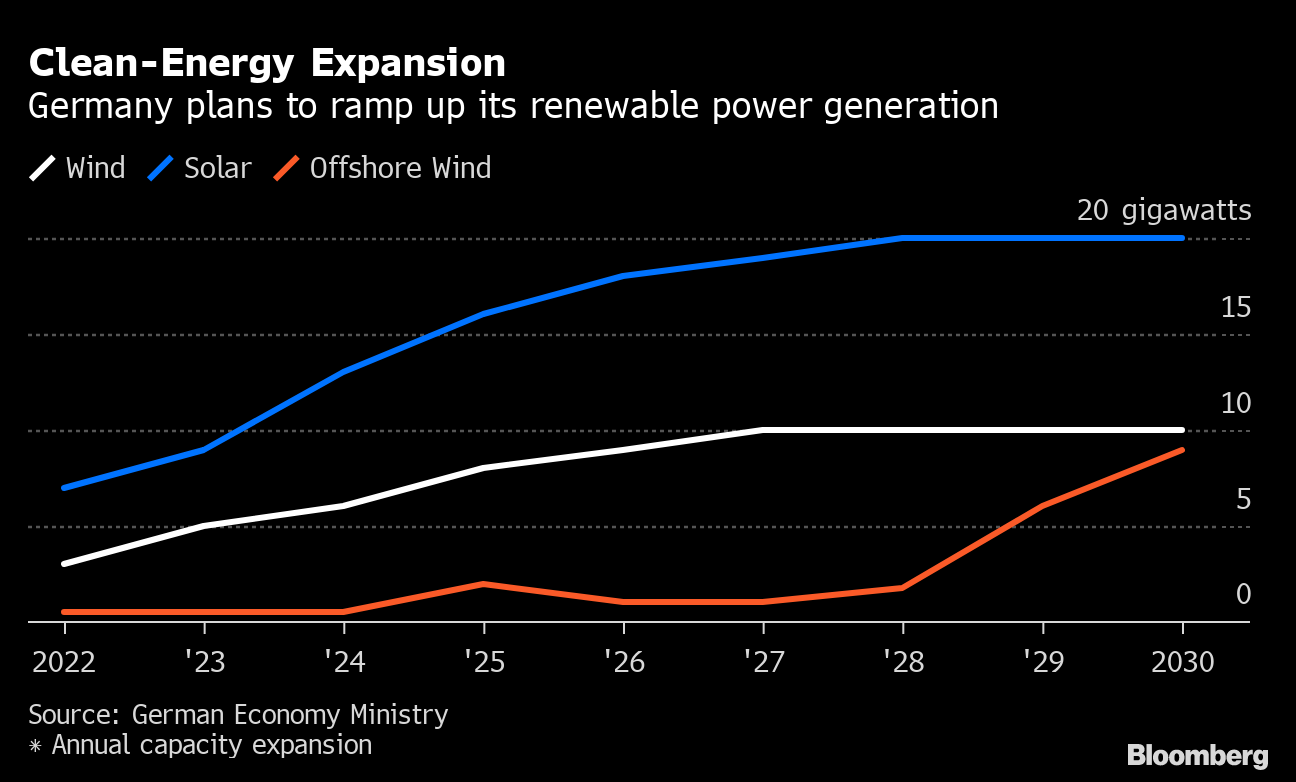

The ultimate fix is a shift toward renewable power, which will also take time and money. Germany has already retreated from nuclear energy in the wake of the Fukushima reactor disaster a decade ago -- its final three reactors are slated to shut this year.

Insurers Euler Hermes and Allianz SE estimate that it would require 170 billion euros in investment a year for the European Union to gain independence from Russian energy. Habeck, a former co-leader of the Green party, proposed legislation this week that would roughly triple the pace of adding wind and solar power.

What was consciously built up in the last 10, 15 years -- namely, making the dependence on Russian energy greater -- cant of course be completely changed in a few days or in three months, Habeck said on Thursday after convening with business leaders to discuss the crisis. We will and need to remain open for energy imports from Russia.

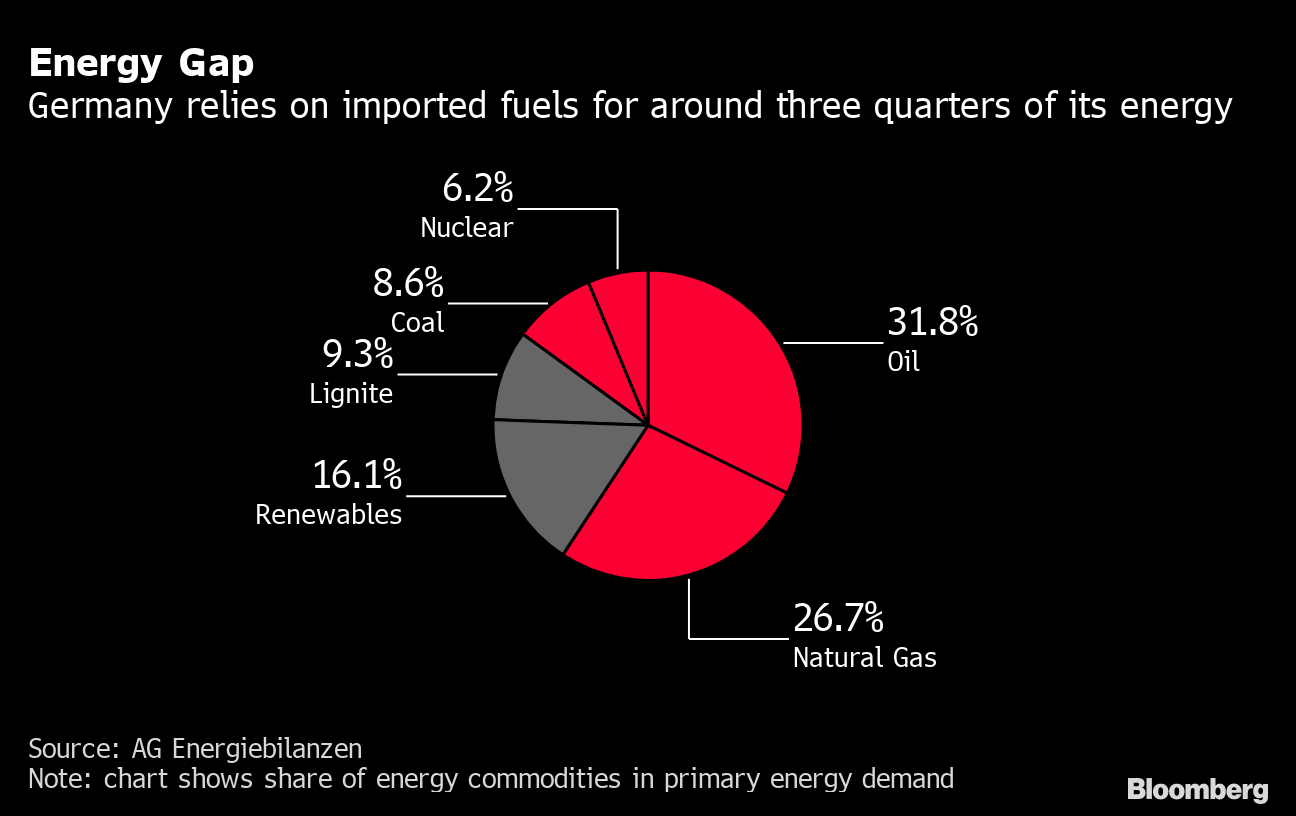

The reason for concern is clear. Russia supplies more than half of Germany's gas, half of its coal and roughly a third of its oil. BloombergNEF estimates that replacing Russian gas would require an additional 82 LNG tankers a month, more than the February output of Qatar -- one of the world's top producers.

Russia shutting down deliveries isnt a far-fetched scenario, because gas only provides the government with a quarter of the revenue compared with oil, according to Stefan Ulrich, a BloombergNEF analyst.

“Industry production in Germany would be extremely affected in such a case, Volker Treier, head of the foreign trade board of Germany's industry lobby group DIHK, adding that compensating for the loss of Russian gas in the short term borders on the impossible.

A gas shortage could prompt BASF to halt some factories, dealing a blow to supplies of materials used in cars, fertilizers and medicines across Europe. Some energy-intensive companies are starting to inquire about alternative fuels in the event of a gas cutoff, according to Wolfgang Hahn, owner of Energy Consulting GmbH, which advises hundreds of companies in Germany.

This is the biggest energy crisis people in Europe have faced since the Second World War, said Hahn. The 1970s was just a price crisis. This is more serious than that.

(Updates with announcement of new LNG terminal in sixth paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Slovakia Plans Talks on Gas Transit Via Ukraine Starting Next Week

Tesla-Supplier Closure Shows Rising Fallout of Mozambique Unrest

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales