EU to Unveil Controversial Green Label Plan for Gas and Nuclear

(Bloomberg) -- The European Union will finally unveil how it will label investments in some gas and nuclear projects as sustainable, a plan that has divided member states as the energy transition collides with political reality.

The European Commission is announcing its proposal Wednesday in Brussels, which will then be scrutinized by national governments. The move has triggered concerns among investors over the risk of greenwashing, and politicians in some countries criticized the draft, saying it could damage the credibility of the EU’s new rules and divert money away from renewables.

The draft underscored deep divisions among member states. The Netherlands and Denmark oppose including natural gas because they don’t rely on such plants, while Germany -- which is phasing out nuclear -- criticized the green label for atomic power. But those opposing it may find it hard to block, as EU law requires at least 20 member states to reject the plan for that to happen.

The label system is being closely watched by investors to know what projects will count as green, and could potentially attract billions of euros in private finance to aid the shift to a low-carbon economy. The challenge is ensuring that the decision on nuclear and gas gets enough political support, at a time when some lobbies say those forms of energy shouldn’t be included at all.

“At the absolute minimum, the Commission should tighten the draft criteria to reflect the full impact of gas and nuclear energy on climate and environment and strengthen the governance rules to prevent greenwashing,” said Johannes Schroeten, a policy adviser at the E3G environmental think tank. “It would be unacceptable if nothing changes or the criteria are loosened further.”

The EU in April announced a first set of criteria for green investments that will allow producers of rechargeable batteries, energy efficiency equipment, low-emission cars, wind and solar plants to earn a formal green label. It delayed the decision on nuclear and gas projects amid concerns about their inclusion.

The Platform on Sustainable Finance, an advisory group consulted by the Commission, recently slammed the draft criteria for gas, saying it could undermine the EU’s target of net-zero emissions by 2050. It also said it’s unclear how the bloc will deal with possible environmental impacts from nuclear waste. A number of investors and lenders, including the European Investment Bank, said they’ll likely shun the technologies in portfolios.

“Even if something is in the taxonomy, such as natural gas or nuclear, it doesn’t mean we have to go and buy it,” said Isobel Edwards, a green bond analyst at NN Investment Partners. “Our clients expect certain types of investments, such as renewable energy, clean transportation and green buildings, so we couldn’t just start buying nuclear and natural gas.”

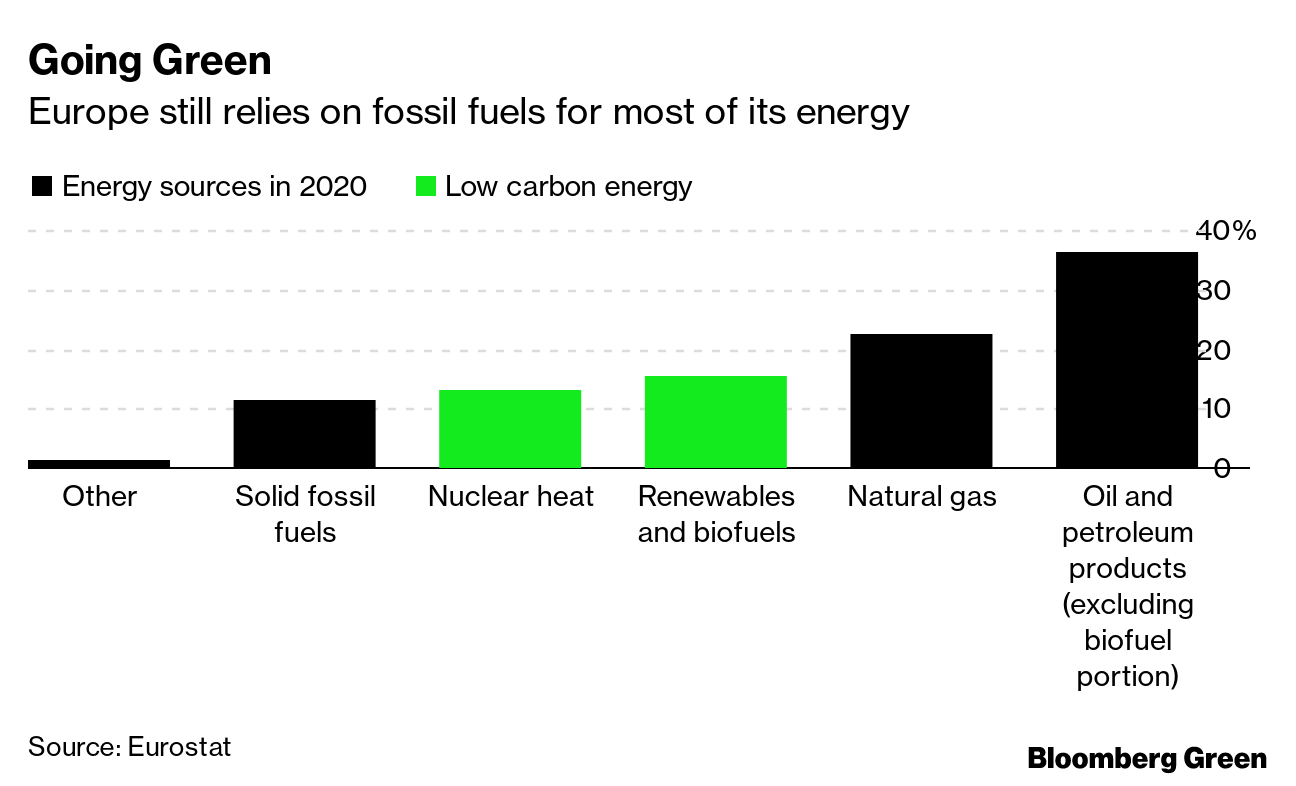

The EU wants to reach climate neutrality under its Green Deal, a sweeping overhaul that touches everything from energy supply to manufacturing to transport. Yet the recent energy crisis has highlighted the challenge of cutting dependence on fossil fuels and nuclear power that offers reliable supplies.

It’s up to member states to decide what energy sources they want to rely on at home -- and they want different things.

For example, coal-dependent Poland says giving a temporary green label to certain gas projects could aid investment in cleaning up its heating system. France and the Czech Republic say nuclear has a key role in the clean transition as a stable source of low-carbon power.

It’ll be hard for the European Parliament and member states in the EU Council to reject the Commissions taxonomy proposal. Neither has the right to propose amendments -- they can only block it if they get enough votes.

The “taxonomy could fail to deliver on its own objectives to steer private money into sustainable investment and fight greenwashing,” said Sebastian Mack, a policy fellow for European financial markets at the Jacques Delors Centre. “The Commission should not try to please everybody, but concentrate on creating a credible standard. The clear rebuttal from asset managers is serious.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Slovakia Plans Talks on Gas Transit Via Ukraine Starting Next Week

Tesla-Supplier Closure Shows Rising Fallout of Mozambique Unrest

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales