European Gas Prices Fall as Ministers Push for Agreement on Cap

(Bloomberg) -- European gas futures declined amid milder weather and a key European Union meeting aimed at averting extreme price swings once winter gets well under way.

Benchmark futures slipped as much as 7.4%. Prices are now slightly lower than where they were at this time last year, though they remain almost triple the five-year average as Russia limits flows to the continent.

Northwest Europe is set to see warmer weather in the coming days, which may help to curb heating demand after a recent freeze. But another cold snap is coming at the end of the year, testing the region’s resilience. While gas stockpiles are still above seasonal averages, they’ve also fallen faster than usual since their peak.

Read: Taking Stock of Europe’s Gas Inventories After the Cold Snap

Meanwhile, EU member states are meeting in Brussels in an effort to break their deadlock over a proposed gas-price cap. The Czech government, which holds the EU’s rotating presidency, has suggested lowering the ceiling to €188 euros per megawatt-hour compared with the €275 proposed by the European Commission last month.

The measure is controversial because of concerns the cap could have on availability of supply for Europe. Industry has warned that liquefied natural gas cargoes may move to Asia if prices there are higher than caps in Europe, just as China’s demand awakens after Covid-induced curtailments.

“It is incredibly hard to judge what the effects of a market correction mechanism like this would have,” Ebba Busch, Sweden’s deputy prime minister and energy minister, said ahead of the talks. “One positive thing is that we will get more analysis before this would enter into force, to be able to understand the full implications.”

Read: Europe’s $1 Trillion Energy Bill Only Marks Start of the Crisis

Storage sites across Europe are now about 84% full, after freezing temperatures sped up the pace of withdrawals.

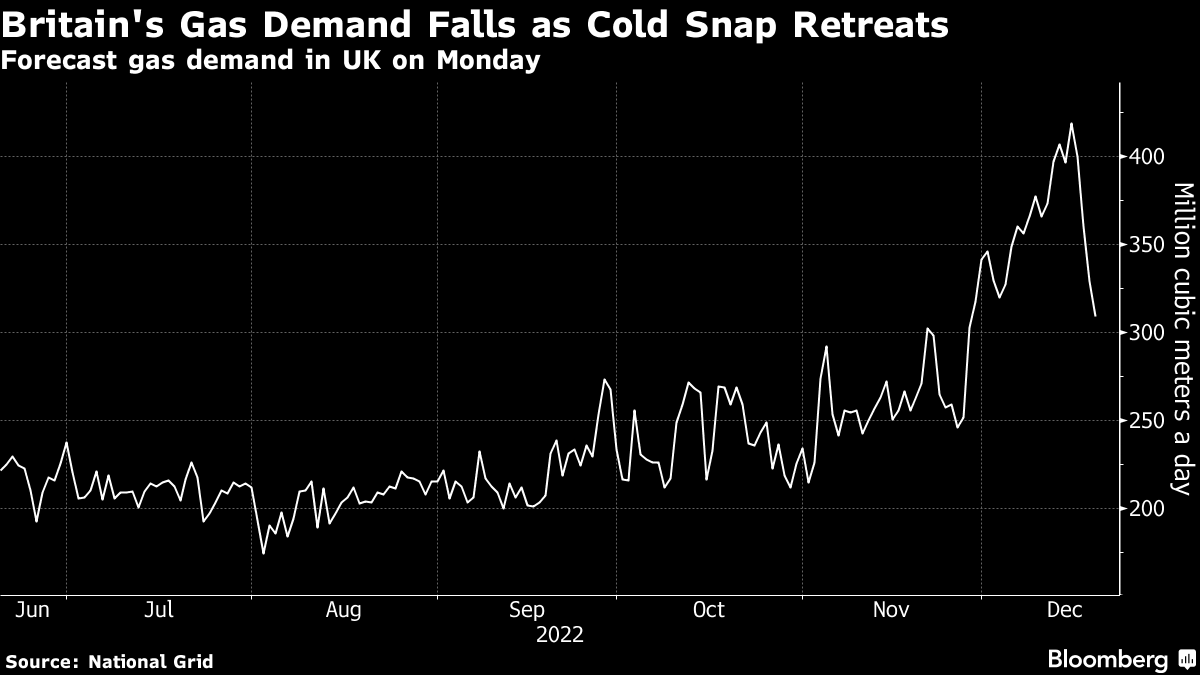

Windy weather is offering the region some support. In Britain, wind generation accounted for almost half of electricity production on Monday. Total forecast demand in the UK is down by about a quarter compared to the end of last week.

Dutch front-month futures, Europe’s gas benchmark, declined 6.8% to €107.55 a megawatt-hour by 11:27 in Amsterdam. The UK equivalent contract fell 6%.

--With assistance from .

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales

ADNOC signs 15-year agreement with PETRONAS for Ruwais LNG project

Woodside signs revised EPC deal with Bechtel for Louisiana LNG