Europe Faces Energy Price Shock With Gas and Power at Records

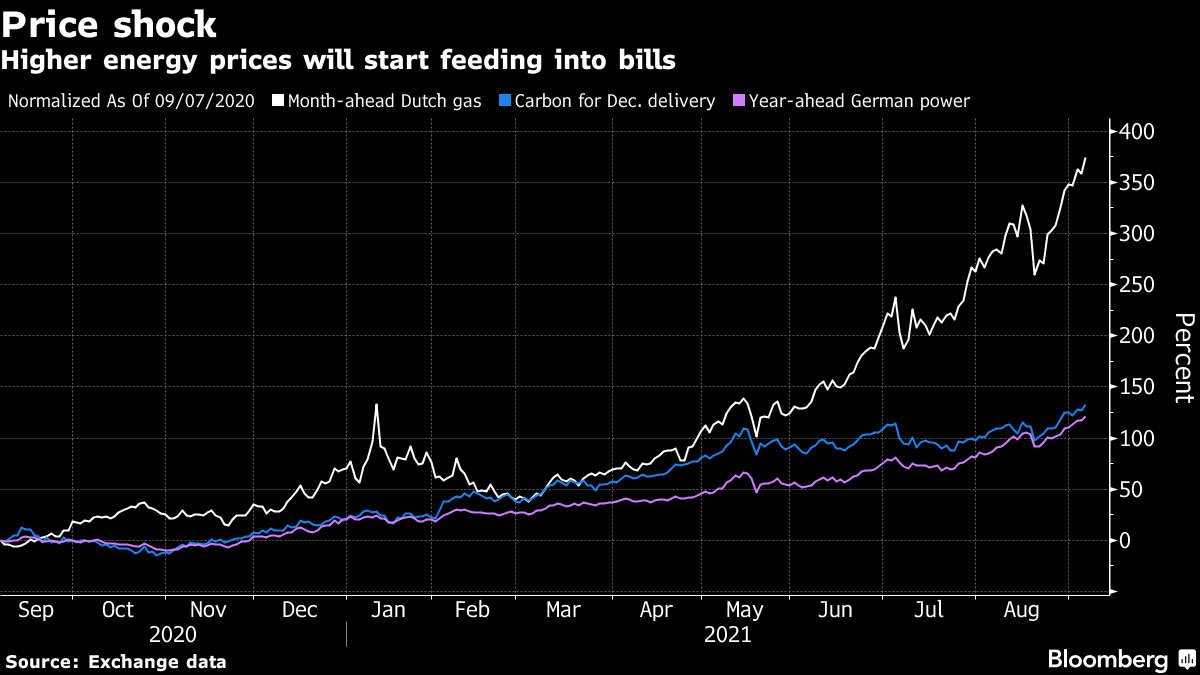

(Bloomberg) -- Europe is facing an energy price shock as the cost of natural gas and electricity surges to record levels.

A gas supply crunch is boosting the cost of producing power from the U.K. to Germany just as businesses reopen and people return to the office, increasing demand. Rising prices are fueling inflation and threatening to stall the economic recovery as energy-intensive industries from fertilizer to steel may need to curb output.

Prices are rallying even though it’s still summer, when demand is usually low, setting the stage for a difficult winter. Utilities are hiking prices for consumers at the same time as everything from food to transport costs are also rising, a headache for politicians trying to garner support for the energy transition.

“The problem hasn’t even started yet,” said Julien Hoarau, the head of EnergyScan, the analytics unit of French utility Engie SA. “Europe will face a very tight winter.”

Benchmark European gas futures traded in the Netherlands surged to a record on Monday, as did U.K. prices. Short-term power in Britain also climbed to an all-time high, as the year-ahead contract in Germany -- Europe’s biggest electricity market -- also climbed to a record.

Hot weather and low wind speeds are curbing renewable power production, boosting the use of fossil fuel-fired generation and pushing the price of coal up more than 70% in Europe this year. All of that sent the cost of polluting in Europe to the highest ever.

Europe is facing a gas crunch after a bitter winter left storage sites depleted. Boosting inventories -- already at the lowest in more than a decade -- hasn’t been easy, with top supplier Russia limiting flows at a time when Asia is scooping up cargoes of liquefied natural gas that might otherwise head to Europe.

Europe can’t count on its own production either, with several outages disrupting flows from the North Sea. Domestic output is also in decline, with the giant Groningen gas field in the Netherlands possibly closing three years ahead of schedule. Gas prices are so high that they are trading at a rare premium to crude oil.

Soaring energy prices have already sent German inflation to its highest since 2008. Prices soared 3.4% in August, higher than the 2% rate the European Central Bank is targeting for the euro area. Things could still get worse if there’s a repeat of the cold weather in 2018, when the Beast from the East brought freezing temperatures to Western Europe.

“If we have a weather event like the Beast of the East, I wouldn’t be surprised we could have spot prices reaching three digits,” Hoarau said.

Energy executives from Italian utility giant Enel SpA and Austria’s oil and gas major OMV AG have already warned of a difficult winter ahead. Gas and electricity prices in Europe could translate into a 20% increase in the average dual-fuel utility bill of European retail consumers, according to Citigroup Inc.

“The spectre of energy poverty may fall quickly across Europe this winter,” Citi analysts including Alastair Syme said in a note.

Utilities in the U.K. from Electricite de France SA to EON SE have already increased domestic rates.

“As the current strength in wholesale prices increasingly feeds through to retail tariffs in coming months, there’s likely to be growing focus on the role of governments in mitigating the impacts of the rises in both the short and medium term,” said Glenn Rickson, head of European power analysis at S&P Global Platts in London.

The U.K. power market is already showing signs of strain and it’s not even cold yet. Prices for Monday reached a record after low wind and the delayed return of two nuclear reactors meant reduced spare supplies. While network operator National Grid Plc reassured the market that the situation was manageable, it has admitted that the cushion of spare supply this winter is going to be smaller than last year.

Higher gas prices are making coal generation more profitable, pushing up the cost of carbon permits needed to cover emissions.

“People who trade the carbon market are hostage to the fortunes of gas,” said Louis Redshaw, director of Redshaw Advisors Ltd. “If gas prices drop, those lignite plants will go out of the money and the people owning that carbon will want to sell it.”

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Slovakia Plans Talks on Gas Transit Via Ukraine Starting Next Week

Tesla-Supplier Closure Shows Rising Fallout of Mozambique Unrest

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales