Oil Drops as U.S. Inventories Rise and Russia Eases Supply Fears

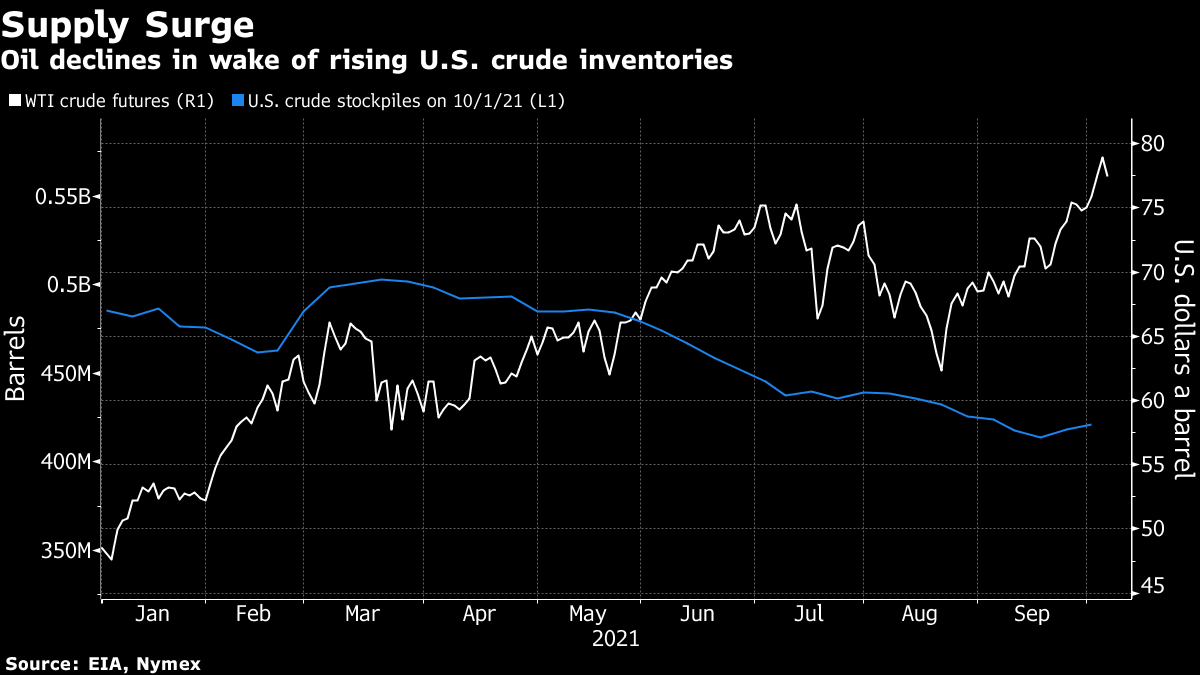

(Bloomberg) -- Oil extended losses after a bigger-than-expected increase in U.S. crude supplies and after Russia signaled it is ready to help ease a growing global natural gas crisis.

Futures in New York slid as much as 2% on Wednesday. U.S. government data showed crude inventories increased 2.35 million barrels last week, more than the industry-funded American Petroleum Institute’s reported supply gain. Meanwhile, Russian President Vladimir Putin said the country could export record volumes of natural gas to Europe this year in order to stabilize energy markets. Major banks have said they expect the recent soaring natural gas prices to prompt gas-to-oil switching.

Putin’s comments started to “muddy the dialogue on fuel switching,” said Bob Yawger, director of the futures division at Mizuho Securities USA. The “fuel switching situation may or may not actually pan out.”

Oil closed at the highest since 2014 on Tuesday as surging natural gas prices spur greater demand for crude and oil products ahead of winter, while OPEC+ continues to only drip-feed additional supply into the market.

Exports from Gazprom PJSC to Europe in the first nine months of the year were close to all-time highs, according to the company. If that pace is sustained for the rest of 2021, it would be a record year, Putin said at an energy meeting on Wednesday. Lower-than-anticipated supplies from Russia, the region’s largest supplier, have been a major cause of the crisis, according to some European officials.

The Energy Information Administration data also showed U.S. crude exports declined for the first time in a month, while fuel stockpiles rose the highest since August.

Meanwhile, Saudi Aramco cut prices for all its crudes destined for Asia and Europe, and for some grades to U.S. At least four Asian buyers will request full supply of November-loading cargoes, according to people at refineries who asked not to be identified due to the sensitivity of the negotiations. The nominations are due on Wednesday.

Also read: European Industry Buckles Under a Worsening Energy Squeeze

“Inventory data over the last 24 hours was not supportive,” said Giovanni Staunovo, commodity analyst at UBS Group AG. “A stronger dollar and risk-off environment are also not of help.”

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Slovakia Plans Talks on Gas Transit Via Ukraine Starting Next Week

Tesla-Supplier Closure Shows Rising Fallout of Mozambique Unrest

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales