Global LNG Market Faces Shakeup From Japan’s Green Shift

(Bloomberg) -- Japan’s aggressive new plan to champion clean energy is shaking up the liquefied natural gas market that it helped pioneer 60 years ago.

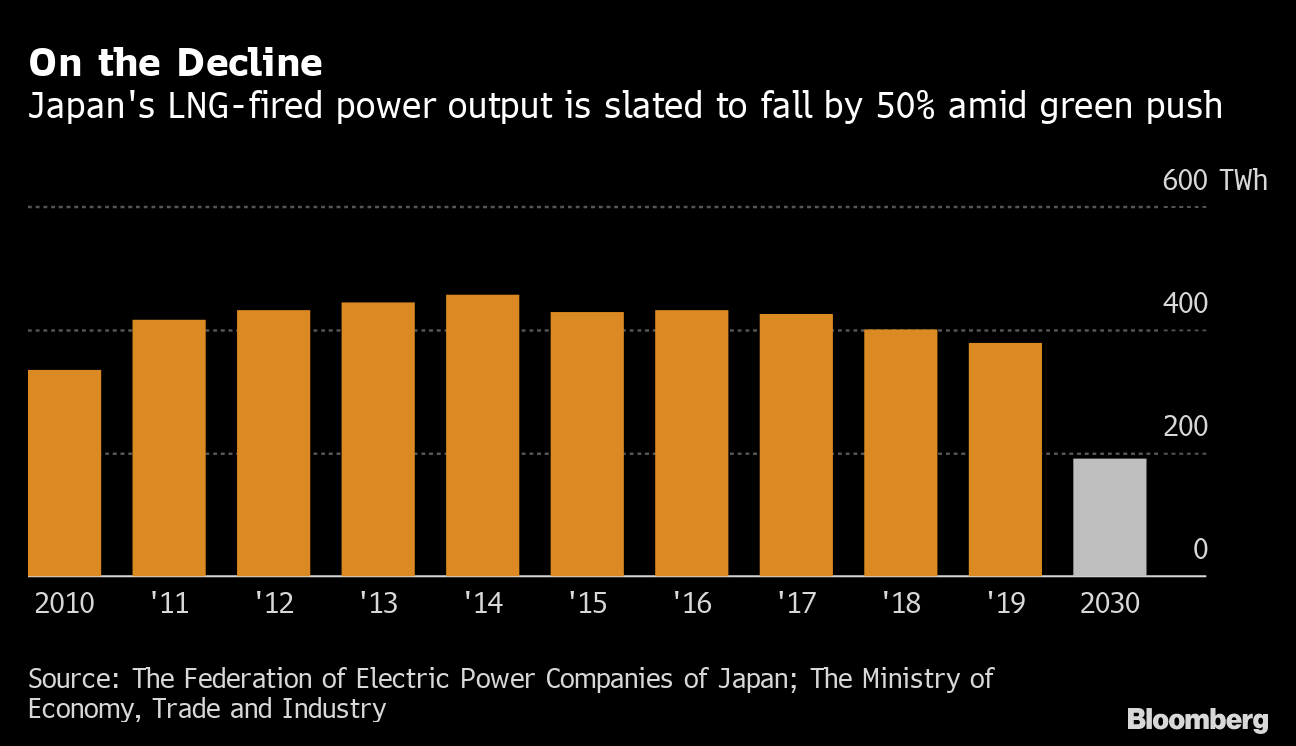

The country, the world’s top LNG importer, called for more renewables such as wind and solar to replace natural gas in a revised plan released last week. The shift aims for LNG-fired power generation to fall by roughly half this decade, creating upheaval for Japanese utilities as well as suppliers from Qatar to Australia to the U.S.

The stricter guidelines will see Japan imports drop by a third by the end of the decade, according to traders and analysts. It will force domestic utilities to abandon long-term LNG deals, which have been the backbone of the nation’s imports, while increasing dependence on the more turbulent spot market.

“The move will further dampen Japanese LNG buyers’ appetite to sign long-term deals that extend beyond 2030, which could leave them more exposed to short-term price dynamics if demand ends up higher than targeted,” said Saul Kavonic, an energy analyst at Credit Suisse Group AG.

The policy was a surprise to suppliers around the world. Natural gas -- once widely seen as the bridge to a green future -- has been falling out of favor with some governments as they boost efforts to slow climate change and the cost of renewables drops drastically. Until recently, Japan had been touting the super-chilled fuel as a cleaner alternative to coal.

It isn’t clear if Japan will reach its new goals. To help replace the 50% drop in LNG, the country will need to restart nearly all of its nuclear reactors -- a tall order considering the strong local opposition. The uncertainty will force Japan to dive into the spot market or sign short-term contracts, which combined currently only make up 30% of total imports. That’s below the global average of 40%.

“Inevitably, the share of spot and short-term purchase is expected to increase,” said Hiroshi Hashimoto, a Tokyo-based analyst at the Institute of Energy Economics, Japan. “Utility companies are expected to reduce contract periods as well as volumes not only because of the new policy, but also uncertainty over requirements from individual business activities.”

Japan’s desire for long-term LNG deals helped build and sustain the industry since the 1960s. Deals that last more than 20 years are pillars for new LNG export projects, and without them it is challenging for developers to get backing from banks and investors for new terminals or expansions.

That’s bad news for Qatar, which is aggressively boosting output, and for proposed projects from the U.S. to Papua New Guinea vying for investment.

Utilities that have stakes in LNG export facilities are likely to increase investments in import terminals and power projects across Southeast Asia in order to build demand for their fuel, traders said. This will effectively turn Japan into an LNG middle-man as its domestic consumption slides.

Rebalancing Portfolios

Japanese companies were already seeking shorter-term contracts that are under 10 years length, as the nation’s declining population and advances in energy efficiencies meant that its LNG demand already peaked last decade. But the government’s new targets mean that demand will fall more than expected, and require utilities to accelerate efforts to rebalance LNG portfolios.

If the 2030 targets are met, then Japan’s LNG demand could fall by nearly 25 million tons, according to BloombergNEF analyst Olympe Mattei. Japan imported 74.4 million tons in 2020, according to the International Group of Liquefied Natural Gas Importers.

Meanwhile, Japanese firms will think twice before renewing legacy contracts or investing in new export plants. Japan’s oldest LNG agreement with Indonesia, which had been in place for nearly 50 years, fell apart last year due to uncertainty exacerbated by the coronavirus pandemic.

(Updates with analyst’s comment in seventh paragraph.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales

ADNOC signs 15-year agreement with PETRONAS for Ruwais LNG project

Woodside signs revised EPC deal with Bechtel for Louisiana LNG

Vitol, Glencore Eye New Fortress’ Jamaica LNG Assets