Power, pragmatism and AI: energy’s reality check at Gastech 2025 Milan

The message from Gastech 2025 was unmistakable: LNG remains the bedrock of energy security, but its future credibility rests on the whole industry’s demonstrable resilience. Climate shocks, cyber threats, the pace of renewables, AI's growing power demand, and looming price volatility expose deep global imbalances.

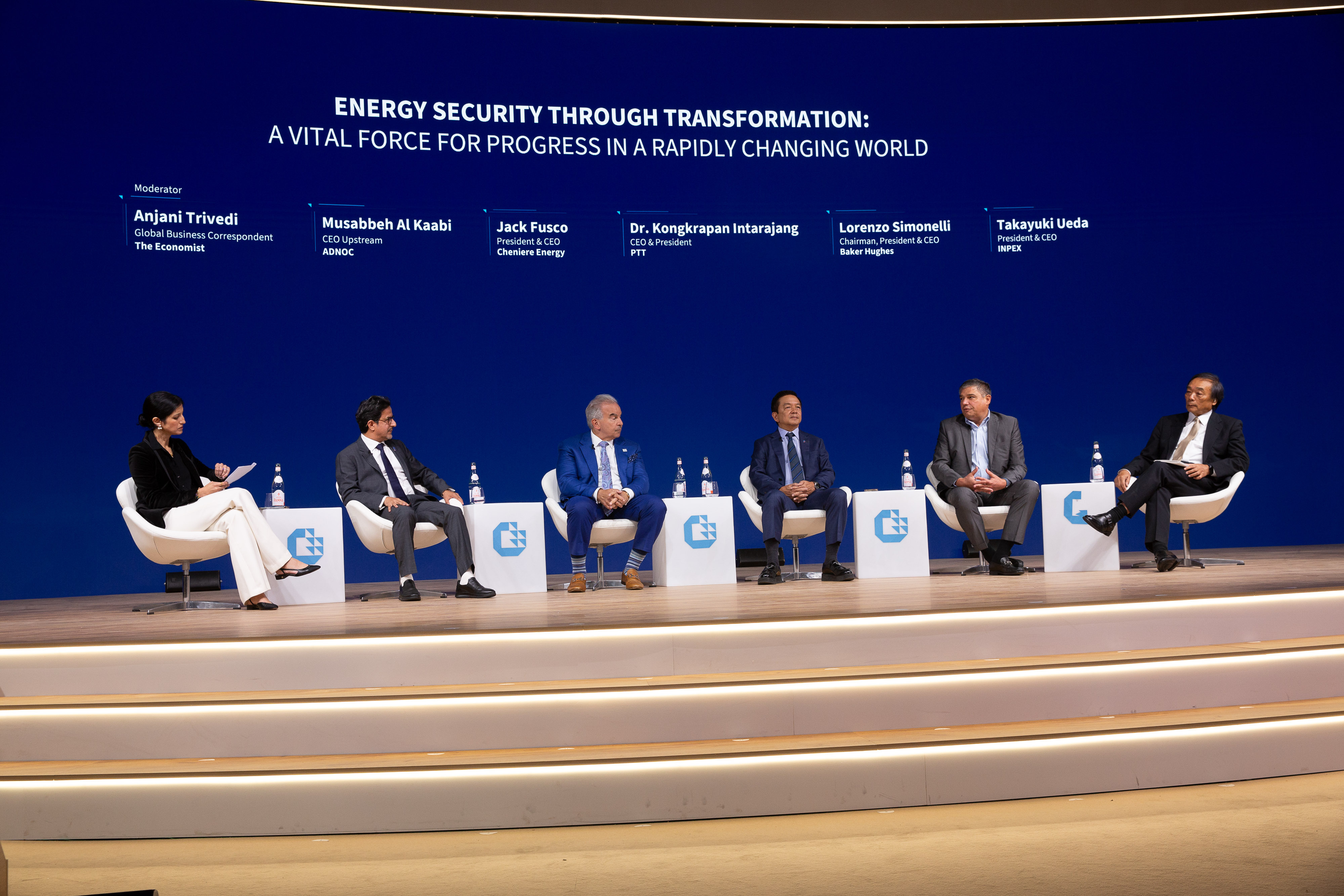

The global dialogue at this month's top industry conference in Italy was inevitably shaped by the competing ambitions of producers in the Middle East and North America, the nuanced demands of Asian buyers, and the strategic anxieties of a security-focused Europe. Africa was in the spotlight as hydrogen flagged as an interim solution worldwide. Most companies increasingly see the need for a little help from nuclear power to support the twin transition.

Reporting from Milan and drawing on post-conference feedback from executives, policymakers, experts, and some of the 50,000 visitors and participants, Energy Connects distilled four macro-takeaways that define the current state of the sector — and may again shape the agenda for the next edition of Gastech taking place in Bangkok in in September 2026 under the theme "Powering a secure and sustainable future with natural gas and LNG."

Market dynamics: global growth meets new (and old) challenges

Fundamentals were at the center of discussion in Milan, with Asia-Pacific's dual exposure emerging as a defining challenge — while the region remains the growth engine for demand, it is equally the most exposed to climate risks. Petronas LNG CEO Ezran Mahadzir emphasised the need for comprehensive risk management, noting that "risk management processes now are supposed to be more focused, looking at it from a price exposure basis, on a day-to-day basis, but also looking at it from a strategic perspective — and I suppose that by doing so, we need to have a much more optimal portfolio."

Regional participants also noted the logistical fragility caused by extreme weather.

Africa's frontier story also gained momentum: both as a potential new supply base and a future demand hub, where gas remains essential to providing affordable energy access.

Overlaying these narratives was the looming supply wave. The sharp increase in LNG capacity slated for 2026–27 split forecasts: optimists see demand absorbing volumes at stable prices, while more cautious voices warn prices could plunge before rebounding.

Geopolitics in focus: a power race?

The conference spotlighted a shifting balance in global energy diplomacy. On the supply side, the United States projected confidence. A high-profile delegation — led by US Secretary of Energy Chris Wright and Secretary of the Interior Doug Burgum — delivered an unequivocal message of support for American LNG. The administration's "energy dominance" agenda, reinforced by promises to streamline permitting further, gave producers a powerful political tailwind and reassured global buyers seeking reliability.

The European Union, by contrast, conveyed a more cautious message. Ditte Juul Jørgensen, Director-General of Energy at the Commission in Brussels, emphasised Europe's intention to deepen partnerships with reliable suppliers — above all the US, which has emerged as Europe's single largest gas provider.

Asia - led by China - frames much of the demand outlook. Beijing's robust contracting strategy, combining long-term supply agreements with Qatar, the US, and other producers, was cited as decisive in shaping flows for the decade ahead. China is consolidating its role as the price-setter for Asia, using its scale both to secure volumes and to negotiate favorable terms, leaving regional buyers with little choice but to follow its lead.

Meanwhile, the Middle East positioned itself as both producer and resilience leader. Gulf exporters signaled that their role rests not only on massive production capacity but also on pairing it with technology and financial stability— selling themselves as indispensable pillars of the global supply equation.

Technology: innovation's double edge and… a little help from nuclear

Technology surfaced as both enabler and disruptor. While AI is poised to revolutionise industries and could add an estimated $13 trillion to the global economy by 2030 according to McKinsey, realising that promise depends on sustainably meeting the substantial power demands of its data centers.

Executives acknowledged that this represents a new source of demand pressure, warning that the explosive growth of data centers and computing power is set to reshape global energy balances. Yet alongside this concern came optimism: AI itself could help regulate that hunger, optimising consumption, forecasting demand peaks, and integrating more renewables into the mix.

On the operational side, AI's cost-cutting impact through predictive maintenance is now proven, with companies reporting measurable reductions in downtime and expenses. At the same time, however, the hyper-connectivity underpinning these gains expands the attack surface for cyber intrusions — recognised as systemic and potentially catastrophic risks.

Hydrogen, too, reflected this pragmatism. Baker Hughes CEO Lorenzo Simonelli called it part of a "new energy trilemma." "Blue hydrogen," made from gas with carbon capture, is increasingly viewed as the most viable interim solution.

The resilience imperative: the new corporate playbook

Gastech 2025 crystallised a unifying theme: resilience is the condition for credibility. This imperative has two dimensions. First, fortification — both physical and financial. Operators are upgrading facilities against climate shocks and cyber-physical threats, while also overhauling their financial risk-management strategies in response to surging insurance and borrowing costs.

Second, diversification — the guiding doctrine behind investment and supply decisions. Fatih Birol, Executive Director of the International Energy Agency, emphasised that "the number one rule of energy security is diversification of supply." This principle is now driving supply diversification and an expanded portfolio across wind, solar, hydrogen, and gas. In the words of ENI's CEO Claudio Descalzi, "achieving a secure and low-carbon future requires a broad and forward-looking mix of energy sources. By leveraging diverse assets, companies can better navigate geopolitical uncertainties and operational challenges while supporting a resilient energy system."

Energy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.