How oil and gas companies can lead in building low-carbon businesses

Oil and gas companies face an unprecedented opportunity to build low-carbon businesses. Investments in technological innovations and smart strategies can position them as leaders in the energy transition.

Oil and gas companies have a major role to play in the energy transition, particularly in low-carbon solution (LCS) development. They are uniquely positioned to innovate and apply LCS at scale. Already, their offerings are reshaping global energy markets, capturing new revenue streams, and providing critical pathways for other industries to meet their net zero targets.

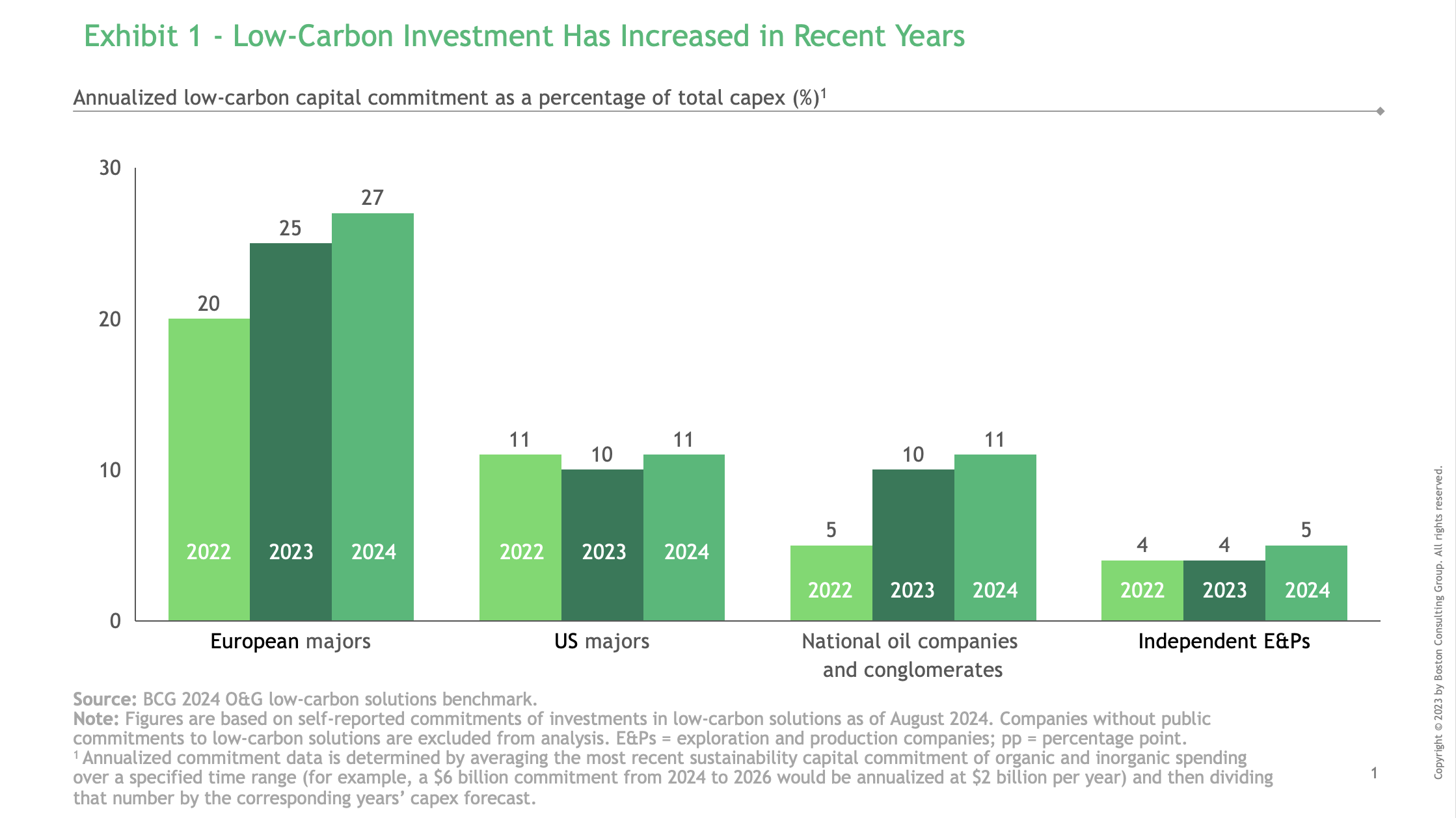

Since 2022, major oil and gas companies in the EU and US have collectively invested $20-25 billion per year in LCS development. Investments in the carbon capture, low-carbon fuel, and feedstock value chains hit $16.8 billion in 2023 in Europe alone. To varying extents, oil and gas companies have grown their low-carbon investment as a share of total capex over the past three years (Exhibit 1). And in 2024, multiple low-carbon businesses – including those of ExxonMobil, Petronas, and Repsol – reached critical milestones. However, although industry investments have been increasing or holding steady, the outlook for 2025 and beyond is not as clear.

BCG conducted a benchmarking study of 28 oil and gas companies worldwide to better understand both their current challenges and how they can seize the LCS opportunity.

BCG conducted a benchmarking study of 28 oil and gas companies worldwide to better understand both their current challenges and how they can seize the LCS opportunity.

The survey examined carbon capture technologies, low-carbon fuels and feedstocks, power, and EV-related offerings. Findings describe significant headwinds, but indicate that specific actions can enable companies to win in the LCS market.

Headwinds are slowing some efforts, and more than 90% of projects dedicated to carbon capture, utilisation, and storage and hydrogen and derivatives are still in early stages of development.

Oil and gas companies’ LCS efforts are facing serious obstacles. More than 90% of planned LCS project capacity has not yet completed the pre-final investment decision (pre-FID) phase of development, due in large part to headwinds in key areas.

- Regulatory Uncertainty. Despite a decade of increasing regulatory support and government commitments to decarbonisation, ongoing support is no longer certain.

- Returns Below Core Business. Companies are reporting returns of less than 10% for power and renewables, and 10% to 15% for hydrogen and low-carbon fuels – below those of many traditional oil and gas projects.

- Stakeholder Support. Major LCS projects can run into public opposition on economic or environmental grounds.

Nevertheless, decarbonisation remains an urgent imperative. Oil and gas players can win in the LCS space by adopting six key best practices.

Despite complications, oil and gas respondents continue to pursue smart, strategic investments in LCS to:

- Offset economic pressure in their core businesses and reduce emissions

- Capture share in emerging green markets, offering stable cash flow and portfolio diversification

- Safeguard their social license to operate

- Improve talent attraction and retention

For companies moving to seize the LCS opportunity, six best practices can position them to win:

- Think strategically. Clarify how LCS integrates into long-term strategy. Is LCS a hedge against future cyclical declines in the core business? Is it a significant new growth opportunity?

- Develop a signpost-based action plan. Identify signposts that mark turning points in the market — and act one is reached. Signposts may include costs declining to a target level or new incentives that make a project economically appealing.

- Tap core assets and differentiated capabilities. Build from the company’s existing base to maximise value. Leverage facilities; repurpose existing infrastructure; explore how vertical integration with traditional assets can accelerate LCS activities.

- Use decarbonisation efforts to fuel LCS progress. Be the anchor offtaker for their own LCS projects, simultaneously stabilising and advancing both LCS and decarbonisation efforts.

- Focus on financing. Adopt new commercial and financing models – for example, asset rotation to selling mature assets and raise cash for project investment. Smart alternative financing can also help bolster equity returns.

- Embrace multistakeholder collaboration. Understand stakeholder needs, and develop offerings in partnership to meet them. Seek commitment from the broad ecosystem of stakeholders, including lenders and investors, regulators, technology providers, logistics players, and offtakers.

Despite the challenges, oil and gas companies will benefit from a sustained commitment to low-carbon investments. With the right approach, they are strongly positioned to lead in this critical area of the energy transition.

Energy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.