Energy CFOs must power the green transition

The energy transition means energy industry players will need to attract and deploy capital on an unprecedented scale – despite tightening regulations, cost inflation, divided investor expectations, and a volatile geopolitical landscape. Chief financial officers (CFOs) and their teams are central to this effort. They must bring a rigorous, long-term value perspective to decision making, prioritising performance and resilience.

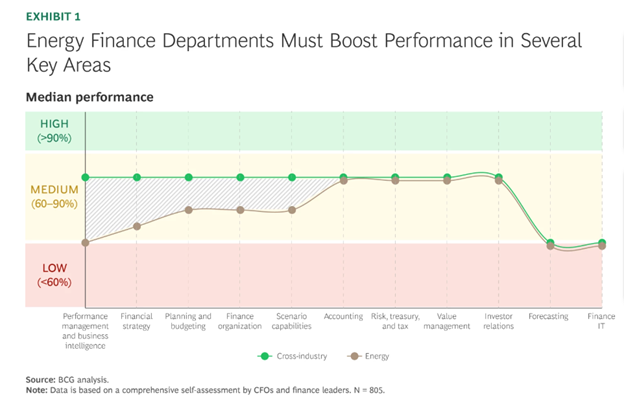

Many energy CFOs are already evolving their role. Nevertheless, BCG’s CFO Excellence Panel shows finance functions trailing their peers in other industries, lacking capabilities the energy transition demands to effectively manage capital spending and optimise operational and regulatory performance (Exhibit 1).

This paper summarises the three key shifts to elevate energy finance function performance and contribution.

1. Shape the Strategic Transformation with a Value Lens

To adopt a more strategic, course-setting role, finance functions must excel on three dimensions.

Dynamic capital allocation and efficiency. Facing unprecedented investment needs, the ability to prioritise, finance, and extract value from capital investments in partnership with the business becomes paramount. Key shifts include: improved portfolio and decision transparency; rigorous prioritisation with expanded metrics; budgetary envelopes permitting dynamic investments.

Transformative equity story. With rising investment community expectations, CFOs and their teams need to lead in crafting a robust thesis that satisfies both traditional and sustainability-focused investors. It should show how the company is driving shareholder return through a blend of traditional profit pools and realistic, inspiring decarbonisation initiatives.

Advanced M&A, integration, and partnering capabilities. The energy transition is spurring global M&A activity, including acquisitions, carveouts, and divestitures. CFOs and their teams should be engaged in this process from end to end, and should build the capabilities to support it: deal sourcing, assessment, and execution; postmerger integration; and postdivestiture cost management.

2. Drive Performance and Bolster Resilience

Finance functions’ role as custodians of performance and resilience has changed: they now need to integrate across many dimensions of performance, including financial and regulatory, sustainability, and societal impact. Strengths in three areas are crucial.

Enhanced decision support and full partnering with the business. With an increasingly volatile operating environment, planning, budgeting, and forecasting are more difficult. Companies also face greater complexity, with expanded performance metrics, complicated regulations, heterogeneous business portfolios, etc. Finance must adopt a business-centric lens to focus their decision support, expand their performance frameworks, and connect closely with the field.

Dynamic planning and forecasting. A business-centric, value-generation approach to the process and tools can improve the quality and timing of decision support. Companies may need to redesign their planning and forecasting processes. Scenario-planning and stress-testing can help prepare for volatility. Predictive analytics can augment the forecasting process, while self-service applications for business users help simplify decision-making.

Balance sheet optimisation. Responding to the new economic climate will mean adjusting energy companies’ portfolios—putting pressure on balance sheets. Finance has multiple levers to boost balance sheet resilience: working capital; cash and liquidity; fixed assets; capital structure; financing; partnerships; risk management. By partnering with the business along these drivers, finance teams can strengthen financial performance, freeing cash to fund the transition.

3. Deliver Top-Level Finance Function Performance

A more effective function means stronger decisions, lower expenses, and better regulatory compliance. Leading CFOs are focusing their attention on three priority areas.

Digital and AI enablement. Enterprise resource planning (ERP) system upgrades still dominate energy companies’ digital roadmaps, but a broader perspective is needed. Finance function technology should combine ERP, best-practice applications, and predictive and GenAI solutions – with associated changes in the operating model. Finance leaders are also modernising their systems with planning suites and data lakes.

End-to-end process excellence. Institutionalise the process orientation with global process owners in charge of end-to-end performance and aligned organisations. Eliminate complexity in major processes, e.g., by simplifying underlying data structures and operating procedures. Shared service centers (tax, treasury, audit, investor relations) remain an important optimisation lever.

New talent and capabilities. The range of functional capabilities needed is widening to include expertise in: business processes/process engineering, regulation, advanced financial data practices, ESG, tax issues, and International Financial Reporting Standards.

CFOs and their teams are retooling the finance function to support the energy transition: filling capability and performance gaps, and focusing on value generation and business impact.

Energy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.