Breaking barriers to data centre growth

Global demand for computing power is surging. Leading data centre players anticipate continued growth in data-intensive technologies and are readying a massive capital deployment to meet the need. Significant barriers, however, could slow the industry’s development. This article summarises the growth outlook, challenges, and practical solutions for ecosystem stakeholders.

Rapid growth and evolving regional dynamics

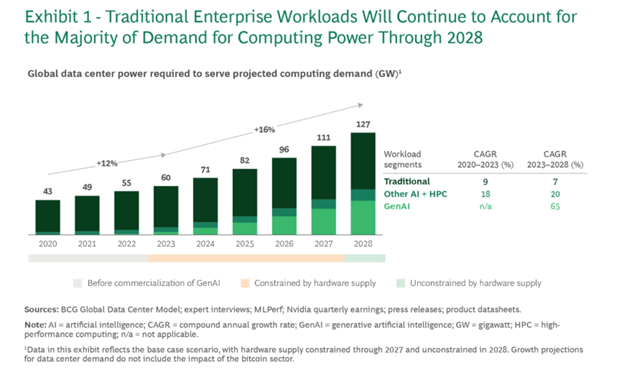

BCG research shows global demand for data centre power growing at ˜16% CAGR 2023-2028, reaching ˜130 GW by 2028 (Exhibit 1). Traditional enterprise workloads represent most of today’s demand and will account for roughly 55% in 2028. Drivers include the continued rise of data volumes, digitisation, and cloud services. But GenAI-related computing is the fastest-growing demand segment, including foundational model training and inferencing workloads. The precise trajectory and timing of computing demand — and data centre buildout — will depend on the path of GenAI computing growth. Hyperscalers like Amazon, Meta, Microsoft, and Google, will generate approximately 60% of the industry’s growth 2023-2028 (45% of global data centre power demand).

The US represents ˜60% of globally installed data centre capacity, and will account for the majority of demand growth 2023-2028. However, locations outside the US will capture 30% of growth driven by:

- Data security and sovereignty concerns

- Increasingly widespread availability of reliable, low-cost power options

- Expansion of AI applications with low latency requirements

Data centre challenges and steps to address them

While national and business leaders are prioritising AI innovation, data centre ecosystem players face significant challenges.

Access to power. Power needed for more and larger data centres is becoming a critical bottleneck. Data centre operators need to work proactively with energy providers to accelerate grid infrastructure development:

- Collaborate in planning and siting. Together, data centre operators and utilities can "intelligently site" facilities, balancing developer needs (e.g., proximity to urban centres) with utilities’ optimisation of system affordability and reliability.

- De-risk grid expansion. Misalignment of planning horizons challenges grid buildout. Operators can help utilities de-risk capital expenditures by offering take-or-pay contracts, financial guarantees, or co-ownership.

Supply chain issues. Chip availability is an established issue, but growth is disrupting the supply chain from power and cooling systems to networking infrastructure. Lead times for critical equipment have gone from months to years. Data centre operators can help alleviate bottlenecks:

- Bulk-purchase long lead time components. Work with engineering, procurement, and construction partners to secure equipment, and store it with third-party logistics providers.

- Pursue partnerships and co-development. Data centre operators and suppliers can establish strategic relationships, including co-investments, to help scale manufacturing and provide visibility into data centre

- Invest in talent development. Recruiting specialised labor, particularly in remote areas, remains a challenge. Companies can create workforce development programs and partner with educational institutions.

Community engagement. Expanding data centres face increasing host community scrutiny regarding their impact on local land and water resources, and how grid upgrade costs will be allocated. Two actions help address these concerns:

- Design equitable rates. Regulators, utilities, and data centre operators can develop new cost recovery frameworks. These should ensure fair distribution of costs among impacted customers, protecting against price increases or reliability issues.

- Proactively engage with host communities. Amplify data centres’ positive impact through local hiring, worforce training, funding energy efficiency programs for households, and providing direct relief to ratepayers.

Climate change impact. Data centres need a continuous, redundant supply of energy. Besides leveraging renewable sources, providers are expanding — or slowing the retirement of — unabated fossil generation. Data centre operators must address their climate impact:

- Mitigate the environmental impacts of fossil fuel plants. Operators can work with utilities to define transition roadmaps for fossil fuel-based assets (e.g., integrating carbon capture and storage or ensuring hydrogen readiness).

- Drive adoption of emerging climate technologies. Mature technologies will play a critical near-term role, but data centre operators can achieve long-term impact by supporting the development of emerging climate solutions.

- Catalyse system-level change. Operators can leverage their scale and buying power to accelerate system-wide adoption of renewable energy. They can provide long-term stability through partnerships or offtake guarantees, as well as convening stakeholders.

The data centre industry stands at a pivotal juncture, with an uncertain path ahead. As operators confront multiple challenges, the industry’s growth depends on creative collaboration throughout the ecosystem.

Energy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.