Transforming the Middle East: balancing oil dominance with renewable growth

The Middle East’s energy sector is at a pivotal point, balancing its role as a global oil and gas leader with the pressures of the global energy transition. Home to major oil and gas reserves, the region is shifting towards renewable energy, particularly solar PV, driven by economic growth, population increase, and the need to reduce carbon emissions.

As population growth continues, the region's economic outlook strengthens. By 2050, power demand will reach about 2,000 terawatt-hours (TWh), compared to the current 1,200 TWh, due to strong industrial development, population growth, and the electrification of transport and other sectors. The region’s residential sector currently accounts for 40% of total power demand, followed by the commercial sector at 26% and the industrial sector at 22%. The remaining 12% includes sectors such as agriculture and transport.

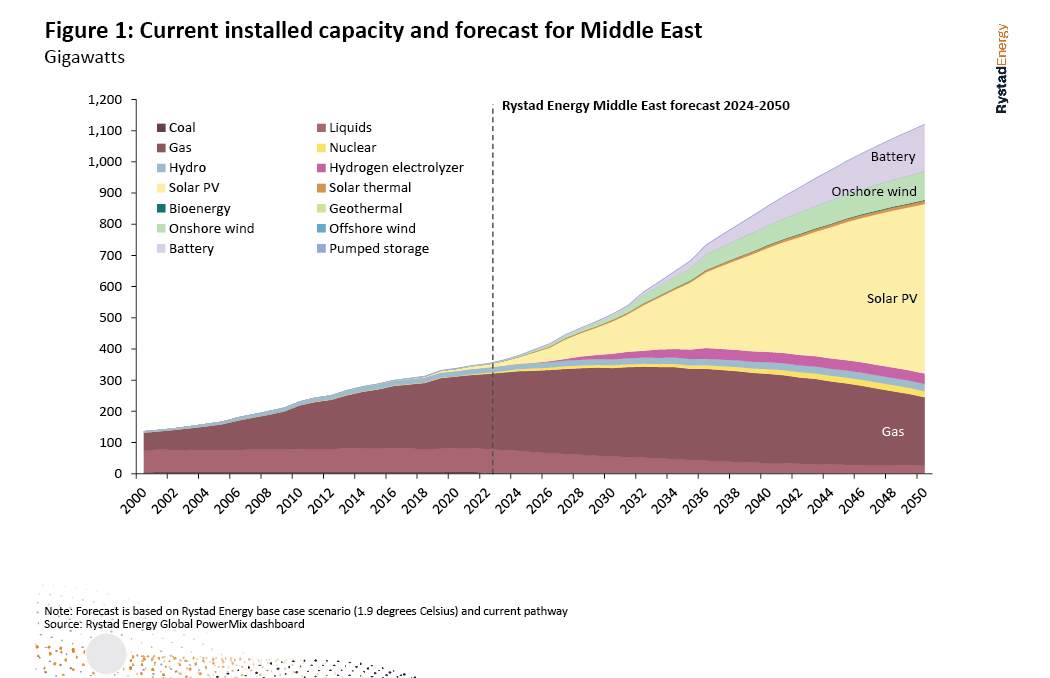

As of now, Middle East's power generation is heavily reliant on fossil fuels, making up 93% of the total at the end of 2023. Renewables accounted for 3% and nuclear and hydro for 2% each. Natural-gas power represented almost three-quarters of the region's electricity generation, making up 40% of the overall gas demand. By 2030, some 30% of the region’s installed capacity is expected to come from renewable energy sources, with the potential to rise to 75% by 2050.

The Middle East has been constantly focusing on increasing its gas production as well as exports, aiding the global shift of oil-based economies to gas-based economies. The region became the second-largest gas producer in 2022, with its production touching 683 billion cubic meters (Bcm) that year. Within two years from then, the region is estimated to have increased its production by between 6.5% and 7%, reaching 725 Bcm of gas production this year. Rystad Energy estimates that regional production will top 700 Bcm by 2028 or 2029. Production is being fuelled by the increase in gas demand for power and industrial use, as well as the energy transition strategies hatched in the UAE (Energy Strategy 2050) and Saudi Arabia (Vision 2030).

The rapid increase in gas production is driven by Qatar, Saudi Arabia, the UAE and sanctions-hit Iran. Iran and Qatar combined are estimated to contribute more than 50% to regional gas production owing to the exploitation of one of the world’s largest gas field, South Pars (Iran)/North Dome (Qatar). Interestingly, while Qatar is a net exporter and one of the largest LNG players, Iran suffers from a shortage of gas even for domestic consumption. Saudi Arabia is on a path to replace liquids with gas for power generation. The UAE is seeing a decline in gas-fired power generation as it rapidly incorporates nuclear and solar power into its energy mix.

Battery energy storage is expected to grow significantly in the 2030s, supporting the intermittency of solar and wind power and aiding in a smooth energy transition. Because of a relative lack of hydropower potential and low gas prices, the Middle East will continue to use gas-fired power as a primary source and eventually as a transitional fuel in the long term. The share of gas in the power generation mix is anticipated to shrink from 74% at the end of 2023 to 46% in 2040 and 22% by 2050.

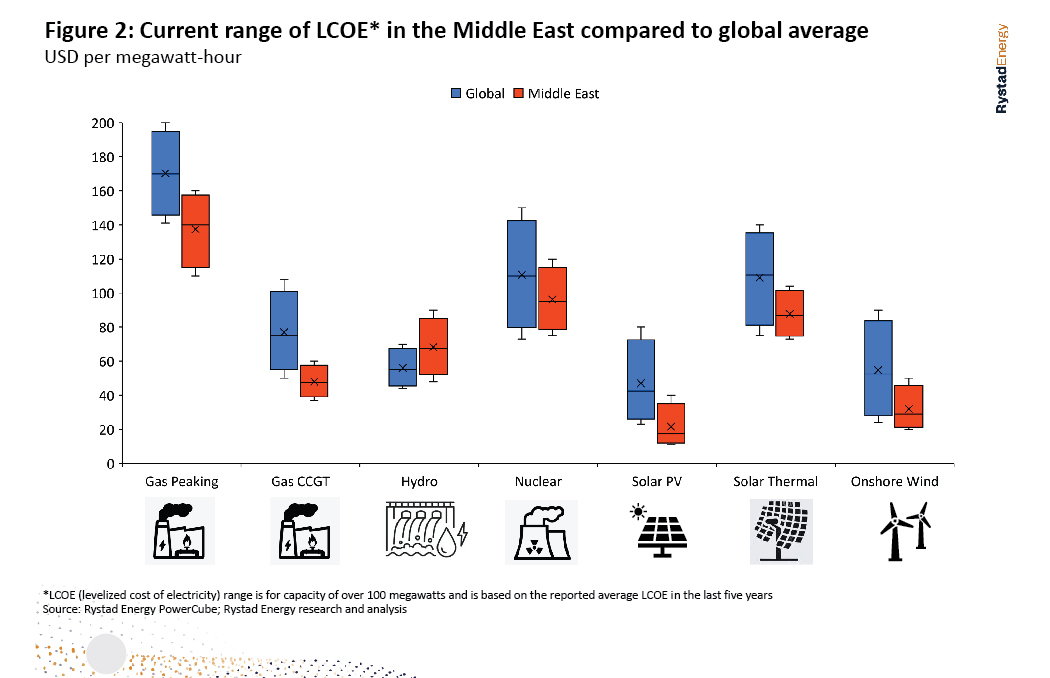

Solar energy is becoming increasingly important in the energy policies of Middle Eastern countries. As the cheapest energy source, solar PV in Saudi Arabia is at a world record-low levelized cost of electricity (LCOE) – an economic metric to assess and compare lifetime costs of generating power across different energy sources – of $10.4 per megawatt-hour (MWh). This is due to factors such as low hurdle rates, large-scale projects, declining hardware prices, low labour costs, and high solar irradiance. In fact, the region has exceptional solar energy potential, receiving more than 2,000 kilowatt-hours (kWh) per square meter annually in solar irradiation in countries such as Saudi Arabia, the UAE, and Oman.

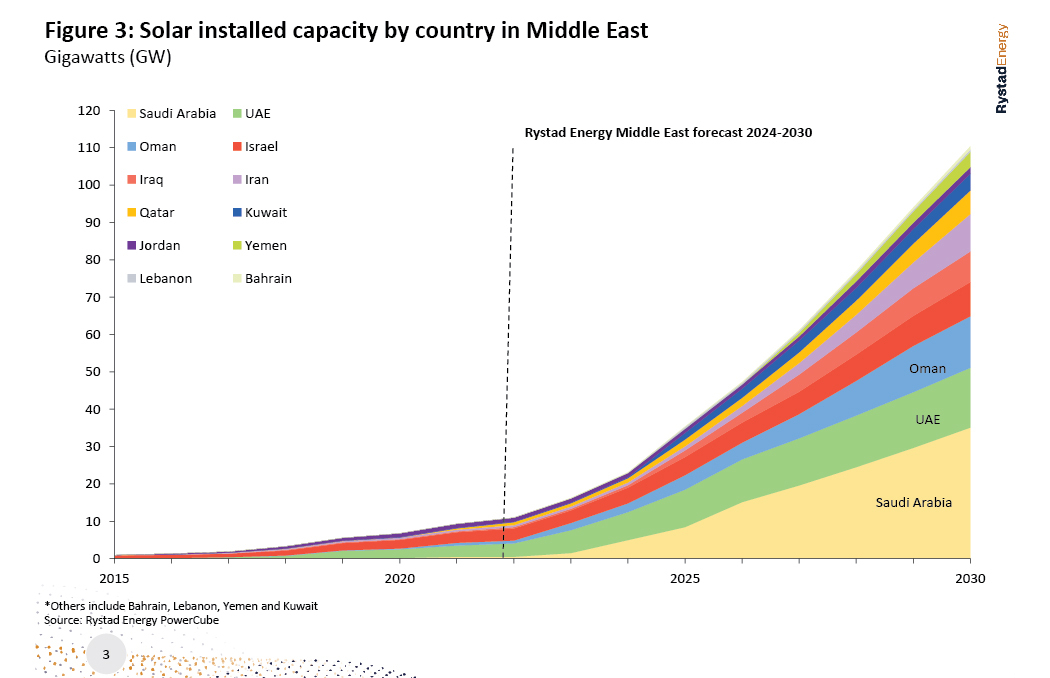

The total solar capacity in the Middle East at the end of 2023 exceeded 16 gigawatts (GW) and is expected to approach 23 GW by the end of 2024. Projections indicate that by 2030, the capacity will surpass 100 GW, with green hydrogen projects contributing to an annual growth rate of 30%. Saudi Arabia, the UAE, Oman, and Israel are on track to collectively account for nearly two-thirds of the region’s total solar capacity by the end of the decade.

Saudi Arabia's Sudair solar project, which boasts 1.5 GW of capacity, is now fully operational, raising the country’s total installed solar capacity to more than 2.7 GW. Saudi Arabia is targeting more than 58 GW of capacity by 2030, demonstrating its commitment to boosting renewable energy power generation to its goal of 50% by 2030, up from 2% currently. However, announced solar projects only account for about 13 GW, with ongoing auctions adding an additional 5.5 GW, leaving a gap of more than 18 GW.

The UAE has also publicly committed to transitioning to clean energy, focusing on building out solar PV to raise its capacity from 6 GW today to 14 GW by 2030. The country is aiming for 44% renewables in its power mix by 2050, up from 6% today. The MBR Solar Park is a landmark project, aiming to achieve a 5 GW alternating current (GWAC) capacity by 2030, with an investment of about $14 billion.

Energy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.