Supermajor to supercharger

Editors note: This article was written in June 2021, some of the data included in the article might have changed.

Big Oil will collectively sink US$70 billion in developing current utility renewable energy portfolios, achieving 45 GWAC by 2030. This build-up; however, falls short of BP or Total’s individual targets. Are Big Oil’s renewables ambitions running on empty? A further US$200 billion will be required from the major players to achieve set targets by the end of the decade. Offshore wind now dominates portfolios; but can this continue as the window of opportunity to develop large projects in key markets by 2030 is closing. What comes next? Solar will deliver the most generation towards the 2030 deadlines, but could hydro power, Big Oil, towards its renewable capacity goals?

Targets and outlook – Thirty times boost by 2030

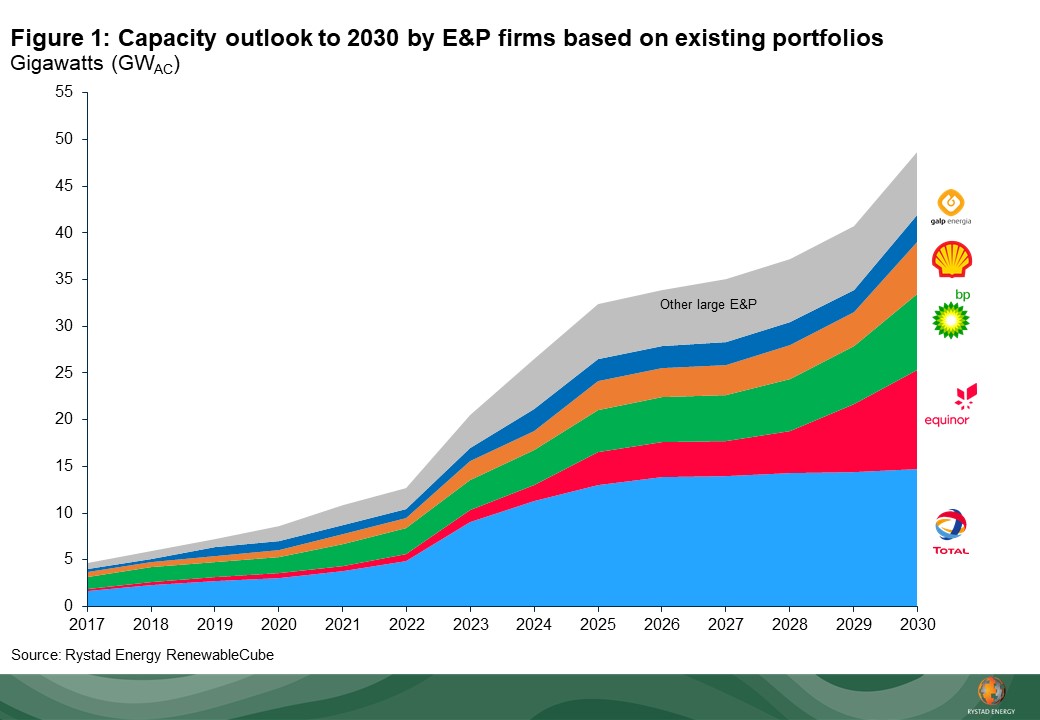

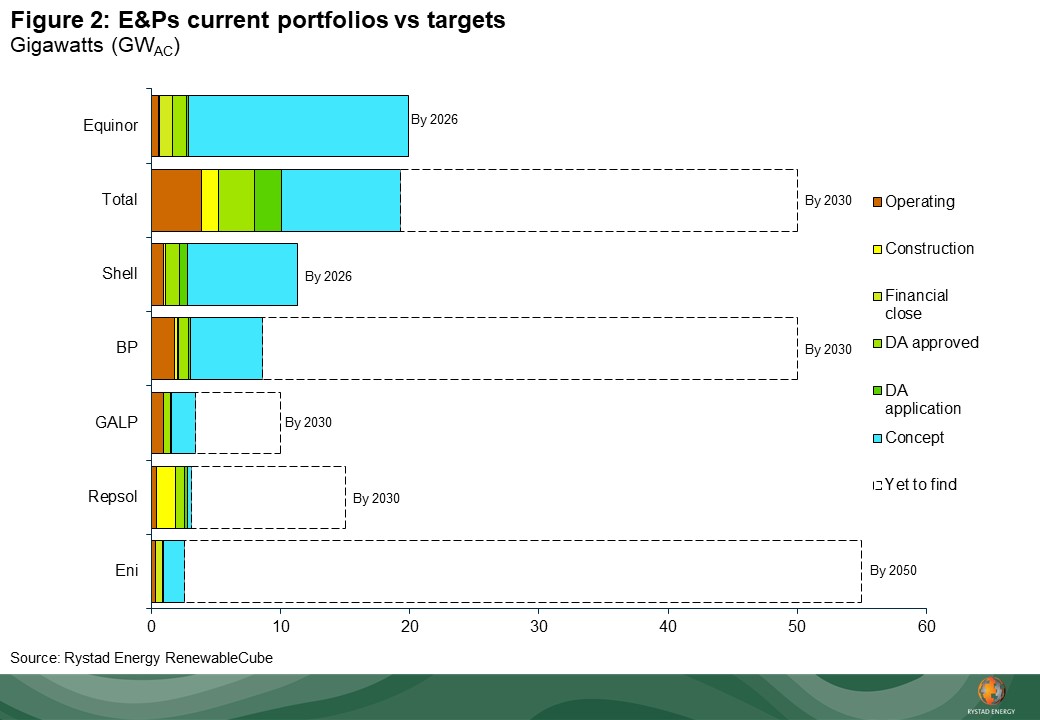

Big Oil operates globally some 5 GWAC of utility renewables, or about half a percent of global generation, with a further 3 GWAC under construction. As part of decarbonisation plans, the top E&P companies tracked by Rystad Energy aim to increase current operating capacity 30 times by 2030. These companies added 17.3 GWAC of capacity to their portfolios through mergers, acquisitions, and joint ventures so far in 2021. This compares to a total of 18.3 GWAC added during the whole of 2020. Based on this level of M&A activity, the industry is on track to building a sizeable renewable energy portfolio. The challenge; however, will be energizing this capacity by 2030.

Rystad Energy estimates that (collectively) Big Oil’s portfolio will grow to hit around 45 GWAC – or 67 percent of its total portfolio – with giants like BP and Total falling short of individual goals.

Offshore wind dominates portfolios – Will this continue?

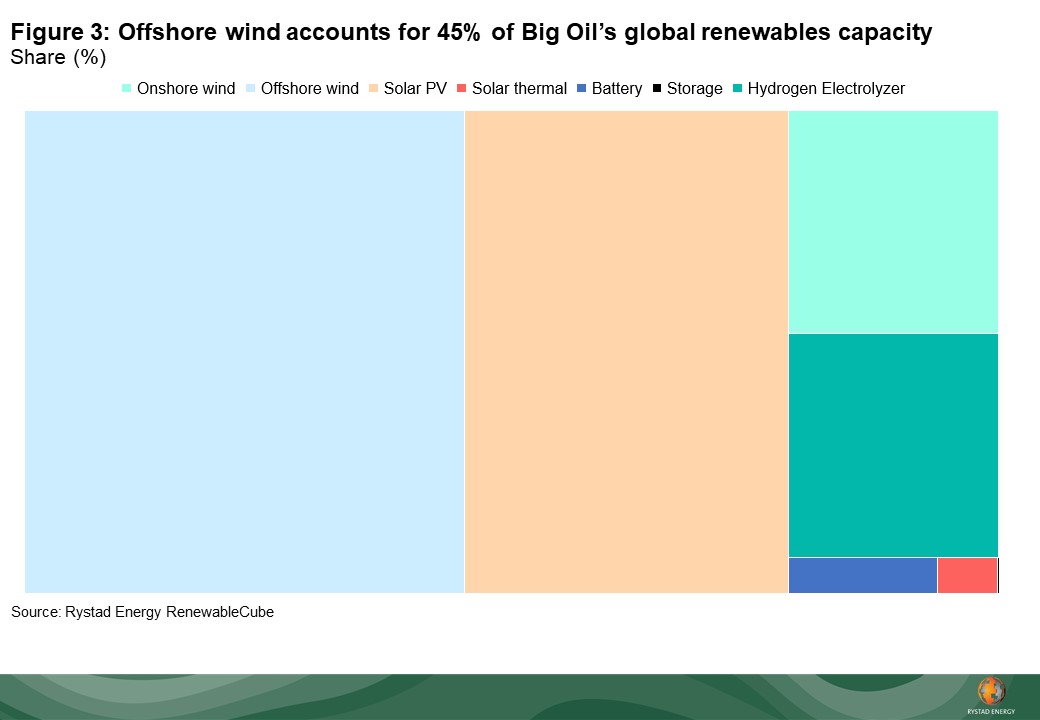

E&Ps renewable energy portfolios, amid current project pipelines, are expected to push through the 70 GWAC mark in the coming weeks. Most of this capacity (45 GWAC) will be generating by the 2030 deadline many of these companies have set. Of this, 20 GWAC will come from utility solar PV projects – the technology of choice for Big Oil. Meanwhile, offshore wind is expected to account for 15 GWAC. Both technologies are expected to dominate E&Ps new energies portfolios as we approach 2030.

Of the 25 GWAC of capacity expected to come online after 2030, 19 GWAC is offshore wind and 6 GWAC hydrogen electrolysers. Offshore wind has seen the highest growth since the targets were announced. With the lead time for larger offshore wind projects ranging between five to eight years, the window of opportunity for offshore wind projects helping to achieve E&Ps 2030 targets is closing. For the UK and the US offshore wind projects – the two regions with some of the highest growth potential – the lead time is estimated at between eight and 10 years; therefore, limiting the window of opportunity further.

If companies fail to identify sufficient offshore wind projects in time, what other technology options do developers have?

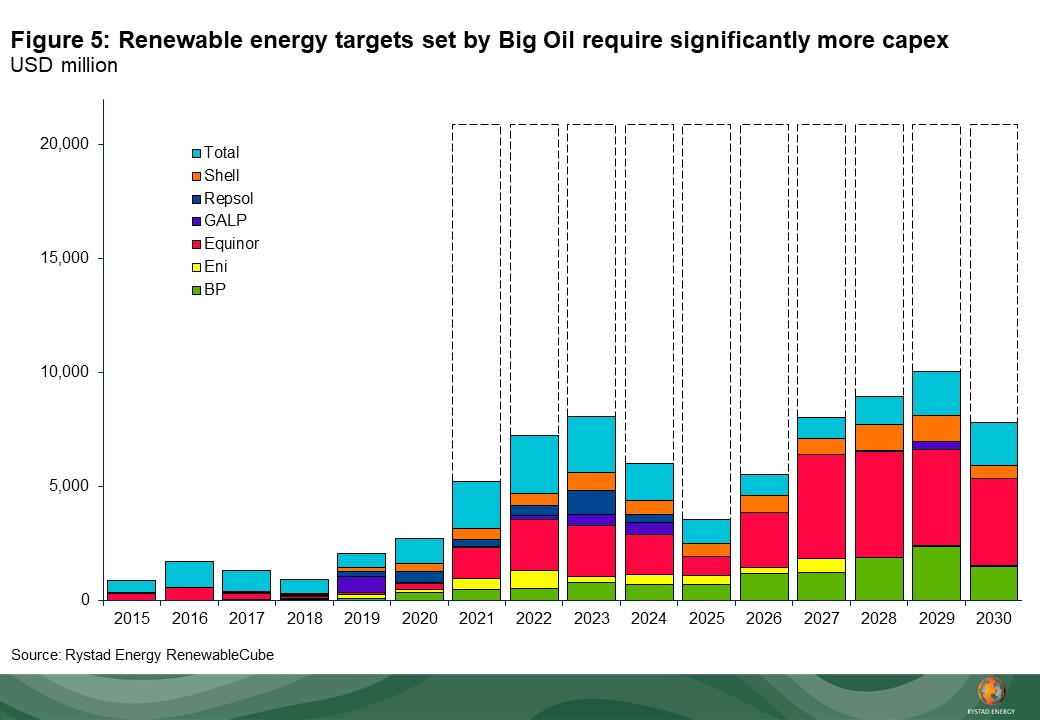

Capital investments need to increase

Rystad Energy estimates E&Ps will invest US$70 billion by 2030 to develop 45 GWAC of renewable energy capacity. This capital expenditure (capex) will peak towards the end of decade at US$10 billion, as some of the larger offshore wind projects are developed. However, more than double this investment is required annually (from this year) if Big Oil is to achieve set targets. This capex boom is unlikely given the size of E&Ps portfolios now. As such, M&A activity is likely to remain high as projects are acquired instead of being developed.

What comes next for Big Oil?

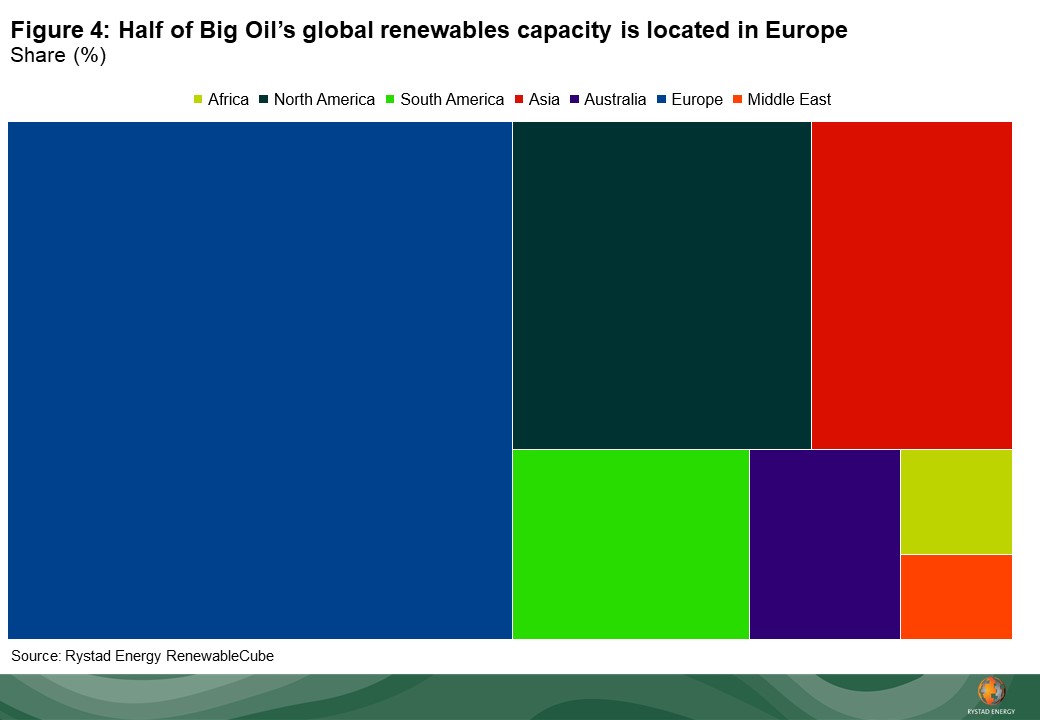

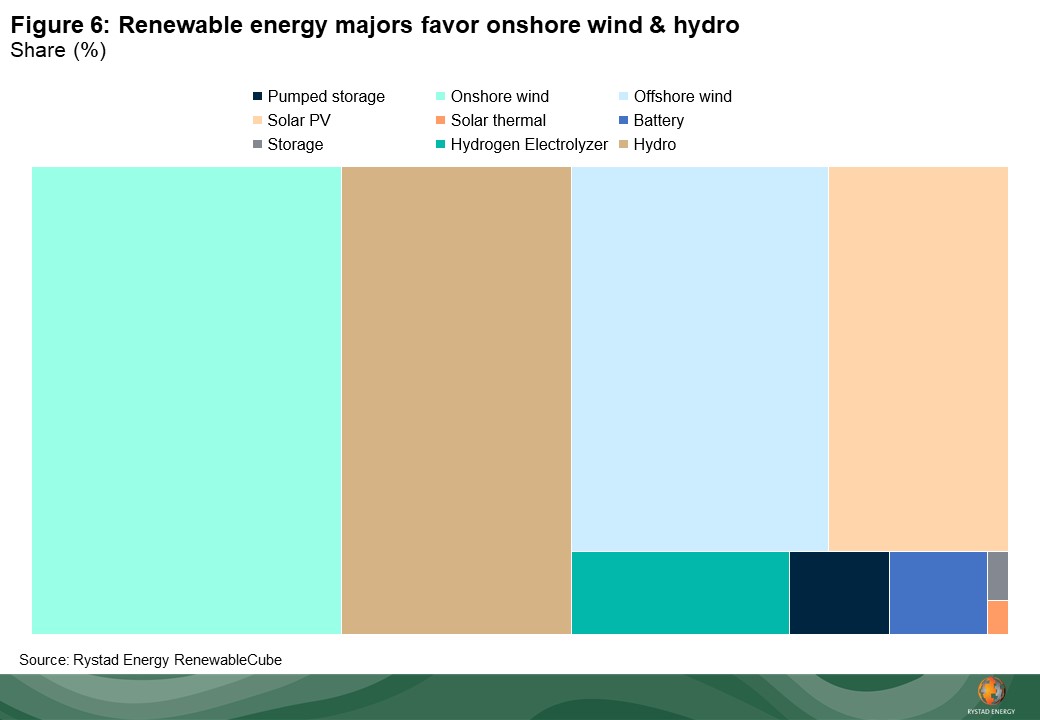

Upstream supermajors are aspiring to be renewable energy supermajors (or superchargers). But unlike Big Oil, the top Big Green companies have built up renewable energy portfolios on the back of onshore wind and hydro. Collectively, these two legacy technologies account for 55 percent of the portfolio of the top utility renewables players. Big Oil, meanwhile, has focused on solar PV and offshore wind as these have been the fastest growing technologies in recent years due to the dramatic cost cuts achieved. Also, since E&Ps announced new and ambitious renewables targets, onshore wind has fallen out of favor. It accounts for less than 10 percent of current portfolios owned by Big Oil. With limited experience in this area, it would be difficult for these companies to find a competitive advantage on Big Green in the onshore wind sector. Instead, offshore wind provides them with clear operational synergies (with upstream operations), including scale, existing supply chain relationships, and high levels of incentives.

Nonetheless, will these E&Ps also look onshore as the scale of projects increases? Onshore wind projects are also approaching the billion-dollar investment scale, or ‘oil and gas’ scale. Projects typically enjoy higher capacity factors than solar PV and a more diverse generation profile. This is becoming progressively more valued in grids with high solar penetration, where pricing can be negative during the day.

Also, could hydro be the wildcard Big Oil has been waiting for? This technology provides a quarter of the capacity owned by renewables majors. It has the advantage of being dispatchable, unlike solar and wind, and presents a valuable source of firming for green hydrogen electrolysers, which upstream has big ambitions for. New hydro developments provide scale and complexity, which are both highly attractive for upstream players. However, the lead times might be challenging as new projects are unlikely to help meet the 2030 targets set by E&Ps. Building hydro capacity through M&A activity is more likely and could help grow and diversify portfolios.

Energy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.