Powering the future: the unprecedented challenge of rapid global energy transformation

A successful energy transition will require the largest, most rapid transformation of the global energy system in history, according to new report released by Bain & Company.

To meet the moment, leaders of energy and natural resource (ENR) companies are undertaking an enormous number of capital projects in the coming years. These spans emerging and conventional technologies and infrastructure, from solar power and liquefied natural gas to copper mining and battery storage.

Many ENR companies have decades of experience executing capital projects.

While some have struggled to deliver large capital projects on time and on budget, many companies take pride in their organisation's track record.

But none have faced anything like what's ahead. Millions of acres of land must be transformed to build assets for renewables, energy transmission, distribution, and storage. Millions of new workers will be needed to change over tens of millions of pieces of machinery and equipment across the energy and raw materials systems, and to develop the mines and supply chains for raw materials and equipment.

Unprecedented capital deployment amid economic and regulatory hurdles

While the volume of capital required to achieve this is unprecedented, so is the speed of the transition. Some companies face the prospect of doubling or tripling their capital deployment levels within a few short years.

At the same time, roadblocks are stacking up. High interest rates and inflation are driving up project costs. Lead times and costs are being stretched by Limited supplies of equipment, materials, and talent. Public sentiment and the regulatory environment are growing more complex, with a patchwork of policies around the world, sometimes with competing agendas. Nascent energy transition technologies are encountering scaling challenges as early estimates meet the realities of capital deployment and construction.

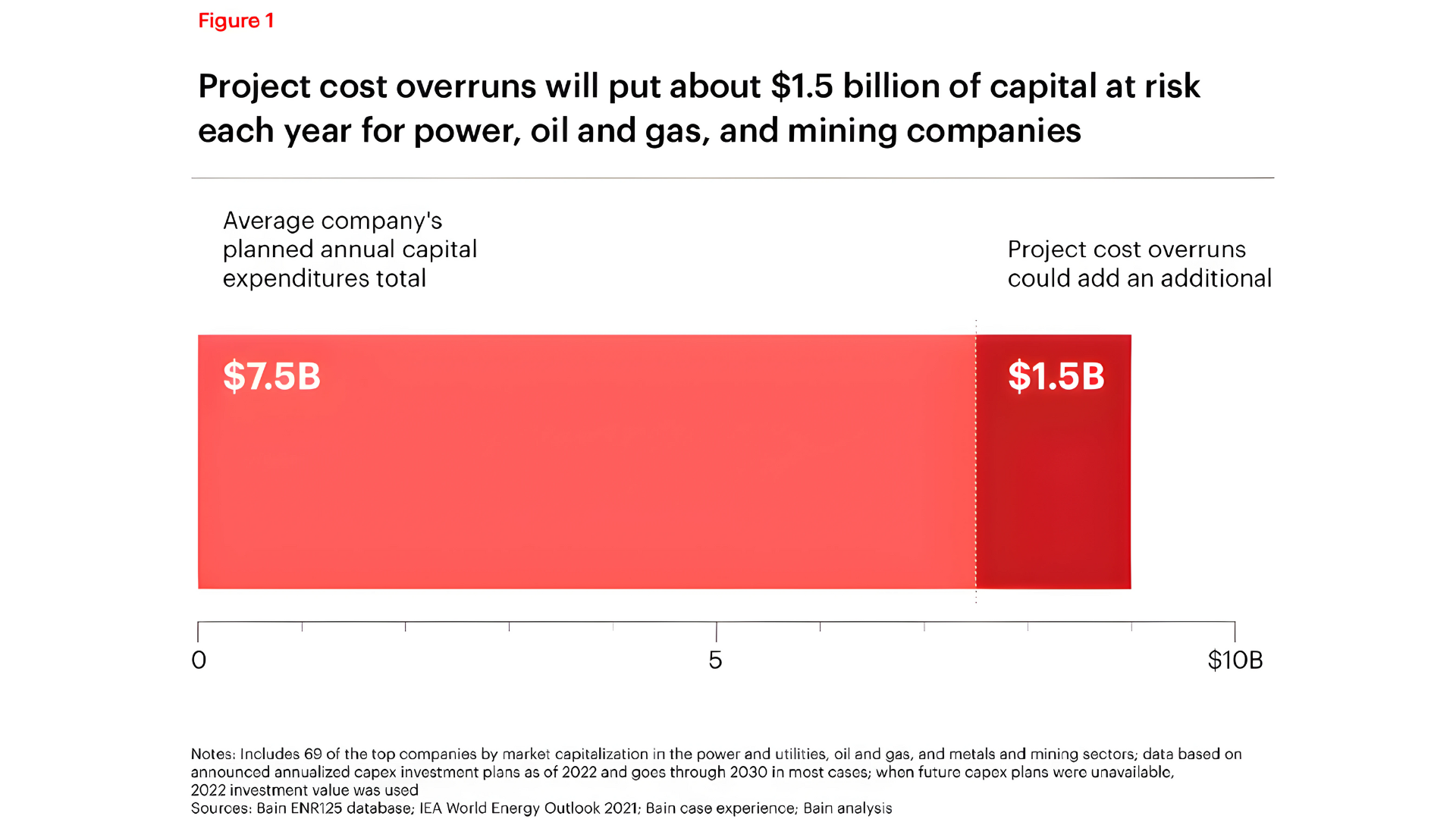

This leaves ENR companies exposed. With large projects often running 15% to 20% over budget, about US $1.5 billion of capital will be at risk each year for the average power, oil and gas, or mining company through 2030, according to Bain & Company analysis of top companies' planned investments (see Figure1). That has serious ramifications for the world's timeline to reach net-zero carbon emissions and for each company's return on capital deployed. It's no surprise that ENR executives are feeling intensifying pressure from shareholders, governments, and local communities to keep projects on track.

Companies will have to take bold action to navigate the wave of capital projects in motion amid this more complex global landscape.

Some of the answers to these challenges are known, and many ENR companies are already implementing them: resetting relationships with suppliers, making purchases more strategically and proactively, deploying Agile ways of working in the project development and delivery phases. But leading companies are now going further and rethinking the long-held model used to facilitate capital delivery: the project stage gate process.