Latin America’s geothermal investments to hit $1.3b in 2027 to explore untapped potential

Latin America boasts abundant geothermal energy resources, offering a promising avenue for clean energy production, decarbonisation of industrial processes and bolstering energy security. Despite these favorable conditions, only a fraction of its potential has been harnessed, with a mere 2 gigawatts electrical (GWe) currently utilized out of a total potential of 33 GWe, according to a new Rystad Energy report. The bulk of this utilisation comes from Mexico, Costa Rica and El Salvador, which collectively account for about 75% of the existing capacity.

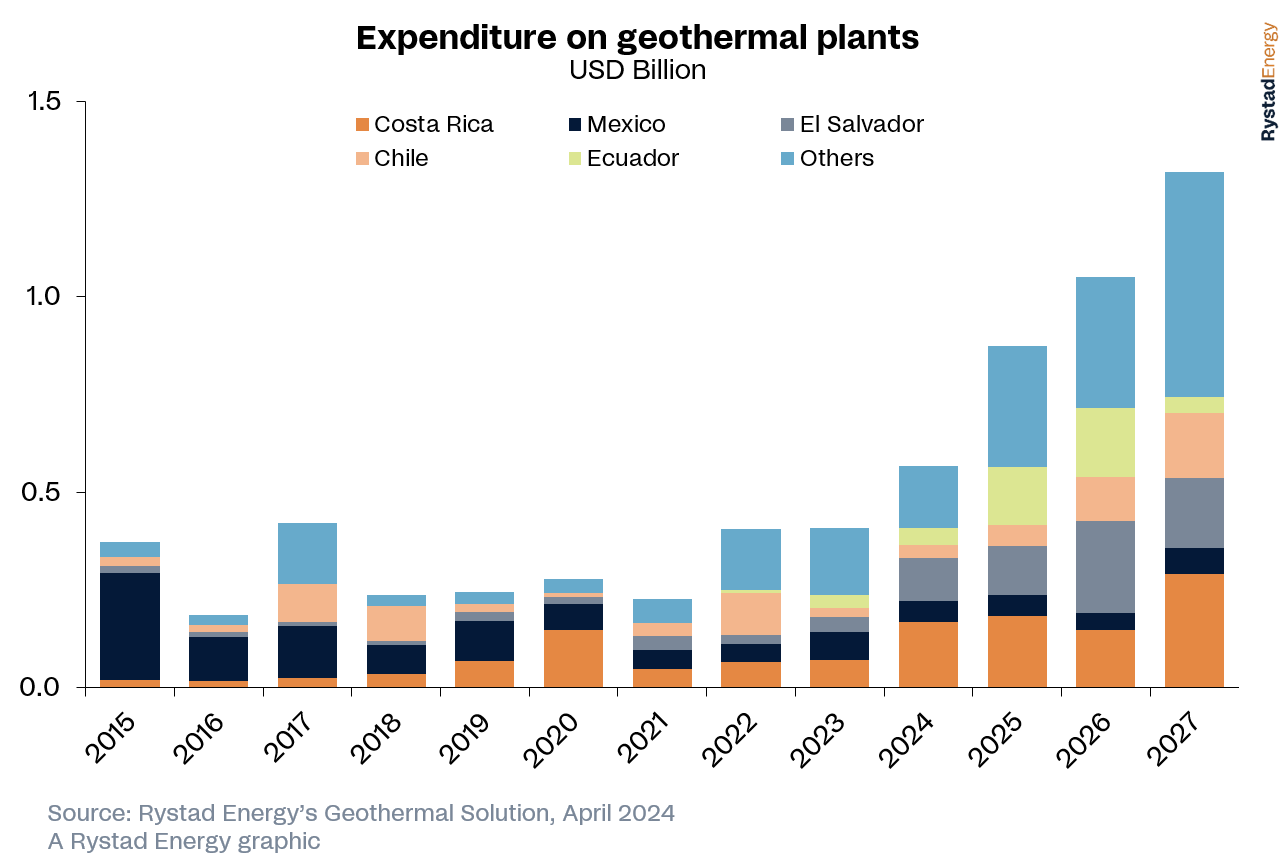

Rystad Energy forecasts show geothermal investments in Latin American are set to spike in the coming years, rising from about $570 million this year to $1.3 billion in 2027. This growth is a result of an expected increase in operational capacity from about 950 megawatts electrical (MWe) to over 1.4 GWe. This rapid expansion is fueled by announced projects and government targets.

Constrained pipeline

Despite this short-term optimism, the project pipeline in the longer term remains constrained due to conditions relating to geothermal sites, with locations often being hard-to-reach, making infrastructure development difficult. Furthermore, even if a good site is found, it may be far from power lines, requiring expensive new construction to connect it to the grid.

Latin America's geothermal capacity growth by 2030 is almost solely driven by government targets, with existing projects fulfilling nearly two-thirds (67%) of these collective goals. The remaining third (33%) will require new, yet-to-be-announced projects. However, beyond 2030, growth is expected to slow as government roadmaps currently lack strong prioritization for geothermal energy.

“Latin America's geothermal potential faces a dual challenge: contending with established, low-cost renewables such as solar and wind in a deregulated market, while grappling with the significant initial investment required for exploration and infrastructure. Yet, amid these hurdles, a promising opportunity arises. Geothermal brine presents a cleaner alternative for lithium extraction, countering the environmentally harmful extraction methods typically employed. This presents an opportunity for the region to harness its abundant natural resources and enhance operational efficiency across the board,” said Shruti Raghuram, Senior Analyst at Rystad Energy.

Mexico as geothermal leader

Mexico stands out as the leader in Latin America's geothermal landscape, leveraging its rich reserves through initiatives led by the state-owned utility, Comisión Federal de Electricidad (CFE). CFE has spearheaded geothermal development, overseeing impressive installations like Cerro Prieto at 570 MWe and Los Azufres at 240 MWe. Collectively, they contribute massively to Mexico’s total capacity of 1 GWe.

Costa Rica follows distantly, with a collective 320 MWe. Here, Grupo ICE plays a key role in advancing geothermal projects like Las Pailas at 90 MWe and Miravalles at 185 MWe. El Salvador takes the third spot, with LaGeo-operated projects like Berlin and Ahuachapan making significant contributions by adding up to 211 MWe.

Nicaragua, Guatemala, Chile, Honduras, Argentina, Bolivia and Colombia follow with progressively lower installed capacities compared to Mexico. However, pilot projects like Sol de Mañana (Bolivia), Las Maracas (Colombia) and the Caldas project (Colombia) – a collaboration between Ecopetrol, Baker Hughes and Grupo EPM – demonstrate ongoing exploration and potential for further development in these regions. El Salvador falls behind the top two countries in the region (Mexico and Costa Rica), with a collective 230 MWe in installed capacity.

Impact on lithium production

Geothermal developments could hold additional promise beyond their traditional power generation uses. The technology could help revolutionise lithium production, particularly in regions with abundant reserves like Chile, Argentina and Bolivia. The Atacama, Salta and Salar de Uyuni regions are teeming with lithium deposits – yet current extraction methods pose environmental concerns. Geothermal brine extraction offers a cleaner alternative, potentially mitigating land use, water consumption and emissions issues.

Key geothermal projects like Cerro Pabellon, Laguna Colorada and Tuzgle-Tocomar are strategically located near these lithium-rich areas. This proximity not only grants access to geothermal brines but also facilitates the development of direct lithium extraction (DLE) projects. Similar to utilising an existing highway, geothermal initiatives can seamlessly integrate with nearby lithium mining operations, thus streamlining supply chains and reducing costs.

By tapping into geothermal brines for lithium extraction, these nations can maximize their natural resources, strengthening their positions in the global lithium market. Additionally, integrating lithium extraction with geothermal energy production enhances operational efficiency and sustainability. Waste heat from geothermal plants can power the extraction process, slashing energy consumption and costs.

This dual approach to renewable energy and lithium production could propel economic growth while advancing global sustainability goals. ‘The Lithium Triangle’, where Chile, Argentina and Bolivia intersect, could emerge as a key player in the green energy transition. However, realizing these benefits hinges on technological advancements, regulatory frameworks and market dynamics.