Global energy executives optimistic of industry’s growth trajectory in 2024

Nearly 73% of senior energy professionals from around the world are bullish on the industry's growth trajectory for the upcoming year, according to DNV's annual Industry Insight survey –revealing a resilient optimism within the energy sector, despite prevailing caution.

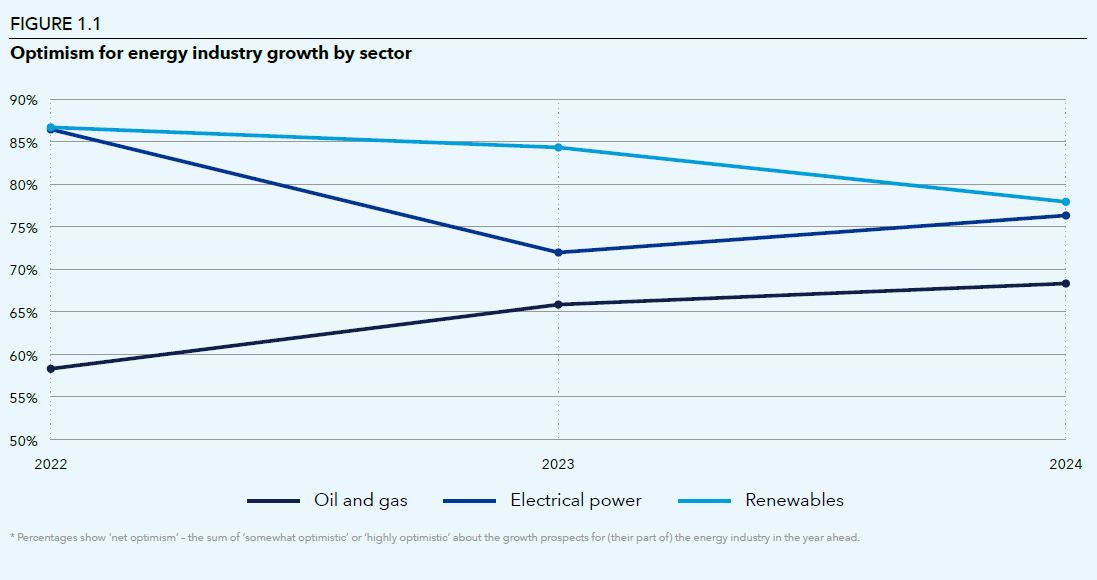

The figure has remained steady at around 74% since 2022, reflecting a resolute stance adopted by the industry amid turbulence, according to DNV’s survey of nearly 1,300 senior energy professionals around the globe.

“The transition towards a sustainable energy future is not just desirable; it's imperative,” said Ditlev Engel, CEO Energy Systems at DNV. “Key drivers of optimism include the relentless march toward decarbonisation and electrification, offering long-term clarity amid near term uncertainty. Understanding this shift as a necessary progression aligns with the industry commitments under the Paris Agreement, reinforcing its determination to drive meaningful change. Consequently, the industry's optimism about the path ahead is well-founded – especially since the requisite technologies are already within our reach,” he said.

However, beneath this apparent stability lies a complex landscape of shifting dynamics, according to DNV. While the industry as a whole maintains a positive outlook, specific sectors, such as electric power and renewables, have witnessed notable declines from previous peaks.

DNV's survey found that nearly two-thirds of the energy sector view global political uncertainty as the primary threat to success over the coming year. Specifically, DNV's study reveals that nearly two-thirds (62%) of respondents perceive the 2024 wave of elections and potential policy shifts as one of the steepest barriers to growth. Political uncertainty, which ranked as the 13th major concern in 2022, surged to sixth place in 2023.

Record year for elections

This year marks a record year for elections, with over two billion people heading to the polls. The prospect of continued policy upheaval is of particular concern in the Americas, with 71% of Latin American and 67% of North American energy professionals highlighting political issues, reflecting the polarised landscape of energy and climate politics. Given its importance to the global energy sector, the outcome of the upcoming elections in the United States holds particularly significant implications for energy industry sentiment and strategic planning.

“For decades, the energy sector has faced enduring political risks, evolving from localised tensions to global challenges affecting every aspect of the industry,” explained Engel.

“Amidst fluctuating prices, disruptions in supply chains, wavering investor confidence, and shifting regulations, stakeholders stress the importance of maintaining a long-term perspective, anchored in stable supply contracts,” he added.

According to Engel, in this climate of uncertainty, the energy sector must demonstrate resilience, adaptability, and a strategic vision for the future to overcome policy ambiguities and foster economic growth, job creation, and prosperity for all.

“Furthermore, to effectively scale the energy transition across various industries, it's imperative to streamline and standardize processes. A key challenge is to secure lasting regulatory support and clear visibility into the future to rapidly deploy existing technologies,” he added.

Optimism among respondents in electrical power has dipped from 87% to 76%, while renewables have experienced a similar downward trend, from 87% to 78%. This decline mirrors a broader shift in industry growth expectations and organisational confidence, with rising costs and supply chain disruptions pose significant hurdles to project viability and the pace of energy transition. Notably, the electric power industry faces a pronounced shortage of skilled talent, hindering progress in energy transition and digital initiatives. Meanwhile, renewables grapple with regulatory hurdles and intensifying market competition.

There has also been a fall in optimism about organisational decarbonisation targets among survey respondents, with the majority (62%) believing that financial costs are the greatest barrier to reaching the goals of the Paris Agreement.

“The price of carbon is still too low globally, and the political difficulty of having energy consumers face the cost of carbon in their everyday decisions is one of the reasons why the energy transition will move slower than many people hope,” said Eirik Wærness, Senior Vice President and Chief Economist, Head of Global External Analysis at Equinor. “So carbon border adjustment mechanisms are needed to encourage every government around the world to put a price on carbon. That is easier said than done, particularly in emerging market democracies, where there are so many urgent priorities.”

Resurgent oil & gas sector

On a brighter note, the oil and gas sector has undergone a resurgence in confidence, rising from 58% in 2022 to 68% in 2024. This recovery reflects the industry's pivotal role in meeting global energy demand while navigating the transition to cleaner fuels. Established oil and gas companies have also gained from branching out into decarbonisation and renewable energy.

“The price of power on any given day can be quite erratic,” says Arnaud Le Foll, Senior Vice President New business, Carbon neutrality at TotalEnergies Exploration and Production, “which is part of why we have kept to our vision of integrated businesses. It's through integration that we have remained strong through the cycles in oil and gas, and we think it will be similarly important in our electricity business.”