Majors target investment increase as first-quarter cash flow holds firm

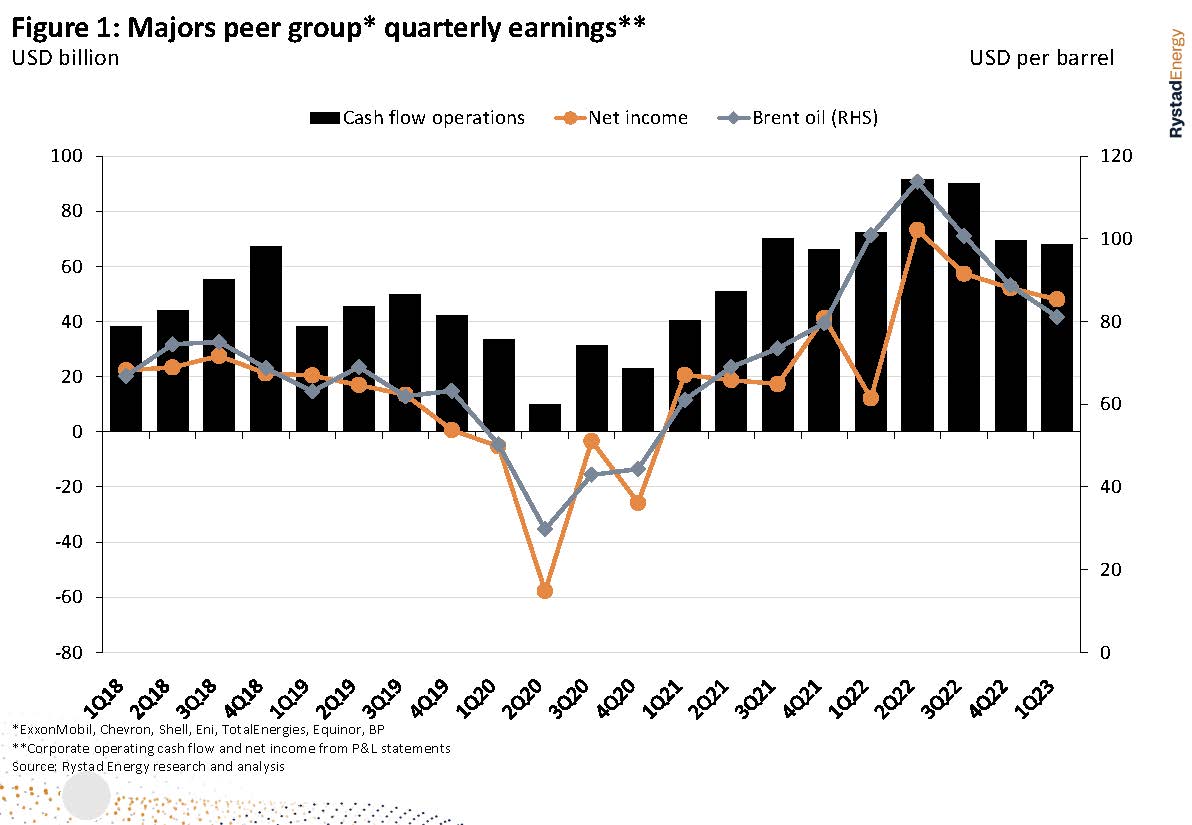

Oil and gas majors posted robust cash flow generation and net income in the first quarter of this year as the peer group saw only a modest 3% decrease in cash flow from operations despite a 9% drop in crude prices compared to the final quarter of last year.

The group of seven majors – comprising ExxonMobil, Shell, Chevron, BP, TotalEnergies, Eni and Equinor – also reduced shareholder payouts by 13% in the first three months of this year while maintaining relativey stable debt levels from the previous quarter. Industry eyes will be on how and where majors allocate their capital, with fresh merger and acquisition (M&A) activity on the table and the proportion of the group’s collective upstream investments to cash flow from operating activities set to rise.

Considering a 7% increase in investments for the full year and expectations of lower cash generation in the remaining months, the peer group of majors may continue reducing shareholder payouts throughout the year to secure financing for their investment goals. Alternatively, they could deplete their cash reserves to sustain high shareholder payouts. It is worth noting that the majors' cash reserves remained unchanged from the previous quarter and are now at their highest level in several years, with an estimated $35 billion in available assets. This suggests that the companies may utilize these reserves for acquisitions this year, indicating the possibility of significant large-scale deals in the offing. However, it is worth contemplating whether the majors are holding onto cash in anticipation of more favorable market conditions for acquisitions.

Shareholders experienced a decrease of approximately 13% in payouts in this year’s first quarter compared to the previous quarter. The first three months of last year saw payouts from the peer group totaling $37 billion, which declined to $32 billion in this year’s first quarter. Dividends also saw a reduction of around 12% to $15 billion, while share repurchases saw a 15% decrease to $17 billion. Nevertheless, this level remains relatively high when considering historical data – prior to the second quarter of 2022, where share repurchases surged due to exceptional cash flow generation, they had since 2018 typically ranged between zero and $5 billion per quarter since.

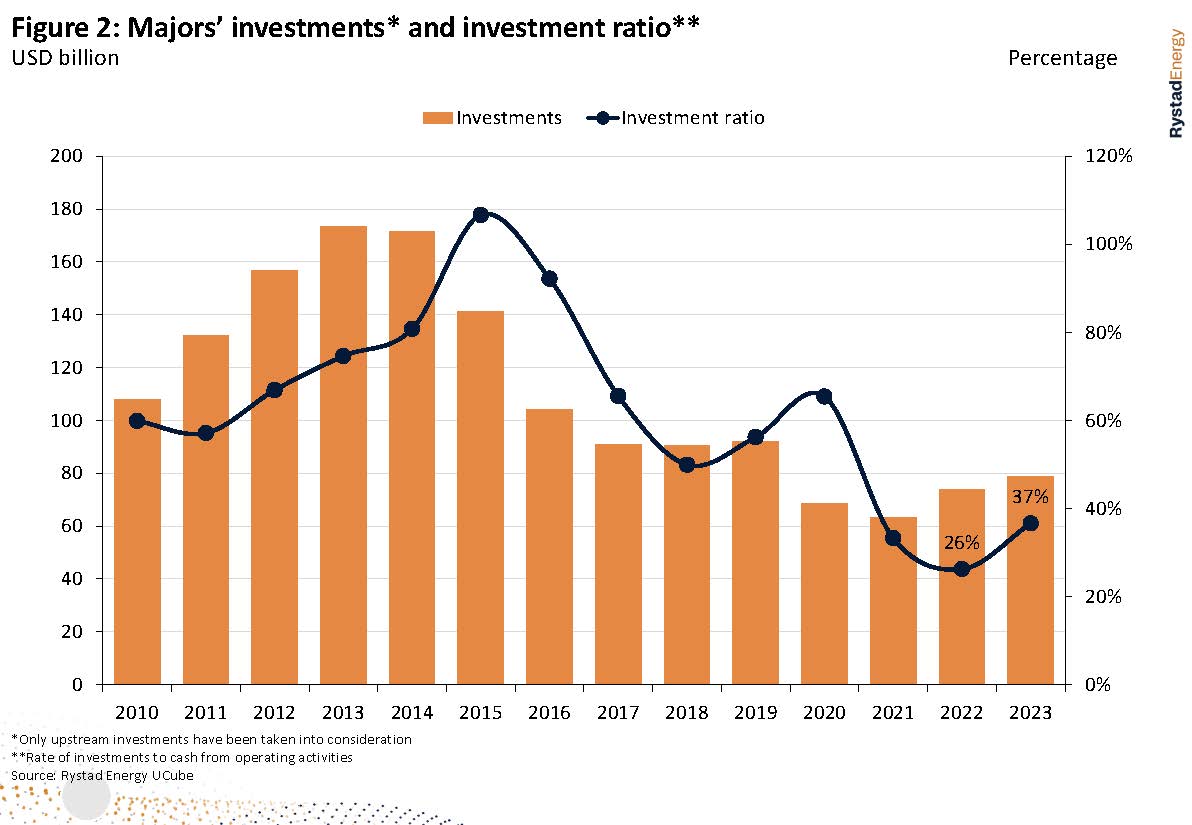

Majors have indicated their intention to increase investments this year compared to the previous three-month period, with a total upward adjustment of 7% in upstream investments. Despite the anticipated decrease in earnings and profitability – as measured by cash flow from operating activities – the majors' proportion of upstream investments to cash flow from operating activities is projected to rise from 26% to 37% during the year.

The key question is how majors will allocate capital held in these substantial cash reserves. The possibility of more significant deals certainly exists, as companies have reported assets available for sale totaling over $35 billion so far this year. However, given the plunge in natural gas markets so far this year and a pullback in oil prices, potential buyers could be exercising caution, awaiting more favorable conditions in the acquisitions market as the prospect of a softening in valuations increases.

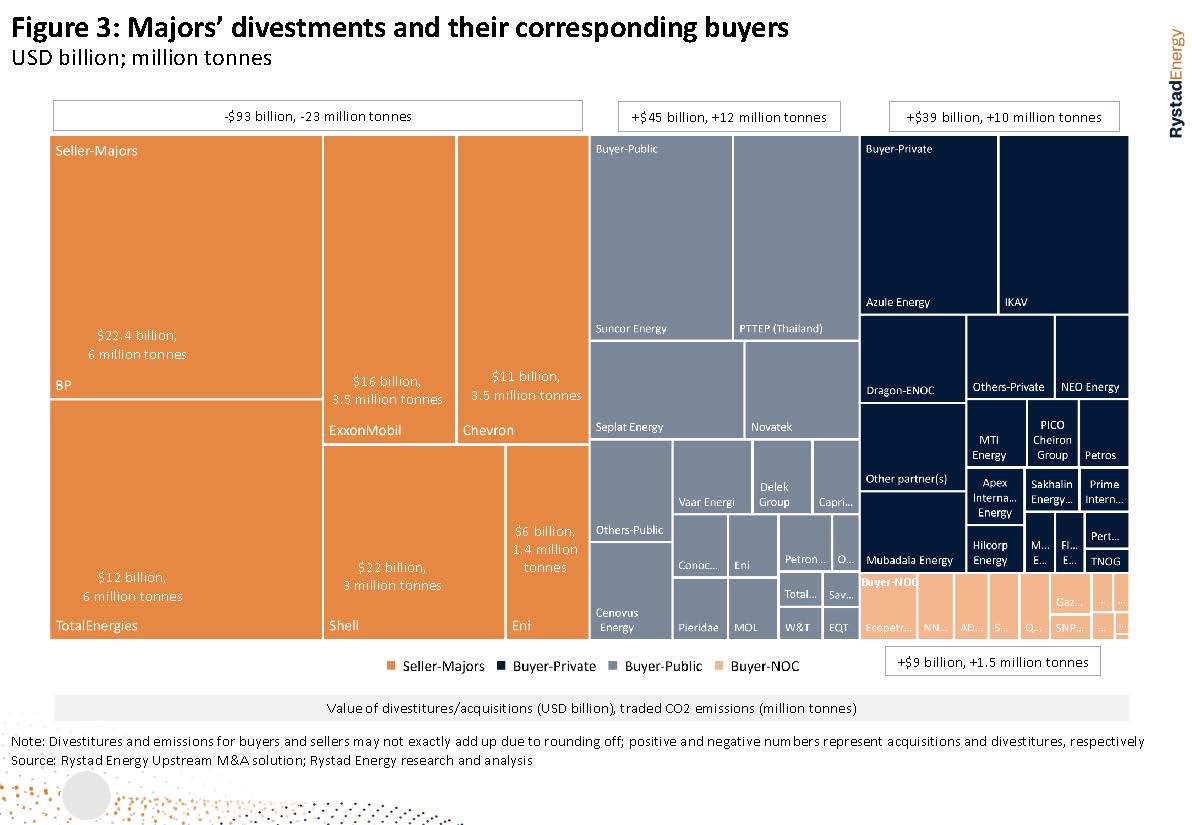

M&A and a push for decarbonisation

According to Rystad Energy analysis, majors in the peer group have sold off upstream assets worth more than a combined $93 billion since 2019, resulting in a reduction of approximately 23 million tonnes of carbon dioxide (CO2) emissions from their portfolios. These majors have primarily relied on portfolio management as a tool to reduce emissions and achieve their net-zero emissions goals. European majors such as BP and TotalEnergies have been at the forefront of this effort, divesting over $34 billion-worth of assets and eliminating around 12 million tonnes of CO2 emissions from their portfolios.

The divestments made by majors reflect their commitment to emissions reduction and are part of a broader range of strategies employed by oil and gas companies to transition towards a low-carbon future. These strategies include low-carbon investments, portfolio diversification, carbon capture and storage (CCS) projects, and portfolio management. Considering acquisitions worth more than $46 billion and associated emissions of around 3 million tonnes during the same period, majors have been net divestors, selling upstream assets valued at $47 billion and reducing emissions from their portfoios by approximately 20 million tonnes. Additionally, higher commodity prices last year allowed majors to exit their carbon-intensive assets at relatively higher valuations, as seen in the case of BP’s exit from the Sunrise oil sands project in Canada in 2022 and TotalEnergies’ divestment of its Canadian operations in April this year.

The assets sold by majors have predominantly been acquired by public and private companies with regional focuses and less strict environmental, social and corporate governance (ESG) targets or investor pressure to reduce emissions. Public companies have acquired around $45 billion-worth of assets from majors, which generated approximately 11 million tonnes of CO2 emissions between 2019 and 2023. Private companies follow closely, acquiring $39 billion-worth of assets and assuming around 10 million tonnes of CO2 emissions.

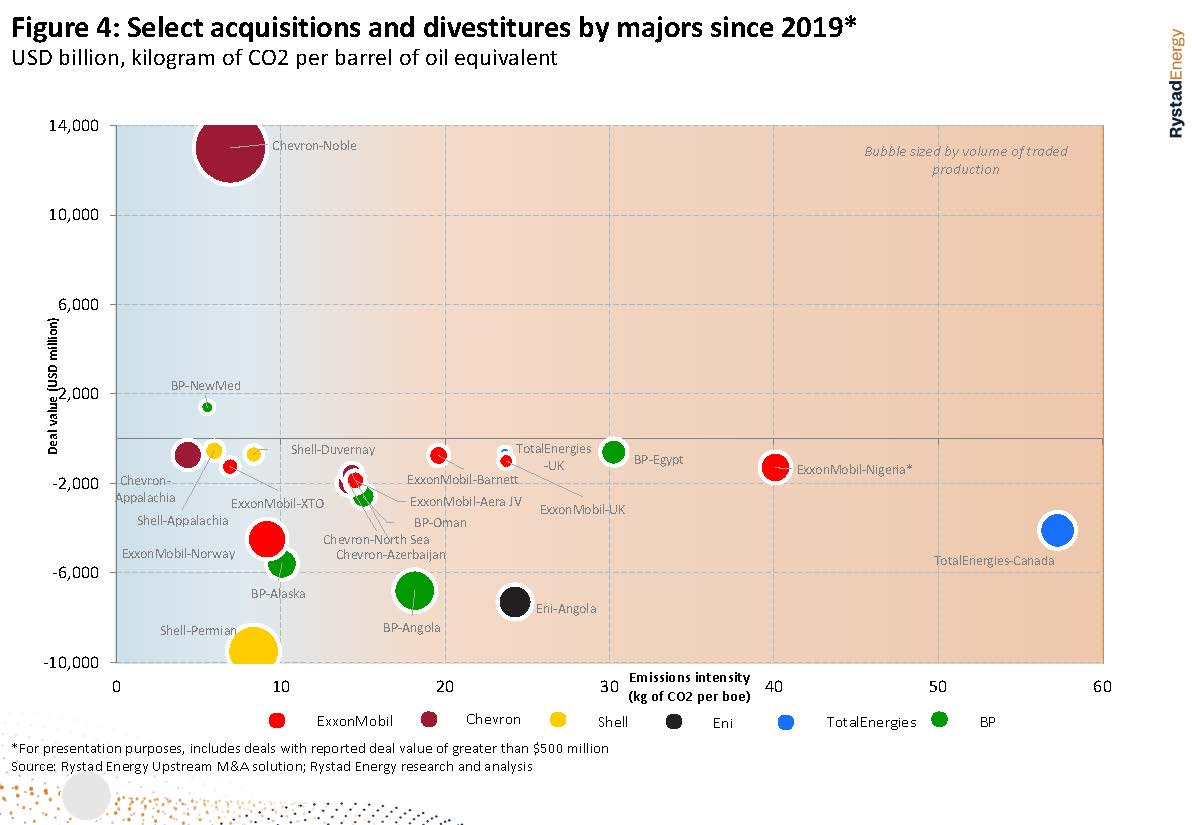

The above figure illustrates the acquisitions and divestitures pursued by majors with reported deal values exceeding $500 million, providing insights into their M&A strategies. When focusing on acquisitions (the upper half of the chart), it becomes apparent that emissions intensity is a significant criterion, as previously mentioned in the case of BP. For instance, BP's recent bid to acquire a stake in NewMed Energy and Chevron's acquisition of Noble Energy exhibit emissions intensities below 10 kilograms of CO2 per barrel of oil equivalent (boe). This is noteworthy considering that the majors' estimated global average emissions intensity stands at around 15 kilograms of CO2 per boe as of 2023, according to Rystad Energy estimates.

However, when examining divestitures by majors, it becomes clear that emissions intensity alone is not the exclusive driver of their divestment strategies – if it were, most divestitures would be concentrated in the lower right-hand portion of the chart. Yet, the presence of assets with low emissions intensity in majors' divestitures indicates that portfolio rationalization and the shedding of non-core assets are also significant factors influencing their divestment strategies. For instance, Chevron's sale of its Appalachian assets in the US to EQT Corporation for $735 million in October 2020 is an example – although these assets had an emissions intensity of approximately 4 kilograms of CO2 per boe, the sale was prompted by Chevron's reduced budget for natural gas assets due to a lower commodity price outlook.

It can be inferred that majors’ acquisition strategies are indeed influenced by their emissions reduction goals. However, the same cannot be said entirely for their divestiture strategies. In divestitures, these companies have also prioritized portfolio streamlining and focusing on core regions, which has led to the sale of assets with lower carbon intensity.