Brief oil boom to accelerate energy transition

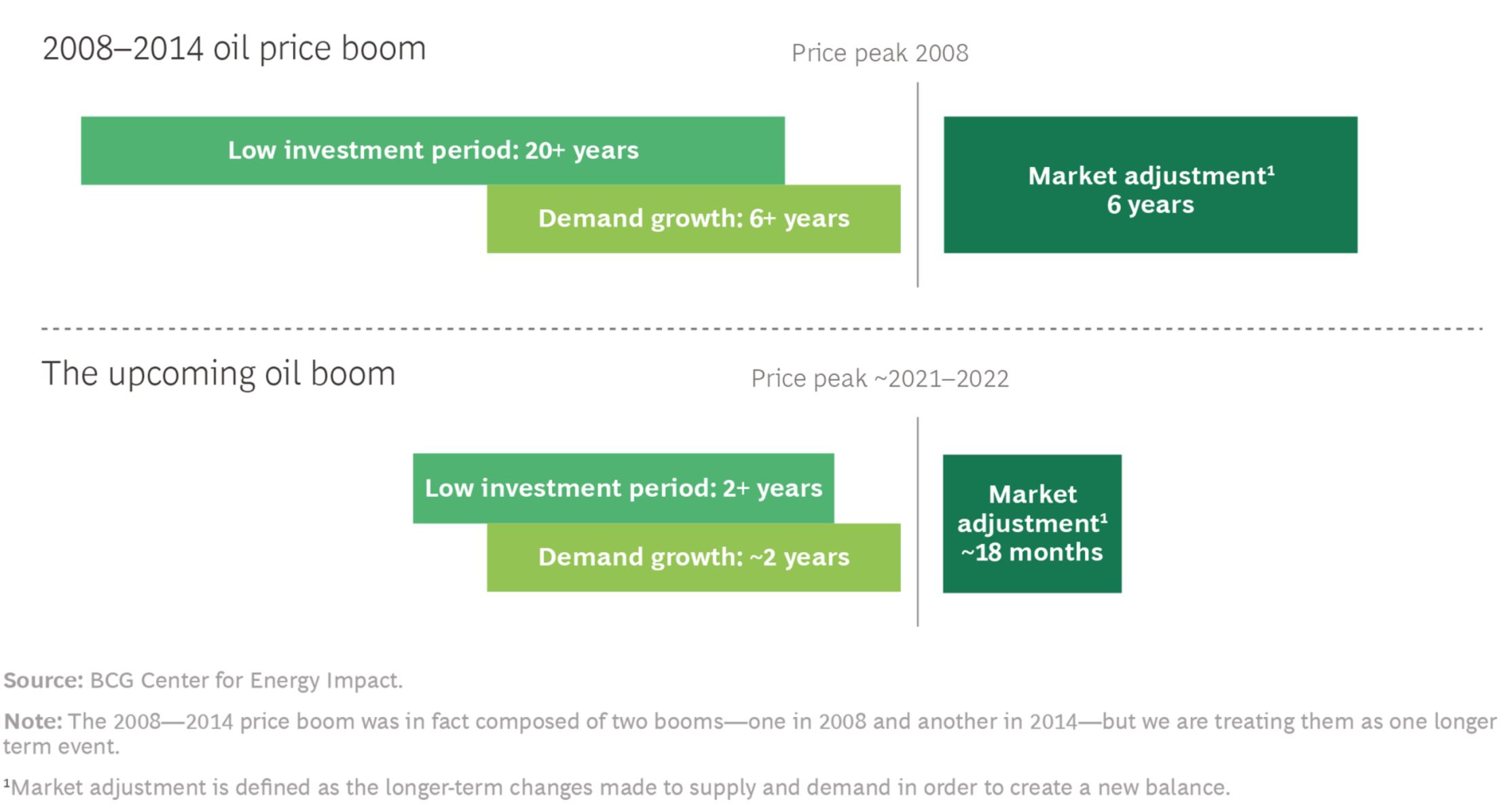

The COVID-19 crisis has increased the likelihood of an oil price boom, with prices already above US $80/b for the past month. The last time this price level and duration occurred was in 2014. However, this cycle is likely to be quick relative to prior cycles (Exhibit 1). This brief revenue boon to the oil industry will open a window for oil and gas producers, governments, and consumers to accelerate their energy transition plans. We looked at the underlying dynamics and how companies can leverage this opportunity.

Short term soar in demand

Oil demand is increasing strongly as the world recovers from the COVID-19 crisis. With vaccinated people eager to resume ordinary activities, oil demand is now experiencing perhaps its strongest growth periods ever.

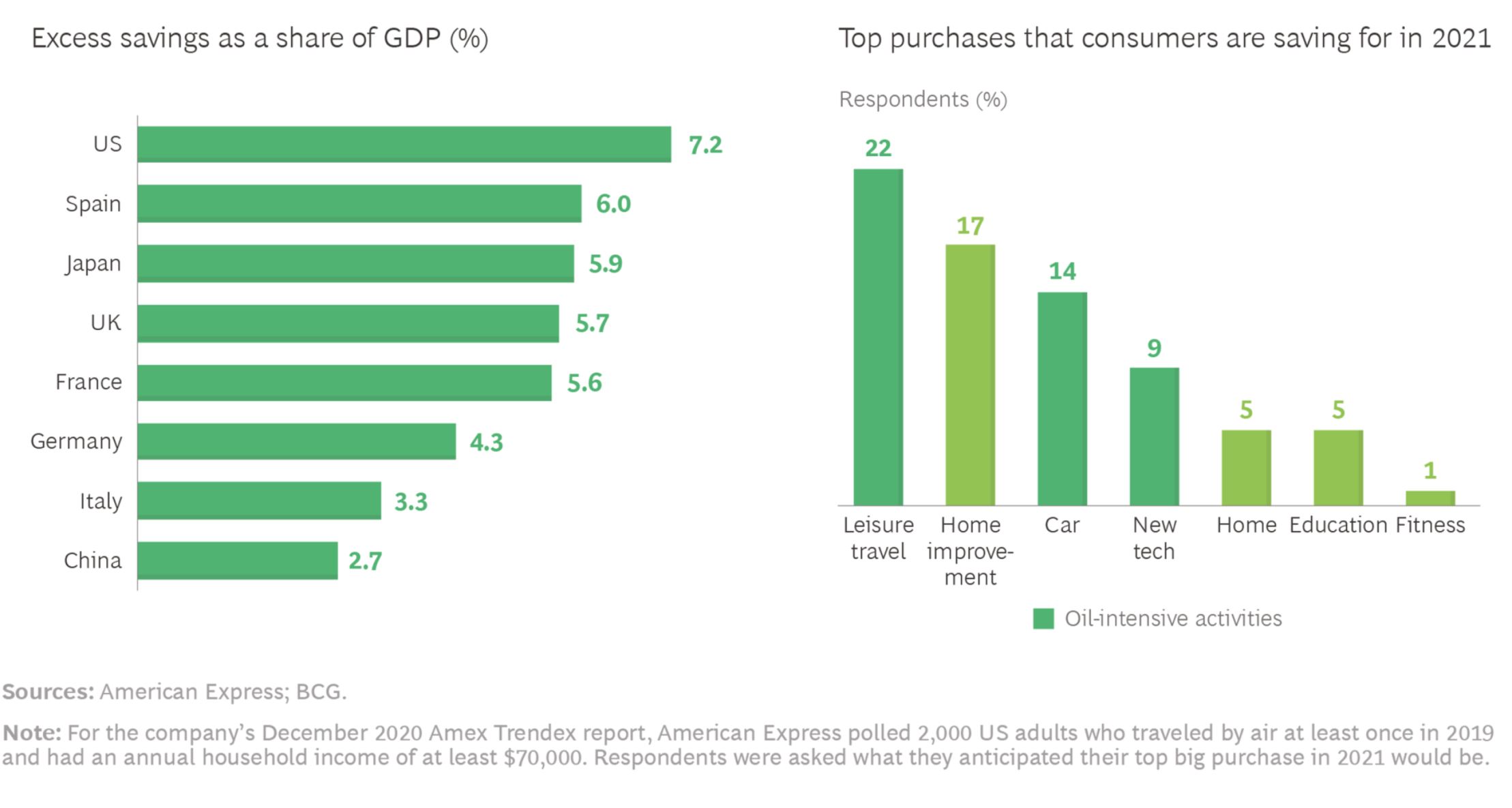

Leisure travel tops US consumers’ 2021 spending priorities (Exhibit 2), boosting expected demand for jet fuel, gasoline, and diesel. And consumers' substantial savings accumulated during lockdown will fund this exuberance. In the US, personal savings averaged 18% of disposable income - three times the level during the 2008 recession. Much of these additional savings have already been spent, even as wealthy families continue to increase savings

The IMF predicts 6 percent growth this year, and 4.9 percent in 2022, augmented by massive government fiscal stimulus packages. By 2024, most advanced economies will be back on their pre-pandemic growth paths.

Lagging supply

Oil and gas companies reduced upstream business investment by 34 percent in 2020, with financial austerity continuing this year as companies contend with investor pressures to return cash, as well as the push to reduce emissions. Meanwhile, inflated crude and oil product stockpiles have fallen since January as economic activity recovers, with Cushing near tank minimums at the time of this writing. This could leave the industry struggling to meet growing demand, particularly as spare capacity is reduced.

We expect a greater impact than in 2014; the last time operators made significant cuts to Capex. Recent reductions are more extensive, and a $1 cut in operator Capex reduced activity by 87 cents, compared to 34 cents in 2014.

A short and uncertain boom

Several factors will affect the timing and magnitude of price increases. Lingering lockdown restrictions kept global demand ~7 mmb/d below 2019 levels but it is now less than 2 mmb/d below pre-pandemic levels, with jet fuel the primary laggard. Renewed restrictions or concerning new COVID-19 variants still hold the potential to reduce demand growth.

Global supply could also increase by as much as 1 mmb/d if the Biden administration seeks a coordinated Strategic Petroleum Reserve release. If prices maintain this price level, US shale players may boost their production and OPEC+ may continue to increase production at a pace that matches demand recovery. If they succeed, the additional supply will help keep price rises in check. But a mismatch could increase volatility, causing price extremes at both high and low ends. Given the much higher price rise in many other energy commodities, there is ample evidence that the oil prices were kept in check.

As supply and demand are adjusted, we expect the price boom to be shorter than past cycles, likely lasting just 12 to 18 months. The oil industry and commodity markets have altered significantly over the past decade, making the industry far more responsive to changing conditions.

Oil production projects are both faster and smaller, allowing greater flexibility as prices change. OPEC+ is nimbler than its predecessor, OPEC. It meets more frequently, and its members are quicker to respond. New communications technology has improved information flow, increasing industry transparency, and informing rapid action.

Price increases also impact oil demand more quickly. Reduced government subsidies, especially in developing countries, have exposed consumers to the real cost of oil, so they are more likely to alter their behavior when prices rise.

Implications for energy transitions

A period of high prices will accelerate energy transitions throughout the economy. It will:

· Spur demand for electric vehicles.

· Reduce business travel – a trend already normalized by the pandemic.

· Prompt policymakers to increase investment in renewable energy and electric vehicle charging networks – including using post-pandemic stimulus programs to “build back green”.

· Help oil and gas companies invest in strategic transitions to renewable energy businesses.

Savvy producers should use the increased price revenue to prepare their businesses for a lower-carbon world:

1. Repair balance sheets. Repairing pandemic-decimated balance sheets and repaying the debt will increase flexibility and fund essential dividend payouts.

2. Accelerate improvements. Streamline operations and reduce environmental impact. Upstream, companies must address methane leakages during production. They should also invest in digital technologies to improve operational efficiencies, drive down costs, and create shareholder value.

3. Deploy additional capital towards energy transitions. Seek energy transition investment opportunities like hydrogen, CCUS, or renewables. The pandemic has already accelerated international oil companies (IOCs) plans to reinvent themselves for a new energy landscape.

European IOCs are expanding into renewables and low-carbon energy businesses. To date, their North American peers have been recommitting to oil and gas production while investing in technologies to increase efficiencies and reduce greenhouse gas emissions. A continued price boom and its consequences on consumer and government actions mean all major producers need to re-evaluate their energy transition strategies as well as the pace of those changes.

To know more, please read the BCG publication, The Last Oil Price Boom May Be in Sight by Jamie Webster, Rebecca Fitz, Maurice Berns, Clint Follette, and Adam Gordon

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.