BNY Launches Tokenized Deposits in Digital Assets Expansion

(Bloomberg) -- Bank of New York Mellon Corp. has launched a tokenized deposit service that allows clients to transfer funds using blockchain rails, becoming the latest major global bank to push deeper into digital assets.

The form of digital cash is an on-chain representation of deposits that BNY clients hold in accounts at the bank, the company said in a statement Friday. This could be used for collateral and margin transactions and to make payments faster, as BNY works toward 24/7 operability, the bank said.

Clients and market participants involved or interested in the new service include exchange operator Intercontinental Exchange Inc., trading firms Citadel Securities and DRW Holdings, Ripple Labs Inc.’s prime brokerage arm Ripple Prime, asset manager Baillie Gifford, and stablecoin company Circle Internet Group Inc., according to the bank.

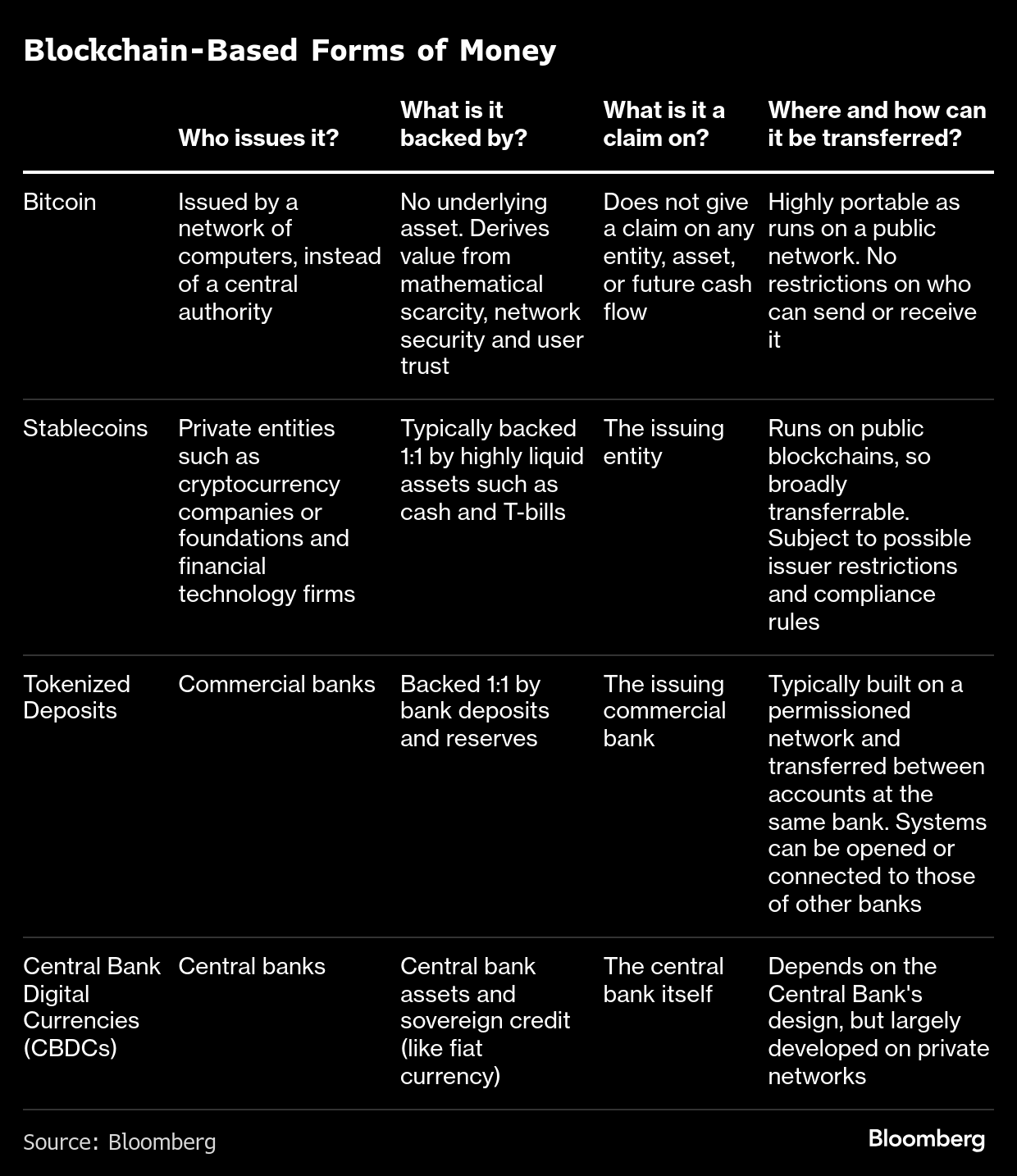

Blockchain-based forms of money could support efforts to tokenize securities such as stocks and bonds by serving as the settlement leg of those transactions. Many financial institutions have ramped up tokenization efforts over the past year, with a particular focus on speeding up the movement of collateral.

“This is very much about connecting traditional banking infrastructure and traditional banking institutions with emerging digital rails and digital ecosystem participants in a way that institutions trust,” Carolyn Weinberg, BNY’s chief product and innovation officer, said in an interview.

BNY joins other major banks looking to leverage the technology underpinning cryptocurrencies for more efficient payments. JPMorgan Chase & Co. began rolling out a deposit token called JPM Coin to institutional clients in November, while HSBC Holdings Pfc plans to expand its tokenized deposit service to corporate clients in the US and United Arab Emirates in the first half of this year.

The move also follows the passage of the Genius Act in the US, which establishes rules for stablecoins, another rapidly growing form of digital money. Unlike stablecoins — digital tokens typically pegged to traditional currencies and backed by liquid assets such as cash or short-term government debt — tokenized deposits are created within the existing banking system and can pay interest.

BNY, one of the world’s largest custodians with $57.8 trillion in assets under custody or administration, has been active in digital assets for years. In July, it said it was working with Goldman Sachs Group Inc. to use blockchain technology to maintain ownership records for money-market funds.

ICE, which owns the New York Stock Exchange, will work toward supporting tokenized deposits across its clearinghouses as it prepares its clearing infrastructure for 24/7 trading, Elizabeth King, the group’s global head of clearing and chief regulatory officer, said in a statement.

ICE Chairman and Chief Executive Officer Jeffrey Sprecher said on an October earnings call that tokenization could contribute to higher trading volumes through round-the-clock collateral management.

A key feature of blockchain-based assets is programmable transactions, which BNY said would be a benefit of tokenized deposits. That allows transfers to occur automatically when predefined conditions are met, such as releasing collateral once a loan obligation has been satisfied.

Steve Kurz, global co-head of digital assets at Galaxy Digital Inc., which is also involved with BNY’s service, said tokenized deposits would introduce programmability and 24/7 settlement “into the core of the banking system.”

(Updates to add chart and comment in the last paragraph. A previous version of this story corrected the third-paragraph description of the companies involved.)

©2026 Bloomberg L.P.