Private Equity Wins Big by Flipping Gas Plants to Producers Racing to Meet AI Needs

(Bloomberg) -- Gas-fired power plants, once unloved bets, are now a hot trade for private equity.

Energy Capital Partners is among investors profiting by flipping natural gas plants to electricity producers, which are scrambling to meet demand for power driven by artificial intelligence. The firm paid $2.3 billion last year to buy gas and coal generation assets from a Blackstone Inc. and ArcLight Capital Partners joint venture, according to people familiar with the matter.

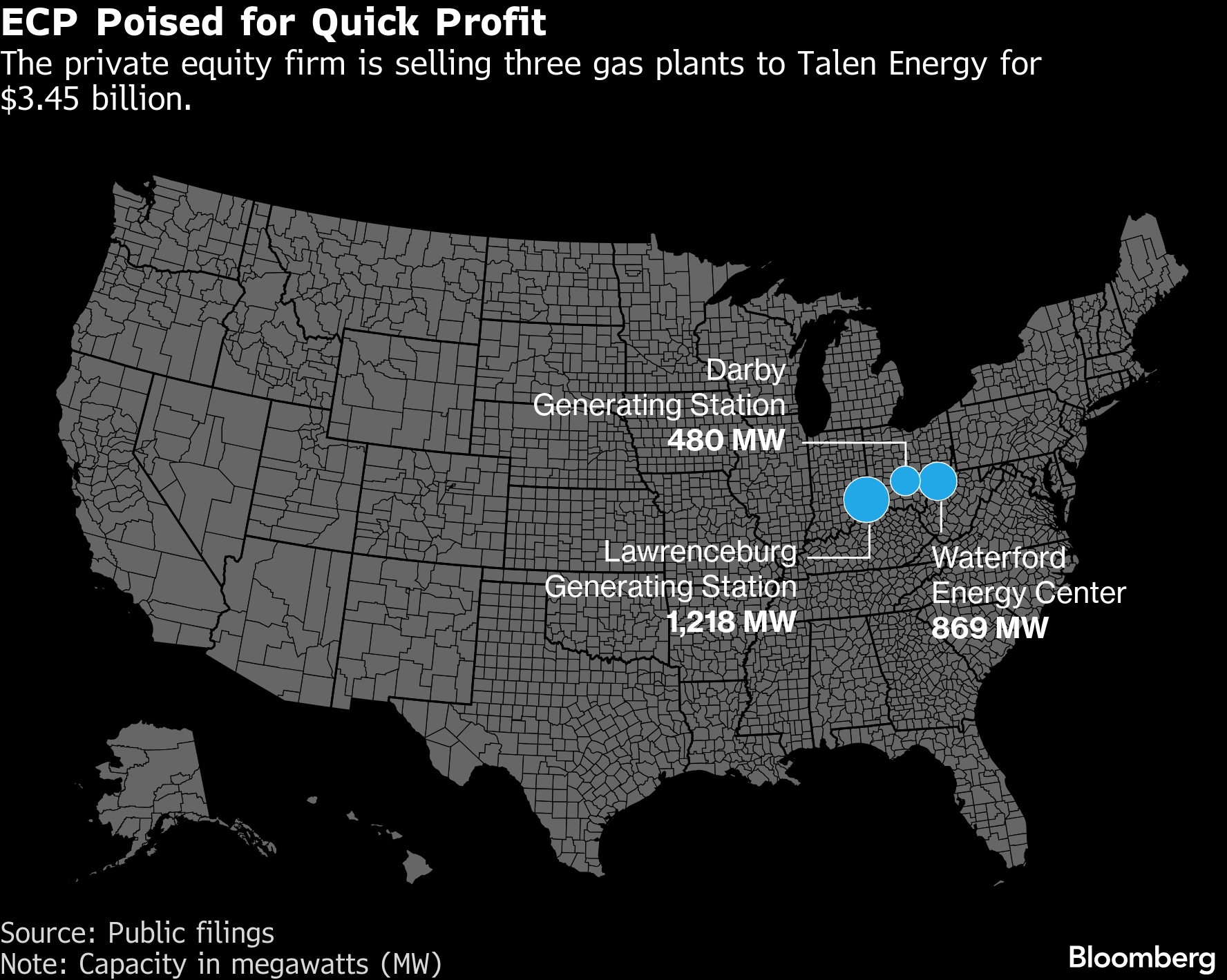

In January, roughly five months after completing the deal, ECP agreed to sell the three gas plants it had just acquired to Talen Energy Corp. for $3.45 billion.

Blackstone notched a gain of about 2.5 times on its roughly eight-year-old investment. Still, the quick profit of more than $1 billion for ECP has caused some dealmakers at Blackstone to question whether the firm should have held onto the assets for longer, according to the people familiar with the matter.

Blackstone and ECP, a unit of Bridgepoint Group Plc, declined to comment on the transaction, which is pending regulatory approval.

ArcLight didn’t reply to messages seeking comment.

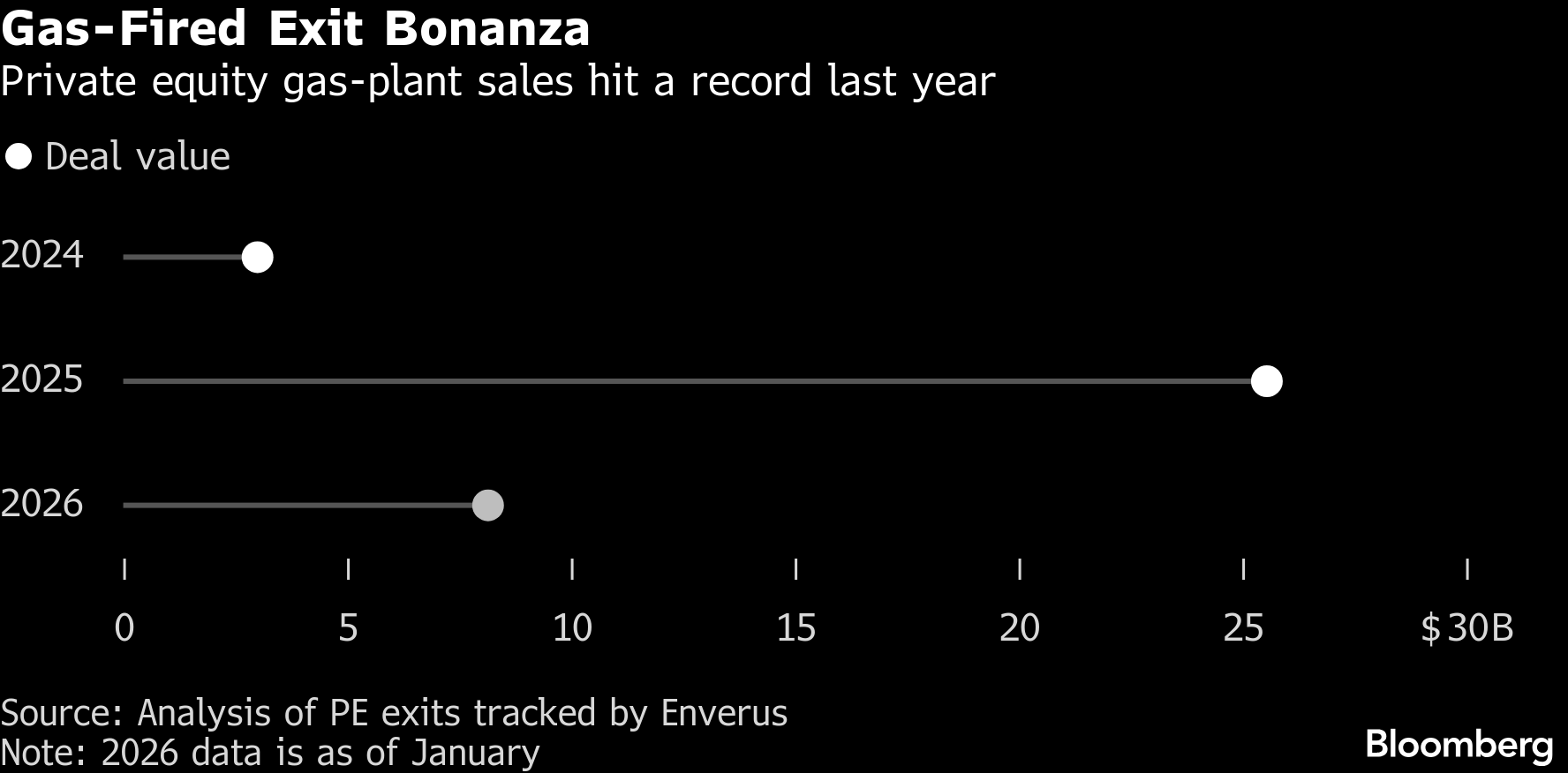

With gas plants trading at a frenzied clip, power investors are poised for another banner year. Private equity firms agreed to sell more than $8 billion of natural gas plants in January alone, compared with more than $25 billion for all of last year, according to data from energy research firm Enverus.

It’s vindication for firms that came under intense scrutiny for stockpiling oil and gas assets, with investors fretting the holdings would be stranded as the Biden administration prodded electricity producers to cut emissions.

The script has flipped.

President Donald Trump has said bolstering the oil and gas industry is critical for national security. The largest grid operator in the US is under pressure from his administration to speed up the development of power plants.

Tech companies require vast amounts of energy to train AI models — and the sooner the better. Data centers’ power footprint will grow by almost 100 gigawatts by 2030, according to JLL. That’s enough to power about 75 million homes.

Surging energy demand is running into the reality of stretched grids and rising electricity bills.

Little new natural gas capacity came online in 2024. When grid operator PJM Interconnection held a recent auction to secure supplies from power generators, it failed to procure enough capacity to guarantee reliability for a grid serving roughly 67 million customers in 13 states and the District of Columbia. Prices, meanwhile, surged to a record.

“The private equity investors selling into a high-demand market for energy made an informed or speculative decision a few years prior that made them well-positioned to sell right now,” said Scott Voss, senior market strategist at HarbourVest.

Electricity generators are eager buyers. Their soaring share prices have given them ballast to do deals just as gas-fired plants are trading at a premium. The asset prices reflect the long wait power producers would face getting permits and parts, such as turbines that spin to generate electricity.

“It is increasingly expensive to develop new gas-fired generation,” said Brent Burnett, head of infrastructure and real assets at Hamilton Lane Inc. “So the value of existing generation assets is going up dramatically.”

LS Power has emerged as a big beneficiary. The New York-based firm began as a private developer of gas plants. It expanded to become an asset manager in the 2000s, buying plants at distressed prices from banks as the 2001 Enron collapse destroyed confidence in the sector.

By last year, the firm’s power portfolio included 17 gigawatts of gas-powered sites — more than double the footprint of its renewables facilities.

This year, the firm completed the $13 billion sale of energy-management company CPower along with a portfolio of gas plants to Houston-based NRG Energy Inc. The deal, involving more than half of LS Power’s footprint, returns money to three different funds holding the assets, according to people familiar with the matter.

It’s a record investment exit for the firm, with the proceeds comprising more than half of the $13 billion it manages for fund investors. LS Power plans to redeploy some money to buy and develop more gas-fired plants, one of the people said.

Power Bankers

Meanwhile, Energy Capital Partners, founded by former Goldman Sachs Group Inc. bankers, has turned a sprawling portfolio of power assets into cash.

In 2018 — just as electricity generators were being squeezed by cheap natural gas and a surge in renewable energy — ECP bought power-plant operator Calpine in a roughly $17 billion take-private deal. As the company was buffeted by swings in gas demand, some investors grew impatient and wanted a path to cash, people familiar with the matter said. So, in 2022, the firm moved a portion of Calpine into a continuation fund.

Then an AI arms race between the likes of OpenAI, Microsoft Corp. and Google parent Alphabet Inc. picked up, sparking a data center boom and sending demand for electricity skyrocketing.

Last year, Constellation Energy Corp. agreed to buy Calpine for $26.6 billion with an eye on boosting its generating capacity. The transaction, completed last month, creates the nation’s largest electricity producer and is the most profitable investment exit in ECP’s two-decade history.

“With data centers and onshoring, there’s just a dramatic need for more power,” said Minesh Mashru, founder of infrastructure investment firm TFI Investments and former head of infrastructure at Cambridge Associates. “People want to bring back assets that are stranded or underutilized because there’s less ruction around what energy you’re producing.”

He warned that US policymakers’ stance toward natural gas could shift, depending on changes in the balance of power after this year’s midterm election and the 2028 presidential contest. That raises the question of whether private equity has just a narrow window for big sales.

“In this part of the market,” Mashru said, “fortune favors the brave.”

©2026 Bloomberg L.P.