Italy to Strip Carbon Costs From Power Bills, Jolts Markets

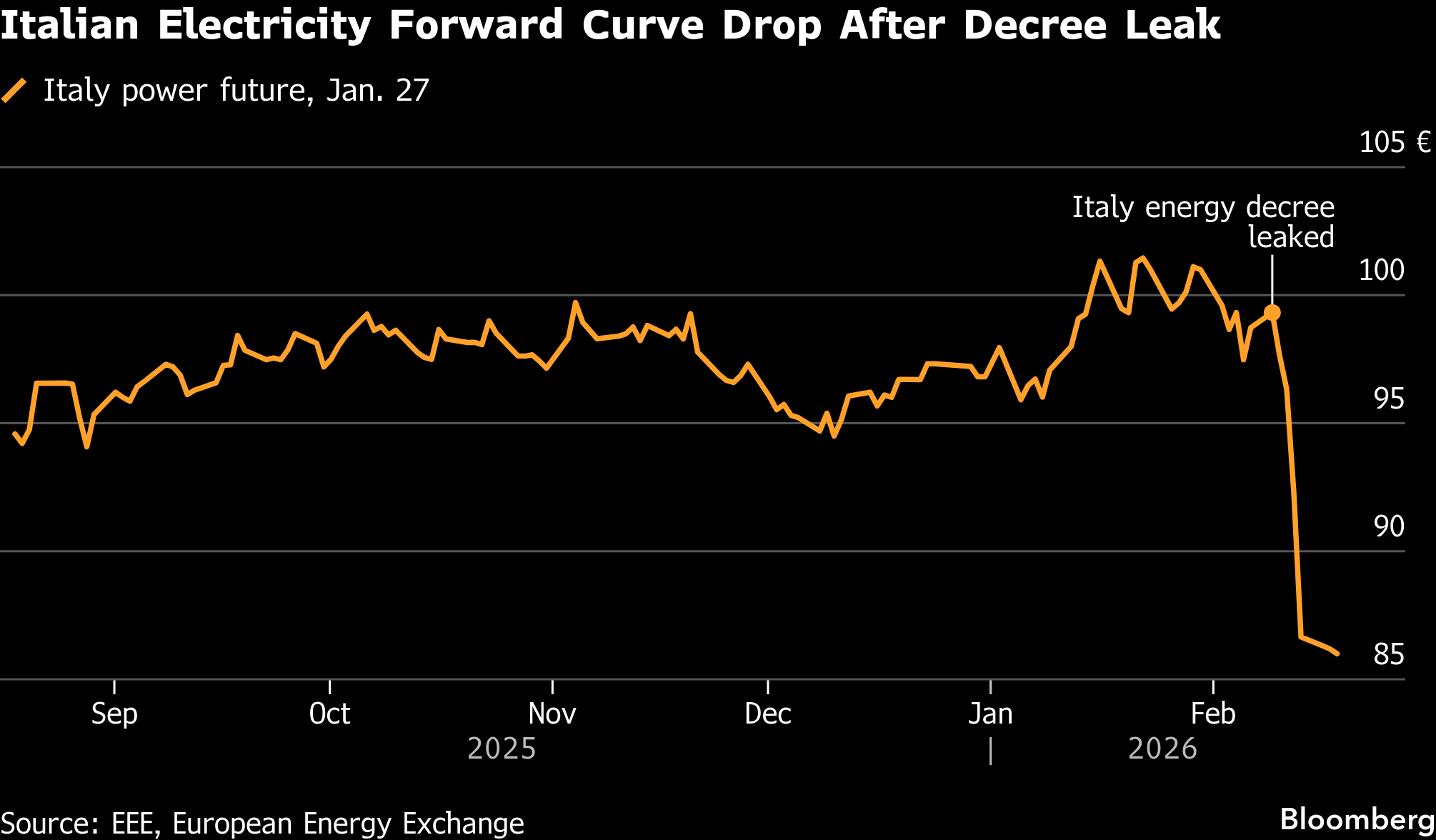

(Bloomberg) -- Italy is preparing a sweeping overhaul of its electricity market that would strip carbon costs from power bills, a move that has sent shock waves through energy markets and driven a sharp selloff in forward prices.

Italy’s cabinet approved the so-called Energy Decree worth more than €3 billion ($3.5 billion) on Wednesday evening, Energy Minister Gilberto Pichetto Fratin said in a statement. Prime Minister Giorgia Meloni called the measures “very significant” and said they kept a promise made to voters when her government took power.

“We’re doing what we can to reduce the weight of energy bills on families and companies,” Meloni said in a posting on X.

The measures in the decree are designed to reimburse gas-fired power plants for the cost of carbon permits under the European Union’s Emissions Trading System. Because gas units typically set the marginal price in Italy’s wholesale power market, the mechanism would in effect remove carbon charges from the price paid by all consumers.

Italy has the second-highest electricity prices in Europe, for companies and fourth-highest for households. By preventing the pass-through of emissions charges by power generators to end-users, the government is seeking to deliver billions of euros in relief to consumers and energy-intensive industries.

Italian year-ahead power prices fell for a seventh straight session on Wednesday and are down almost 15% this month as traders position for the reform. While the measure promises meaningful cost relief for consumers, it could compress margins for utilities and renewable generators, including Enel SpA, Edison SpA and ERG SpA, whose revenues benefit from the current marginal pricing system.

The proposal forms part of Meloni’s broader push to restore industrial competitiveness, narrow the persistent spread between Italy’s domestic gas benchmark and the Dutch TTF hub, and reduce structural costs embedded in power bills. If implemented, it could become a template for other EU member states grappling with high energy costs and political pressure from heavy industry.

“The decree addresses the cost of ETS allowances, which today helps keep prices high and which is a tax imposed by Europe,” Meloni said. “We want to separate the ETS price from the price of renewable energy such as hydroelectric and solar power in order to lower costs,” she added.

Marginal Pricing

Italy’s move strikes at the heart of Europe’s marginal pricing model, under which the most expensive unit needed to meet demand — often a gas-fired plant — sets the price for all generators. When carbon prices rise, gas units pass through those costs, lifting wholesale power prices even if cheaper and cleaner renewables are producing a large share of supply.

That structure has been politically contentious since the 2022 energy crisis, when surging gas prices drove electricity costs to record levels. Although the EU reformed parts of the electricity market design in 2023, it left the marginal pricing system intact. Brussels has repeatedly resisted deeper intervention.

European Commission President Ursula von der Leyen said earlier this month that the bloc would revisit the issue ahead of a March summit, presenting “different options and findings” on whether further reform is needed. She also pledged to bring forward proposals on carbon market adjustments later this year.

Any EU-level legislative change would likely take one to two years. Italy, facing mounting industrial pressure, is moving faster.

Carbon Market

EU carbon allowances have nearly tripled over the past six years and currently trade around €70 per metric ton.

Under the draft plan, clean power would be shielded from carbon price impacts starting in 2027. Gas-fired plants would receive compensation for the emissions costs they would otherwise pass through to consumers. Gas accounted for about 42% of Italy’s generation in 2024, compared with 51.8% for renewables, according to state-owned Gestore dei Servizi Energetici.

The policy, however, carries risks. By reimbursing emissions costs, the government would effectively lower the operating cost of gas plants, potentially increasing fossil fuel use and complicating the EU’s 2050 climate-neutrality target. The compensation mechanism would likely qualify as state aid, requiring approval from the European Commission.

“The sudden announcement of these measures has created instability in the market, undermining regulatory certainty and generating mistrust among operators,” according to Leonardo Santi, President of the Italian Association of Wholesalers and Energy Traders.

Governments across Europe are under pressure from sectors ranging from steel to chemicals to curb energy costs. Yet many are reluctant to weaken carbon pricing too aggressively because revenues from ETS permit auctions support national budgets. Italy’s proposal would effectively recycle part of those revenues back to power producers.

(Updates with Italy cabinet approval, Meloni comments)

©2026 Bloomberg L.P.